- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Is It Too Late to Consider Intuitive Surgical After 29.6% Price Jump?

Reviewed by Bailey Pemberton

- Ever wondered if Intuitive Surgical’s high-flying stock still has room to deliver value, or if it’s already priced for perfection? Let’s break down what’s really driving the story here before jumping to conclusions.

- After a sharp run-up, Intuitive Surgical’s share price climbed 29.6% over the past month and is now up an impressive 131.2% over five years. This suggests that investors have already priced in plenty of growth, but new risks may have emerged along the way.

- Recent headlines have focused on the company’s expansion into new international markets and the acceleration of robotic-assisted procedures in hospitals, which has excited investors. At the same time, the industry is buzzing over growing competition and shifting regulatory landscapes, adding to the mix of optimism and caution.

- While Intuitive Surgical currently scores 0 out of 6 on our undervaluation checks, we are about to unpack what that means across different valuation methods. You will want to see the fresh perspective at the end of this article before making up your mind.

Intuitive Surgical scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

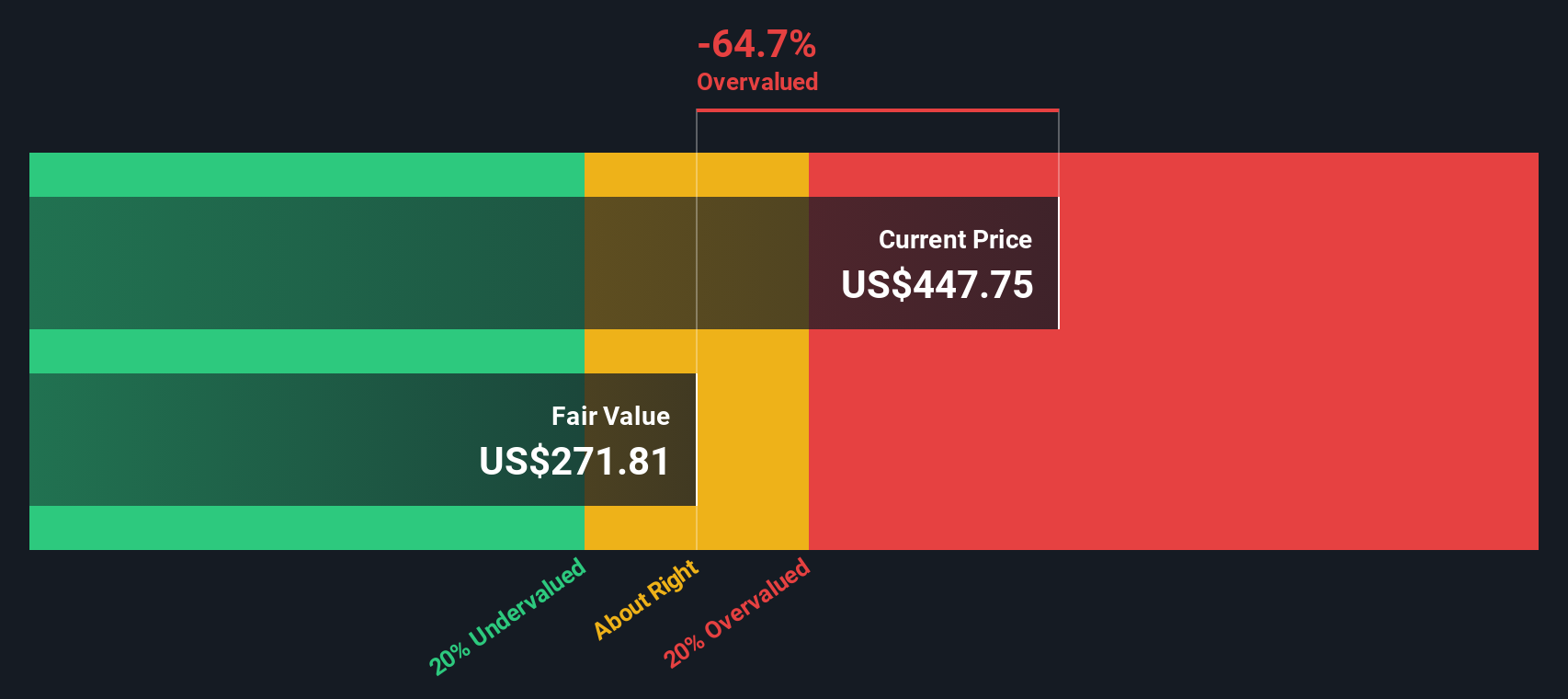

Approach 1: Intuitive Surgical Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company’s future cash flows and discounting them back to today’s value. This method provides a theoretical “intrinsic value” for the stock using cash flow projections as the key input.

For Intuitive Surgical, the latest reported Free Cash Flow is $1.90 billion. Analysts expect these cash flows to grow rapidly over the coming years, projecting figures of $3.66 billion in 2026, $4.33 billion in 2027, and reaching $5.31 billion by 2029. Since analyst estimates typically span only five years, Simply Wall St extends these projections to 2035 with its own growth assumptions. This approach gives investors a fuller look at possible value generation.

Based on this 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share is $328.65. When compared to the current share price, the model implies that the stock is trading at a 72.1% premium to its calculated fair value. This suggests that despite its high growth prospects, Intuitive Surgical may be significantly overvalued on a pure cash flow basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intuitive Surgical may be overvalued by 72.1%. Discover 882 undervalued stocks or create your own screener to find better value opportunities.

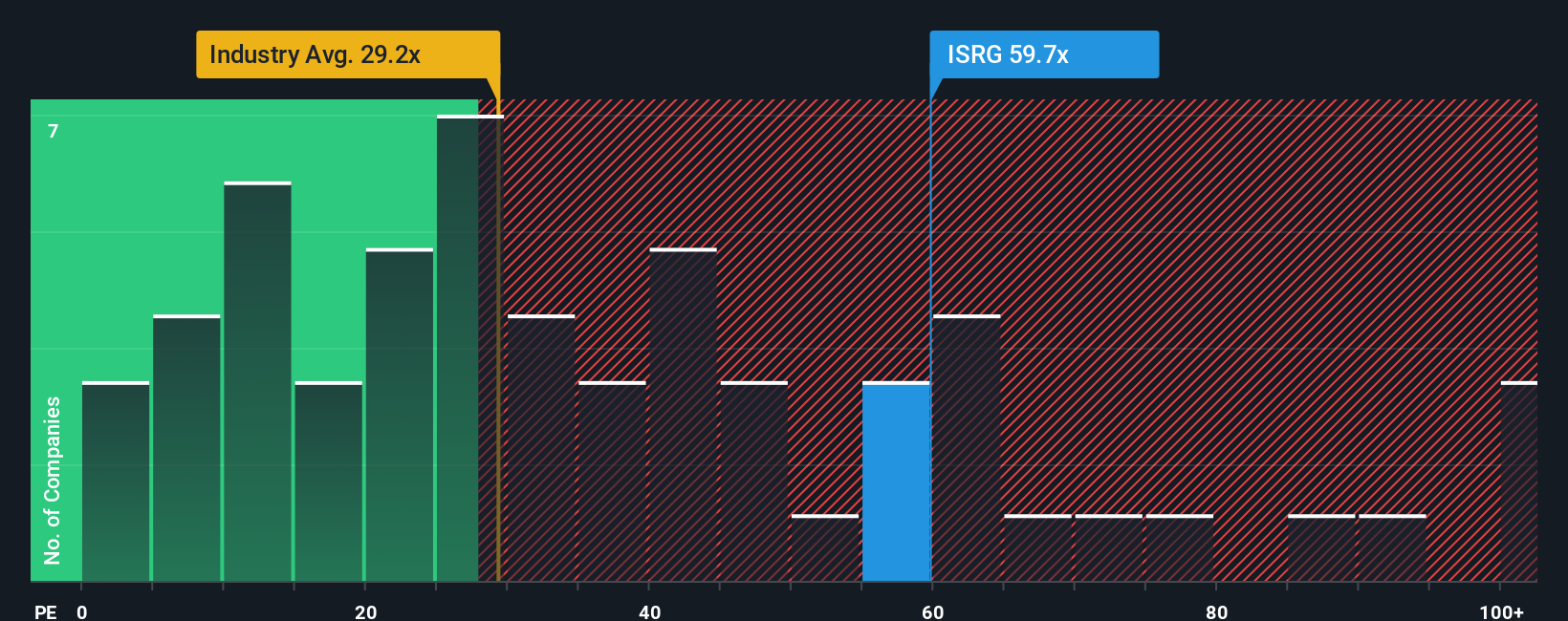

Approach 2: Intuitive Surgical Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely-used metric for valuing profitable companies like Intuitive Surgical, as it tells investors how much they are paying for each dollar of earnings. The right PE ratio for a company depends not only on how fast profits are expected to grow, but also on how risky or stable those future earnings might be compared to the broader market and its industry.

Intuitive Surgical currently trades at a hefty 73x PE, which is far higher than the medical equipment industry average of 27.3x and also well above the average among similar peers of 36.7x. While a premium PE can be justified by strong growth and market leadership, it is important to question how much is too much.

Instead of only comparing across peers, Simply Wall St calculates a “Fair Ratio.” This proprietary PE multiple is tailored to each company by considering not just industry and company size, but also future earnings growth, profit margins, and any known business risks. For Intuitive Surgical, the Fair Ratio currently sits at 39.9x, which is quite a bit below its actual PE.

