- United States

- /

- Medical Equipment

- /

- NasdaqGS:LIVN

How Positive aura6000 Clinical Trial Results Could Shape LivaNova (LIVN)’s Competitive Edge in Sleep Therapy

Reviewed by Sasha Jovanovic

- In recent days, LivaNova presented five-year results from its THN-3 randomized control trial and 12-month top-line data from the OSPREY follow-on study for the aura6000™ System at the International Surgical Sleep Society Annual Meeting, highlighting meaningful responder rates in treating moderate to severe obstructive sleep apnea.

- This scientific data release, paired with additional updates on clinical trial milestones and broader product innovation, has reinvigorated investor interest and suggested new avenues for growth in neuromodulation therapy.

- We'll explore how positive clinical trial outcomes for the aura6000™ System may impact LivaNova's growth outlook and competitive positioning.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

LivaNova Investment Narrative Recap

For investors considering LivaNova, belief in the company’s ability to drive neuromodulation innovation and achieve wider regulatory and reimbursement traction, while managing competitive and cost pressures, is essential. The new positive clinical trial data for the aura6000™ System strengthens LivaNova’s short-term growth catalyst by supporting future system adoption, yet the biggest near-term risk remains reimbursement pressures and pricing power, particularly as public health systems scrutinize costs. The impact of this scientific release is meaningful, but ongoing margin risks cannot be discounted.

Among recent developments, LivaNova’s strong five-year and 12-month clinical trial results for aura6000™ highlight the tangible progress in its OSA therapy pipeline. This momentum is key as successful data can reinforce adoption, reduce approval delays, and accelerate revenue, helping offset margin risks linked to high R&D spending and market competition.

However, it is just as important for investors to recognize the threat of tightening healthcare budgets and cost scrutiny, especially as...

Read the full narrative on LivaNova (it's free!)

LivaNova's outlook forecasts $1.6 billion in revenue and $168.9 million in earnings by 2028. This calls for annual revenue growth of 6.4% and a $380.2 million earnings increase from the current level of -$211.3 million.

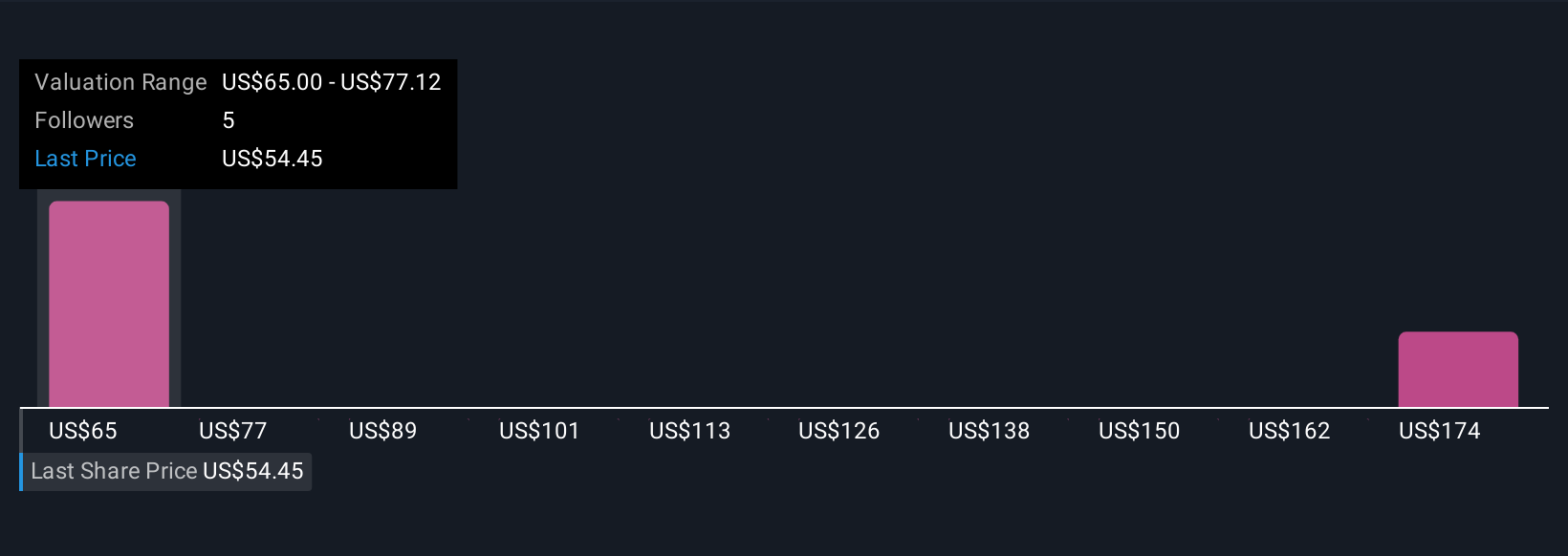

Uncover how LivaNova's forecasts yield a $65.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community peg fair value for LivaNova stock between US$65 and US$188, with two distinct perspectives informing this range. This difference highlights that while some are optimistic about new product milestones, reimbursement and cost challenges still signal caution for future growth.

Explore 2 other fair value estimates on LivaNova - why the stock might be worth just $65.00!

Build Your Own LivaNova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LivaNova research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free LivaNova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LivaNova's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIVN

LivaNova

A medical technology company, designs, develops, manufactures, markets, and sells products and therapies for neurological and cardiac conditions worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives