- United States

- /

- Medical Equipment

- /

- NasdaqGS:LIVN

LivaNova (LIVN) Is Up 5.5% After Medicare Boosts VNS Therapy Reimbursement—Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- In November 2025, LivaNova PLC announced that the U.S. Centers for Medicare & Medicaid Services reassigned VNS Therapy™ for drug-resistant epilepsy to a new payment classification, resulting in significantly higher Medicare outpatient reimbursement rates starting in January 2026.

- This change reduces a key financial barrier for hospitals, making VNS Therapy more accessible for patients and potentially supporting broader adoption of this neuromodulation treatment.

- We'll explore how this substantial increase in Medicare reimbursement for VNS Therapy could influence LivaNova's long-term growth narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

LivaNova Investment Narrative Recap

To be a shareholder in LivaNova, you need to believe in the potential for advanced neuromodulation and cardiopulmonary devices to drive both widespread clinical adoption and continued reimbursement support, despite evolving healthcare cost controls. The recent CMS move raising Medicare reimbursement for VNS Therapy directly addresses a top short-term catalyst, expanded access, while reducing a major financial barrier, but still leaves long-term pricing pressure as the most important risk for the business. The completion of the CORE-VNS study earlier in June 2025 is especially relevant, showing strong seizure reduction with VNS Therapy, which helped pave the way for CMS’s improved payment decision; the data serves as further support for broader adoption, strengthening the case that reimbursement changes can act as a catalyst for future growth. However, investors should also recognize that global cost containment efforts could eventually impact LivaNova’s pricing power...

Read the full narrative on LivaNova (it's free!)

LivaNova's outlook anticipates $1.6 billion in revenue and $168.9 million in earnings by 2028. This forecast assumes a 6.4% annual revenue growth rate and a $380.2 million improvement in earnings from the current level of -$211.3 million.

Uncover how LivaNova's forecasts yield a $69.10 fair value, a 8% upside to its current price.

Exploring Other Perspectives

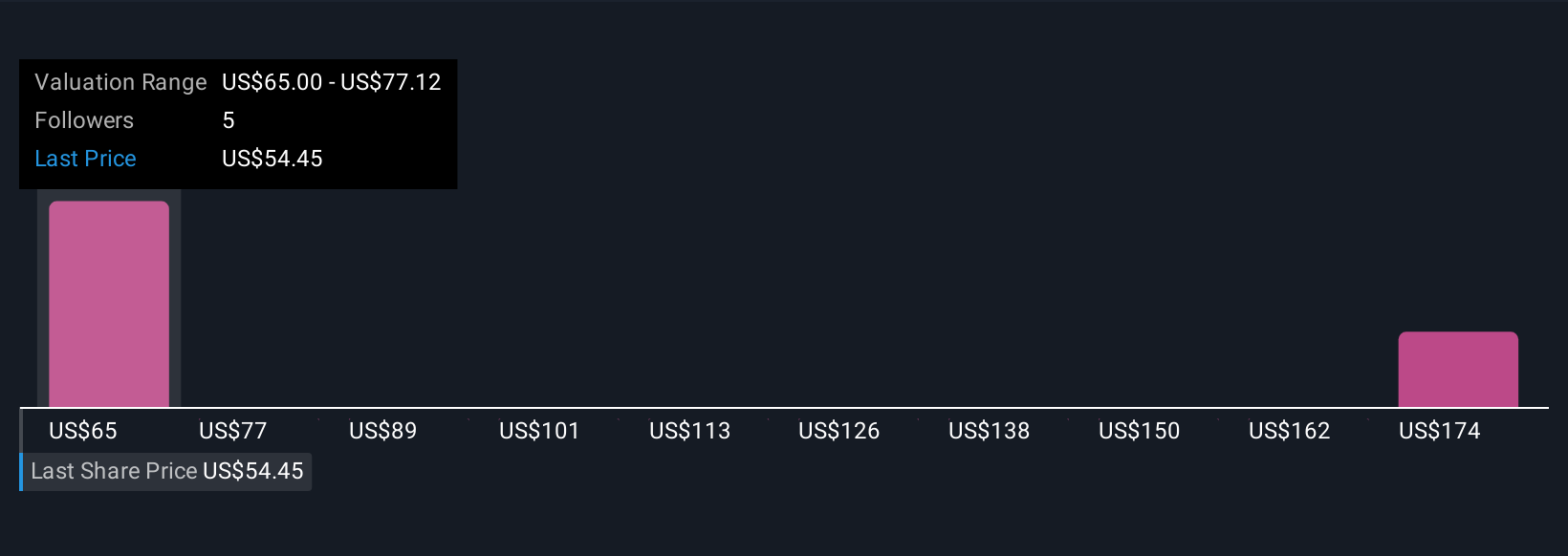

Simply Wall St Community members provided two fair value estimates for LivaNova, ranging widely from US$69.10 to US$177.32 per share. While this showcases sharply different growth assumptions among retail investors, the recent CMS reimbursement revision stands out as a catalyst that could influence long-term adoption and operating margins, reminding you to weigh diverse opinions before making up your mind.

Explore 2 other fair value estimates on LivaNova - why the stock might be worth over 2x more than the current price!

Build Your Own LivaNova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LivaNova research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free LivaNova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LivaNova's overall financial health at a glance.

No Opportunity In LivaNova?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIVN

LivaNova

A medical technology company, designs, develops, manufactures, markets, and sells products and therapies for neurological and cardiac conditions worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026