- United States

- /

- Healthcare Services

- /

- NasdaqGS:LFST

A Look at LifeStance Health Group’s (LFST) Valuation Following Strong Q3 Results and Improved Margin Guidance

Reviewed by Simply Wall St

LifeStance Health Group (LFST) just posted third-quarter results showing higher sales and a return to profitability. The company maintained its full-year outlook and slightly increased its margin expectations, drawing attention from investors.

See our latest analysis for LifeStance Health Group.

LifeStance Health Group’s upbeat quarter and stronger guidance appear to have injected some fresh momentum, with a sharp 33.9% 7-day share price return and a 26% gain over the past month. Despite this rally, the stock’s total shareholder return over one year remains negative. This reflects ongoing investor caution but suggests sentiment may be shifting as fundamental performance improves.

If you’re watching how optimism in healthcare is moving the market, see the full list of companies setting the pace with our See the full list for free.

The recent rally raises a key question: is LifeStance Health Group’s rebound just the start of a broader recovery and undervaluation, or has the market already factored in the improved outlook and future growth potential?

Most Popular Narrative: 23.6% Undervalued

LifeStance Health Group's most closely watched narrative signals a fair value well above its latest closing price. This suggests that the market may not be fully recognizing potential upside from future performance and industry developments.

Investments in AI and digital technology platforms (such as automated revenue cycle tools, patient engagement systems, and enhanced care matching) are expected to drive operating leverage, reduce administrative costs, and improve clinician productivity. These improvements could result in higher net margins and increased earnings over the long term.

Want to know what’s fueling this bold valuation? Contributing factors include rapid revenue growth, transformative margin assumptions, and a future profit multiple that is uncommon in healthcare. Interested in the specific forecasts and financial drivers that shape this narrative? Explore the details behind the analysis that supports this headline fair value estimate.

Result: Fair Value of $8.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition from large healthcare players and persistent insurer reimbursement pressures could significantly challenge LifeStance Health Group’s growth and profitability outlook.

Find out about the key risks to this LifeStance Health Group narrative.

Another Perspective: Is the Market Already Pricing in Optimism?

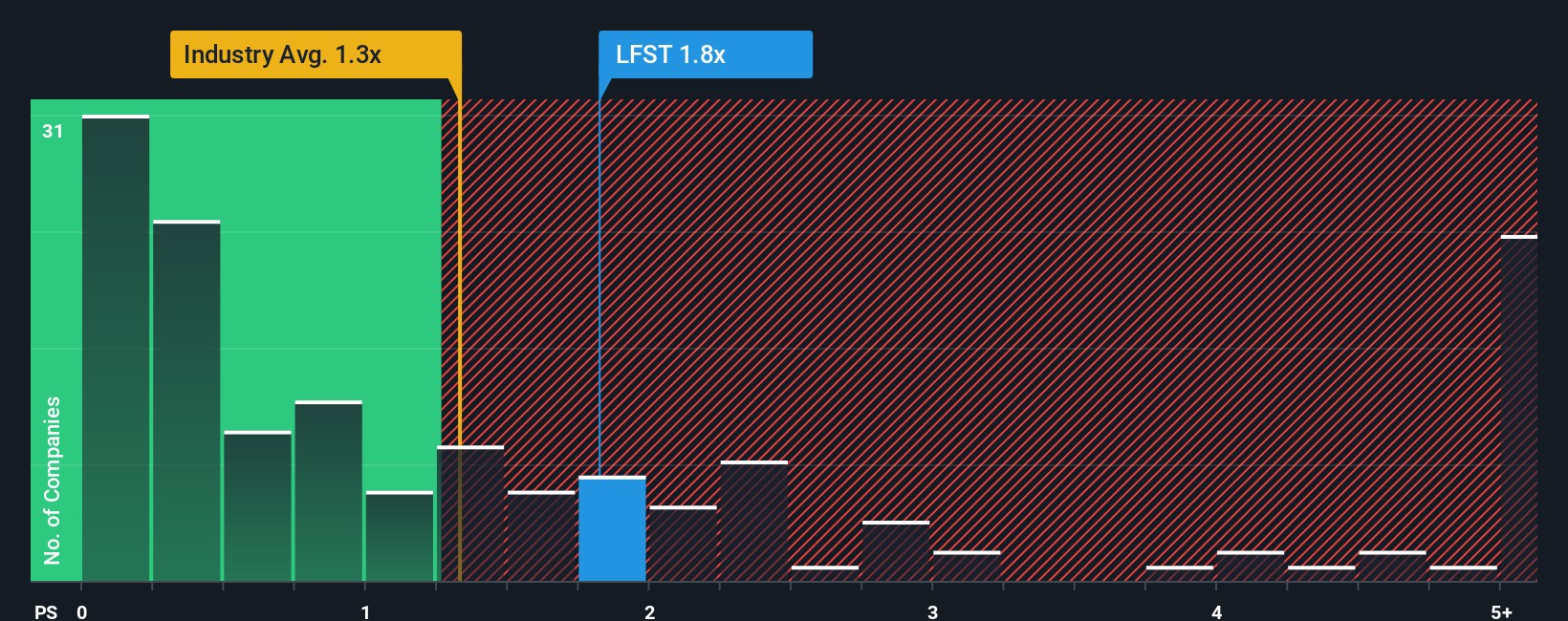

While analyst forecasts point to undervaluation, the company's price-to-sales ratio sits at 1.8x, which is higher than both the US Healthcare industry average (1.4x) and its peer group (1.3x). This premium suggests that investors may be including future optimism in today's price, raising questions about risk if growth disappoints or the market moves closer to the fair ratio of 1.3x.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LifeStance Health Group Narrative

Don’t see things the same way, or want to dig into the numbers yourself? It only takes a few minutes to develop your personal view. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding LifeStance Health Group.

Looking for more investment ideas?

Stop waiting on the sidelines and try these unique investment paths to seize opportunities before others do. Your next winning stock may be closer than you think.

- Start building income potential now by checking out these 14 dividend stocks with yields > 3% delivering impressive yields above 3% to boost your portfolio's returns.

- Uncover companies pushing the frontier in artificial intelligence by examining these 27 AI penny stocks leading the charge in smart automation and next-generation industries.

- Tap into tomorrow’s value plays with these 883 undervalued stocks based on cash flows poised for growth based on robust cash flow metrics that signal strong upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LFST

LifeStance Health Group

Through its subsidiaries, provides outpatient mental health services to children, adolescents, adults, and geriatrics in the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives