- United States

- /

- Medical Equipment

- /

- NasdaqGS:LUNG

Pulmonx Corporation (NASDAQ:LUNG) Stock's 40% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Unfortunately for some shareholders, the Pulmonx Corporation (NASDAQ:LUNG) share price has dived 40% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

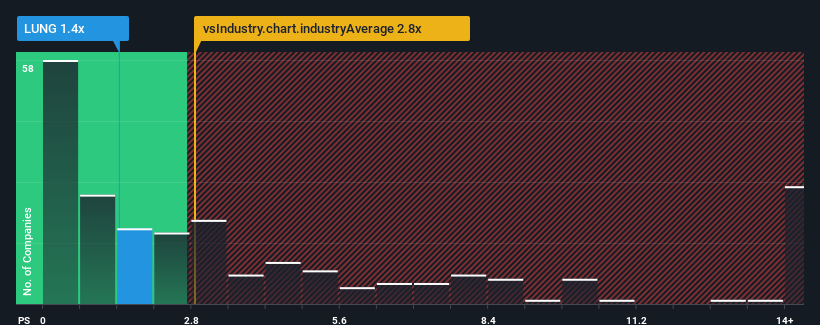

After such a large drop in price, Pulmonx may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 2.8x and even P/S higher than 7x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

We've discovered 2 warning signs about Pulmonx. View them for free.View our latest analysis for Pulmonx

How Pulmonx Has Been Performing

With revenue growth that's superior to most other companies of late, Pulmonx has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Pulmonx will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Pulmonx would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. Pleasingly, revenue has also lifted 75% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 20% per annum as estimated by the seven analysts watching the company. With the industry only predicted to deliver 10% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Pulmonx's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Pulmonx's P/S Mean For Investors?

Pulmonx's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Pulmonx's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Pulmonx that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LUNG

Pulmonx

A commercial-stage medical technology company that provides a minimally invasive treatment for patients with severe emphysema, a form of chronic obstructive pulmonary disease.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026