- United States

- /

- Healthcare Services

- /

- NasdaqCM:JYNT

Optimistic Investors Push The Joint Corp. (NASDAQ:JYNT) Shares Up 26% But Growth Is Lacking

The Joint Corp. (NASDAQ:JYNT) shares have continued their recent momentum with a 26% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 6.7% isn't as impressive.

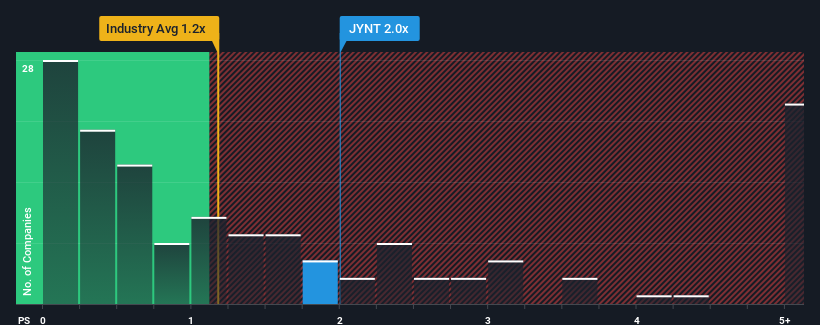

After such a large jump in price, given close to half the companies operating in the United States' Healthcare industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Joint as a stock to potentially avoid with its 2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Joint

How Joint Has Been Performing

There hasn't been much to differentiate Joint's and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Joint will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Joint would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. The latest three year period has also seen an excellent 90% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 6.7% as estimated by the four analysts watching the company. With the industry predicted to deliver 7.3% growth, that's a disappointing outcome.

In light of this, it's alarming that Joint's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Bottom Line On Joint's P/S

The large bounce in Joint's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Joint's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Joint, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:JYNT

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives