- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

How Legal Risks and Leadership Changes Could Reshape Lantheus Holdings' (LNTH) Dependence on Pylarify

Reviewed by Sasha Jovanovic

- Lantheus Holdings reported its third-quarter 2025 results, revealing sales of US$384.01 million and net income of US$27.77 million, while also updating full-year revenue guidance to a range of US$1.49 billion to US$1.51 billion and announcing major executive leadership changes, including the planned retirement of CEO Brian Markison and the appointment of Mary Anne Heino as interim CEO.

- At the same time, the company is facing multiple class action lawsuits alleging misrepresentation of revenue outlook and reimbursement risks related to its key product Pylarify, which has highlighted Lantheus’s reliance on this single revenue driver.

- We’ll examine how ongoing legal challenges over Pylarify’s reimbursement risk may influence the company’s future earnings and portfolio diversification narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Lantheus Holdings Investment Narrative Recap

To own shares of Lantheus Holdings right now, you need to be confident in its ability to successfully diversify beyond Pylarify, even as ongoing class action lawsuits over revenue misrepresentation and reimbursement risks keep short-term focus tightly on this lead product. The current legal challenges have sharpened attention on pricing pressure and contract renegotiations in the PSMA PET imaging segment, which continue to be the most important earnings catalyst and risk, but the recent news is consistent with trends already top of mind for investors.

Among recent company announcements, Lantheus modestly raised its full-year revenue guidance to a range of US$1.49 billion to US$1.51 billion, which, despite the legal overhang and management transitions, suggests limited immediate impact to its core operations or the outlook for upcoming product launches in Alzheimer's and neuroendocrine imaging.

By contrast, investors should be aware that these legal actions over Pylarify reimbursement and pricing create added uncertainty...

Read the full narrative on Lantheus Holdings (it's free!)

Lantheus Holdings is projected to reach $1.8 billion in revenue and $419.8 million in earnings by 2028. This forecast assumes a 5.7% annual revenue growth and a $148.8 million increase in earnings from the current $271.0 million level.

Uncover how Lantheus Holdings' forecasts yield a $83.07 fair value, a 56% upside to its current price.

Exploring Other Perspectives

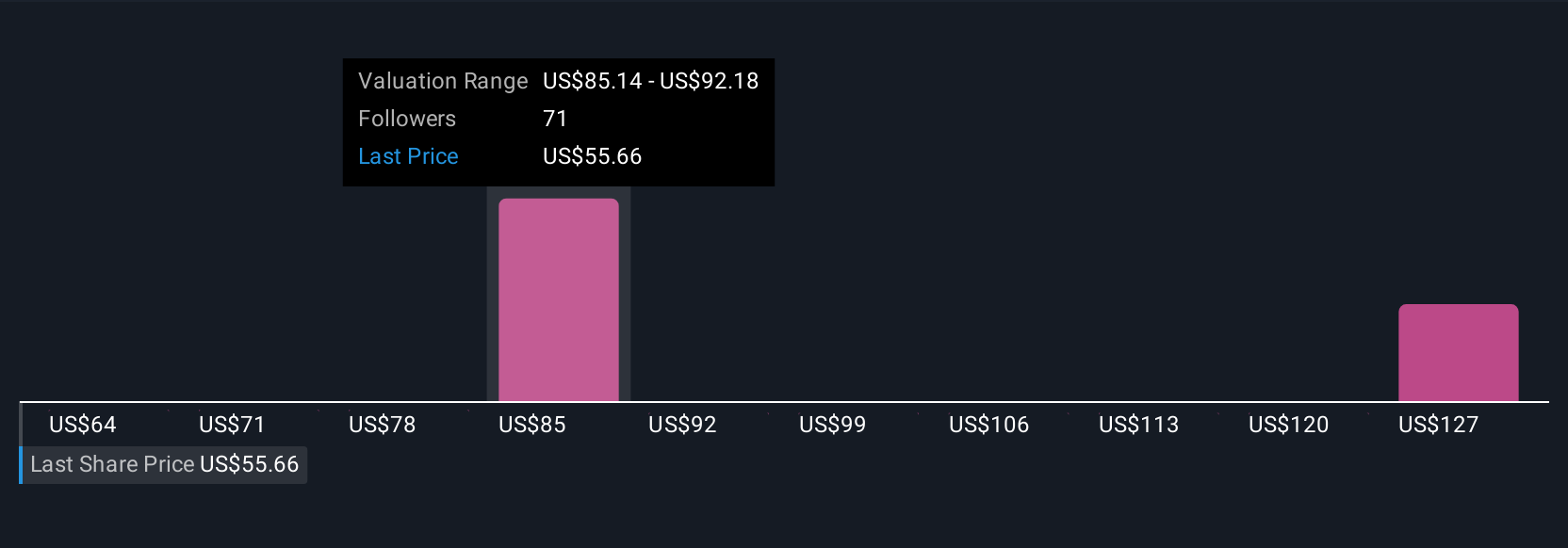

Private investors in the Simply Wall St Community set fair value estimates for Lantheus between US$63 and US$141.12, reflecting ten distinct viewpoints. While some see the growth potential in Alzheimer's diagnostics, others weigh the impact of Pylarify legal and reimbursement risks, shaping a wide range of expectations for the company’s future performance.

Explore 10 other fair value estimates on Lantheus Holdings - why the stock might be worth just $63.00!

Build Your Own Lantheus Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lantheus Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lantheus Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lantheus Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives