- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

What Intuitive Surgical, Inc.'s (NASDAQ:ISRG) P/E Is Not Telling You

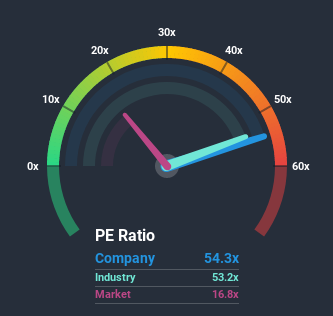

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider Intuitive Surgical, Inc. (NASDAQ:ISRG) as a stock to avoid entirely with its 54.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's superior to most other companies of late, Intuitive Surgical has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Intuitive Surgical

Does Intuitive Surgical Have A Relatively High Or Low P/E For Its Industry?

We'd like to see if P/E's within Intuitive Surgical's industry might provide some colour around the company's particularly high P/E ratio. The image below shows that the Medical Equipment industry as a whole also has a P/E ratio significantly higher than the market. So this certainly goes a fair way towards explaining the company's ratio right now. Ordinarily, the majority of companies' P/E's would be lifted firmly by the general conditions within the Medical Equipment industry. Still, the strength of the company's earnings will most likely determine where its P/E shall sit.

How Is Intuitive Surgical's Growth Trending?

In order to justify its P/E ratio, Intuitive Surgical would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 19% gain to the company's bottom line. Pleasingly, EPS has also lifted 76% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 7.3% per annum during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 10.0% per annum growth forecast for the broader market.

With this information, we find it concerning that Intuitive Surgical is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

The price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Intuitive Surgical currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Intuitive Surgical with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Intuitive Surgical. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you decide to trade Intuitive Surgical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives