- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

How Class Action Lawsuits Over Pylarify Disclosures Will Impact Lantheus Holdings (LNTH) Investors

Reviewed by Sasha Jovanovic

- In October 2025, multiple law firms announced class action lawsuits against Lantheus Holdings, alleging that the company made materially false and misleading statements about its radiopharmaceutical product Pylarify's pricing, competition, and future growth. The lawsuits follow a period in 2025 when Lantheus reported missed financial estimates and reduced growth guidance for Pylarify, prompting investor losses and increased scrutiny of its communications.

- An important insight is that these legal actions specifically focus on Lantheus's disclosures and understanding of Pylarify's market position, highlighting concerns about transparency and the accuracy of management's previous guidance.

- We'll explore how these allegations of misleading statements about Pylarify's market dynamics could influence the outlook and growth assumptions underpinning Lantheus's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Lantheus Holdings Investment Narrative Recap

To be a shareholder in Lantheus Holdings, you need confidence in the company's ability to regain and expand its leadership in radiopharmaceutical imaging, especially as Pylarify remains its chief revenue driver. The latest class action lawsuits raise concerns about disclosure and transparency at a time when maintaining investor trust is critical; given the focus on Pylarify's pricing and competition, these legal and reputational challenges could weigh heavily on short-term sentiment and bring new risks to the company’s largest near-term catalyst, the rollout and margin reset of next-generation Pylarify formulations.

Among recent developments, the exclusive licensing agreement with GE HealthCare for Pylarify in Japan stands out, as it broadens international exposure and builds an additional earnings stream outside the US market. This move enhances the business case for Lantheus beyond its existing product concentration but is unlikely to immediately offset the heightened scrutiny and pressures facing the US franchise's revenue and growth assumptions.

By contrast, investors should be aware that heavy concentration in one product line could quickly become a double-edged sword if...

Read the full narrative on Lantheus Holdings (it's free!)

Lantheus Holdings' outlook anticipates $1.8 billion in revenue and $419.8 million in earnings by 2028. This scenario reflects a 5.7% annual revenue growth rate and an earnings increase of $148.8 million from the current earnings of $271.0 million.

Uncover how Lantheus Holdings' forecasts yield a $84.29 fair value, a 52% upside to its current price.

Exploring Other Perspectives

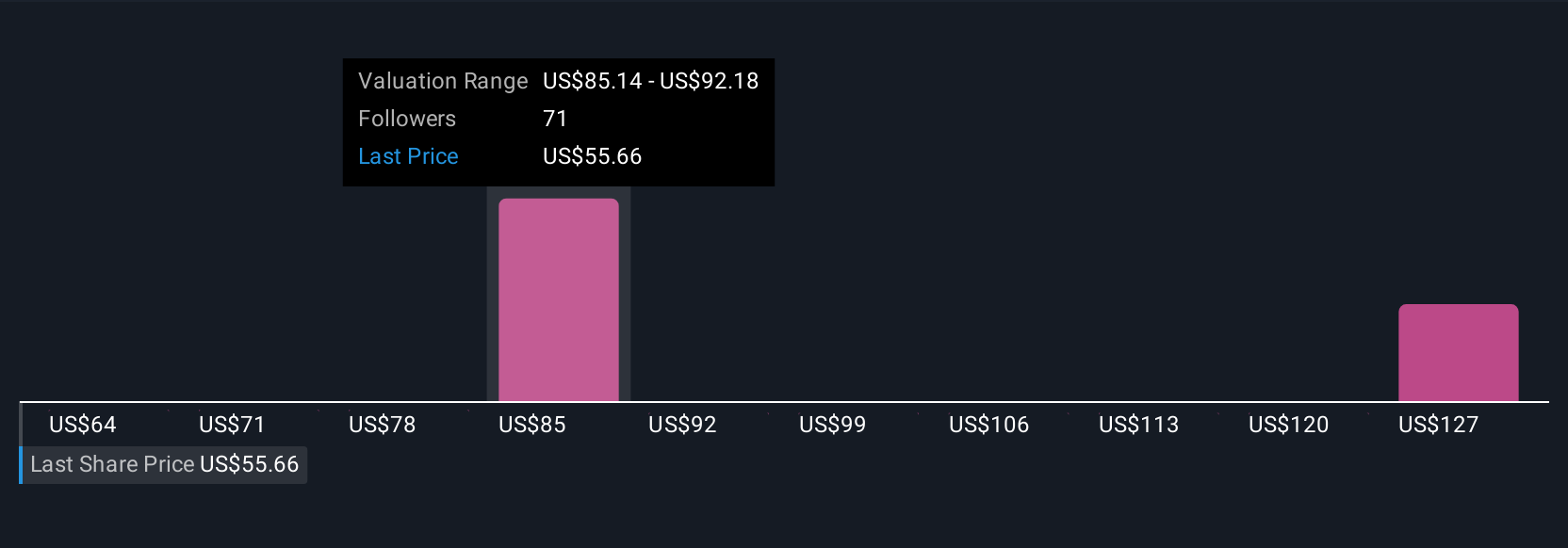

Six individual fair value estimates from the Simply Wall St Community place Lantheus between US$63 and US$91.08 per share. With new legal risks to Pylarify’s outlook, these perspectives remind you to weigh how competitive threats can reshape market assumptions.

Explore 6 other fair value estimates on Lantheus Holdings - why the stock might be worth just $63.00!

Build Your Own Lantheus Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lantheus Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lantheus Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lantheus Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives