Some Lianluo Smart (NASDAQ:LLIT) Shareholders Have Taken A Painful 84% Share Price Drop

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. For example, we sympathize with anyone who was caught holding Lianluo Smart Limited (NASDAQ:LLIT) during the five years that saw its share price drop a whopping 84%. And we doubt long term believers are the only worried holders, since the stock price has declined 71% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 40% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Lianluo Smart

We don't think Lianluo Smart's revenue of US$383,458 is enough to establish significant demand. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Lianluo Smart will significantly advance the business plan before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that the company needed to issue more shares recently so that it could raise enough money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Lianluo Smart has already given some investors a taste of the bitter losses that high risk investing can cause.

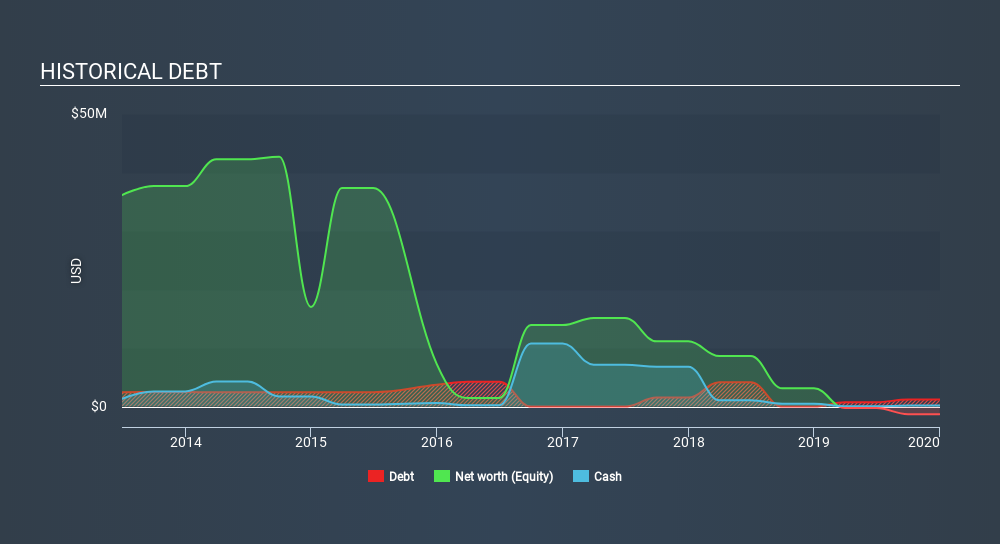

Our data indicates that Lianluo Smart had more in total liabilities than it had cash, when it last reported. That put it in the highest risk category, according to our analysis. But since the share price has dived -31% per year, over 5 years , it looks like some investors think it's time to abandon ship, so to speak, even though the cash reserves look a little better with the capital raising. You can see in the image below, how Lianluo Smart's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? I'd like that just about as much as I like to drink milk and fruit juice mixed together. You can click here to see if there are insiders selling.

A Different Perspective

While the broader market gained around 6.1% in the last year, Lianluo Smart shareholders lost 71%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 31% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Lianluo Smart better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Lianluo Smart (of which 3 are concerning!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Market Insights

Community Narratives