Since the stock’s PE of 73x significantly exceeds its Fair Ratio, this approach suggests Intuitive Surgical’s shares are priced well above what its fundamentals and risk profile justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

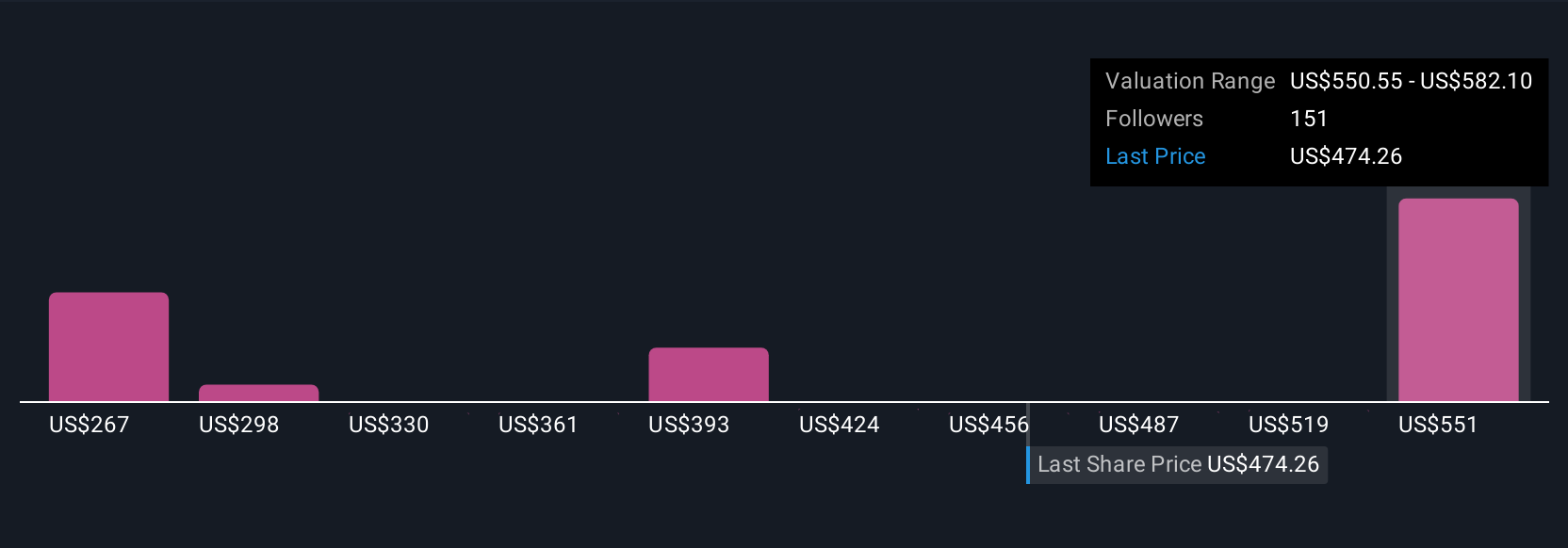

Upgrade Your Decision Making: Choose your Intuitive Surgical Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story and perspective about a company, combined with your assumptions for things like fair value, future revenue, earnings, and margins, all in one place. Narratives link a company's unique story to a concrete financial forecast, allowing you to arrive at your own fair value and investment thesis.

On Simply Wall St’s Community page (used by millions of investors), Narratives make this analysis easy and accessible by letting you map your outlook directly to the company’s numbers. Narratives help you decide when to buy or sell by visually comparing your Fair Value to the current Price, making your convictions clear and actionable. Even better, Narratives are dynamic: when new information such as earnings releases or industry news becomes available, the forecast and fair value update instantly, so your view stays fresh.

For example, one investor’s Narrative sees Intuitive Surgical fairly valued at $685, reflecting strong expected growth, while another pegs its value at $325, highlighting worries about valuation and competition. This demonstrates how Narratives capture a range of smart, differing perspectives behind every share price.

For Intuitive Surgical, we’ll make it easy for you with previews of two leading Intuitive Surgical Narratives:

- 🐂 Intuitive Surgical Bull Case

Fair value per share: $592.96

Current price is 4.6% below fair value

Projected revenue growth: 13.5%

- Analysts see robust global adoption and new procedures supporting recurring revenues and long-term competitive advantage. Product innovation and digital tools are driving utilization.

- Margin stability and growth are projected due to strong clinical outcomes, broadening market access, and expansion into emerging markets. Future earnings are projected to climb toward $3.7 billion by 2028.

- Key risks include regulatory delays, international budget constraints, growing competition from third-party suppliers, and evolving reimbursement policies that could impact growth and profitability.

- 🐻 Intuitive Surgical Bear Case

Fair value per share: $400.91

Current price is 41.1% above fair value

Projected revenue growth: 12.0%

- Intuitive Surgical pioneered robotic-assisted surgery and now generates 83% of its revenue from high-margin, recurring service and parts for its 9,500+ installed da Vinci systems.

- Despite rapid growth and a strong digital ecosystem, the stock’s valuation is considered stretched. The current price is estimated to offer only about a 1% annual return based on cash flow assumptions.

- This narrative views ISRG as a strong company but too expensive to buy today, given its history of rarely trading at attractive value levels. Some suggest patient investors may wish to wait for a better entry point.

Do you think there's more to the story for Intuitive Surgical? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives