- United States

- /

- Medical Equipment

- /

- NasdaqCM:LFWD

Investors Give ReWalk Robotics Ltd. (NASDAQ:LFWD) Shares A 28% Hiding

ReWalk Robotics Ltd. (NASDAQ:LFWD) shares have had a horrible month, losing 28% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 14% share price drop.

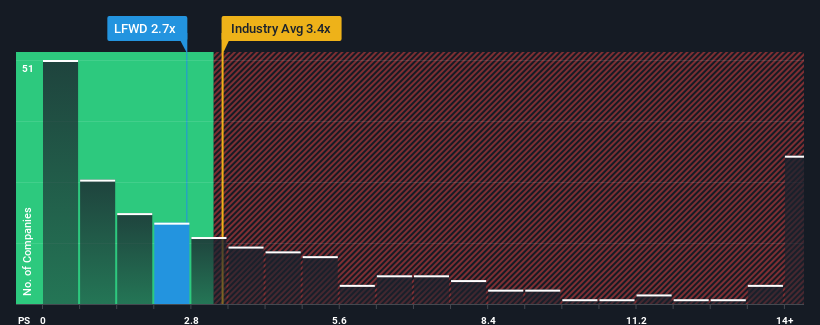

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about ReWalk Robotics' P/S ratio of 2.7x, since the median price-to-sales (or "P/S") ratio for the Medical Equipment industry in the United States is also close to 3.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for ReWalk Robotics

What Does ReWalk Robotics' Recent Performance Look Like?

ReWalk Robotics certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think ReWalk Robotics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, ReWalk Robotics would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 151% last year. The strong recent performance means it was also able to grow revenue by 215% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 58% per annum as estimated by the only analyst watching the company. With the industry only predicted to deliver 9.5% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that ReWalk Robotics' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

ReWalk Robotics' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that ReWalk Robotics currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for ReWalk Robotics that you need to be mindful of.

If you're unsure about the strength of ReWalk Robotics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LFWD

Lifeward

A medical device company, designs, develops, and commercializes technologies that enable mobility and wellness in rehabilitation and daily life for individuals with physical and neurological conditions in the United States, Europe, the Asia-Pacific, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success