- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

Market Participants Recognise Lantheus Holdings, Inc.'s (NASDAQ:LNTH) Earnings

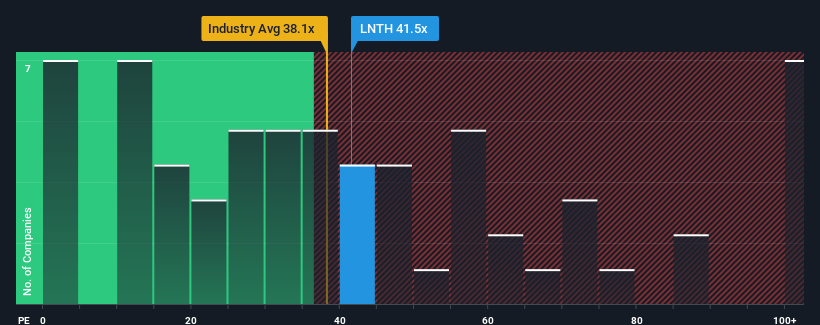

Lantheus Holdings, Inc.'s (NASDAQ:LNTH) price-to-earnings (or "P/E") ratio of 41.5x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 16x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times haven't been advantageous for Lantheus Holdings as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Lantheus Holdings

How Is Lantheus Holdings' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Lantheus Holdings' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 2.7% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 18,345% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 60% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 12% per annum, which is noticeably less attractive.

With this information, we can see why Lantheus Holdings is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Lantheus Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Lantheus Holdings you should be aware of, and 1 of them is potentially serious.

You might be able to find a better investment than Lantheus Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success