- United States

- /

- Medical Equipment

- /

- NasdaqGM:LMAT

How Investors May Respond To LeMaitre Vascular (LMAT) Raised Guidance and Insider Share Sales

Reviewed by Sasha Jovanovic

- LeMaitre Vascular recently reported quarterly earnings that exceeded analyst forecasts, with a 15% rise in revenue year-over-year and newly raised guidance for upcoming quarters.

- August saw significant insider share sales by two directors, coinciding with institutional interest as Vanguard Personalized Indexing Management LLC established a new position in the company during the second quarter.

- With management raising financial guidance after better-than-expected earnings, we will now examine how this announcement impacts LeMaitre Vascular’s investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

LeMaitre Vascular Investment Narrative Recap

To own shares of LeMaitre Vascular, you need conviction in sustained demand for vascular interventions, continued product innovation, and successful global market expansion. The recent strong earnings and updated guidance reinforce optimism about near-term execution. However, the most important short-term catalyst, ongoing margin and revenue growth, is tempered by risks surrounding the sustainability of recent unit growth after a temporary boost from catheter stocking orders. The latest results do not materially reduce the risk that growth may normalize at a slower pace in coming quarters.

From the company’s latest announcements, the August update to quarterly guidance and revenue outlook stands out as most relevant. This move, following outperformance in earnings, signals confidence from management in delivering further growth. Yet, the sustainability of growth drivers, especially after events that may have temporarily elevated numbers, remains a focal point for investors tracking upcoming quarters.

Yet, despite recent results, investors should be mindful that temporary order boosts could mean future growth looks different if...

Read the full narrative on LeMaitre Vascular (it's free!)

LeMaitre Vascular's outlook anticipates $312.8 million in revenue and $65.6 million in earnings by 2028. This reflects a projected annual revenue growth rate of 10.1% and a $18.5 million earnings increase from current earnings of $47.1 million.

Uncover how LeMaitre Vascular's forecasts yield a $104.78 fair value, a 17% upside to its current price.

Exploring Other Perspectives

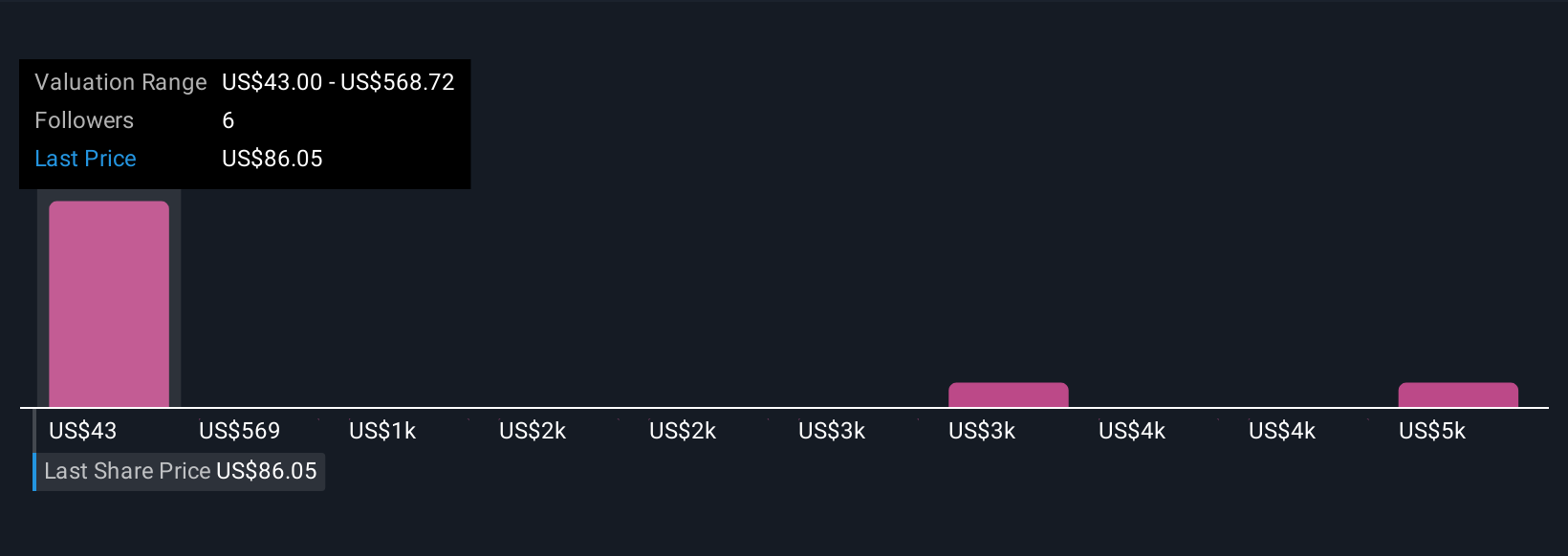

Five fair value estimates from the Simply Wall St Community range from US$43 to as high as US$5,300. With such varied viewpoints, make sure to weigh these alongside the possibility that recent revenue growth may not fully persist in future periods.

Explore 5 other fair value estimates on LeMaitre Vascular - why the stock might be a potential multi-bagger!

Build Your Own LeMaitre Vascular Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LeMaitre Vascular research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free LeMaitre Vascular research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LeMaitre Vascular's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LMAT

LeMaitre Vascular

Develops, manufactures, and markets medical devices and implants used in the field of vascular surgery in the Americas, Europe, the Middle Esat, Africa, and the Asia Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives