- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

Lantheus Holdings (LNTH) Faces Class Action Over Pylarify Sales Projections

Reviewed by Simply Wall St

Lantheus Holdings (LNTH) is currently facing a class action lawsuit for allegedly providing misleading statements about its financial outlook, leading to a decrease in the sales of its principal product, Pylarify. In the past week, Lantheus experienced a 4.81% decline in its share price. This occurred while the U.S. stock markets reached record highs, driven by inflation data that kept hopes for interest rate cuts alive. While the legal proceedings might have added weight to Lantheus’s decline, it contrasted with the broader market’s upward movement, highlighting investor concerns specific to the company's challenges.

Lantheus Holdings has 1 weakness we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

The recent class action lawsuit facing Lantheus Holdings could significantly impact the company's strategic narrative, which emphasizes growth opportunities in Alzheimer's and oncology imaging. If the allegations prove true, they might amplify investor worries about the company’s leadership and operational transparency amidst market pressures. This could further exacerbate the investor sentiment that has already contributed to a 4.81% share price decline.

Despite short-term volatility, Lantheus's long-term shareholder returns are notable, with a 300.15% increase over the past five years. However, these gains are contrasted by underperforming relative returns over the last year, as Lantheus lagged behind the US Medical Equipment industry, which returned 0.7%, and the broader US market, which enjoyed a 19.1% increase.

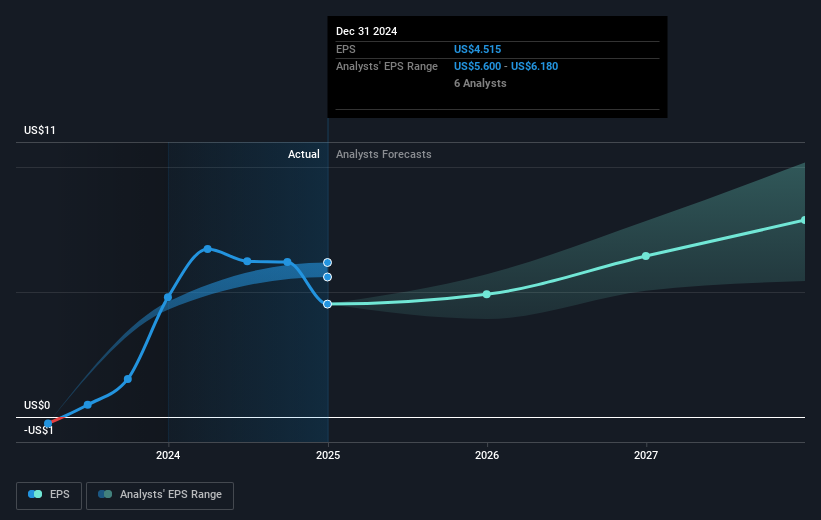

The legal issues may hinder Lantheus's ability to actualize earnings and revenue forecasts. With revenue growing 5.7% annually and earnings anticipated at US$419.8 million by September 2028, uncertainty regarding legal outcomes could necessitate revisions to these projections. Such outcomes also pose risks to achieving an analyst consensus price target of US$89.5, especially when the current share price stands at US$52.50, reflecting a significant gap that suggests substantial recovery is needed. While longer-term growth prospects remain buoyant, the pending legal challenges present immediate headwinds to both market confidence and valuation progress.

Gain insights into Lantheus Holdings' historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion