- United States

- /

- Medical Equipment

- /

- NasdaqGS:IRTC

Why iRhythm Technologies (IRTC) Is Up 22.9% After AI Partnership and Q2 Outlook Announcement

Reviewed by Simply Wall St

- In the past week, iRhythm Technologies reported its second quarter 2025 earnings with sales reaching US$186.69 million and net loss reduced to US$14.22 million, while also providing a full year 2025 revenue outlook of US$720 million to US$730 million.

- The company unveiled a partnership with Lucem Health to launch an AI-powered solution for earlier arrhythmia detection in high-risk patient groups, reflecting ongoing innovation and a shift toward preventative healthcare.

- We'll assess how the AI-driven partnership for early arrhythmia detection shapes the evolving investment narrative for iRhythm Technologies.

Find companies with promising cash flow potential yet trading below their fair value.

iRhythm Technologies Investment Narrative Recap

Investors in iRhythm Technologies need to believe in the ongoing shift toward preventative, digital health solutions for cardiac care, with the prospect of expanding AI-powered technologies as the key to unlocking growth in new and underdiagnosed patient populations. The recent earnings announcement and Lucem Health partnership reinforce this vision and speak directly to innovation-driven catalysts, but do not fundamentally change the most pressing risk, which remains regulatory and reimbursement headwinds in core and international markets.

Among recent developments, the AI-powered collaboration with Lucem Health stands out, as it could meaningfully broaden iRhythm’s reach into chronic disease groups not previously prioritized for ambulatory cardiac monitoring. With new data on the cost and clinical burden of undetected arrhythmias, this move positions the company at the intersection of preventative care and scalable, real-world impact, a potentially important edge as health systems increasingly favor value-based solutions.

However, before getting caught up in this momentum, investors should be aware that regulatory and compliance challenges remain a significant concern, as continued FDA scrutiny and the need for quality upgrades may...

Read the full narrative on iRhythm Technologies (it's free!)

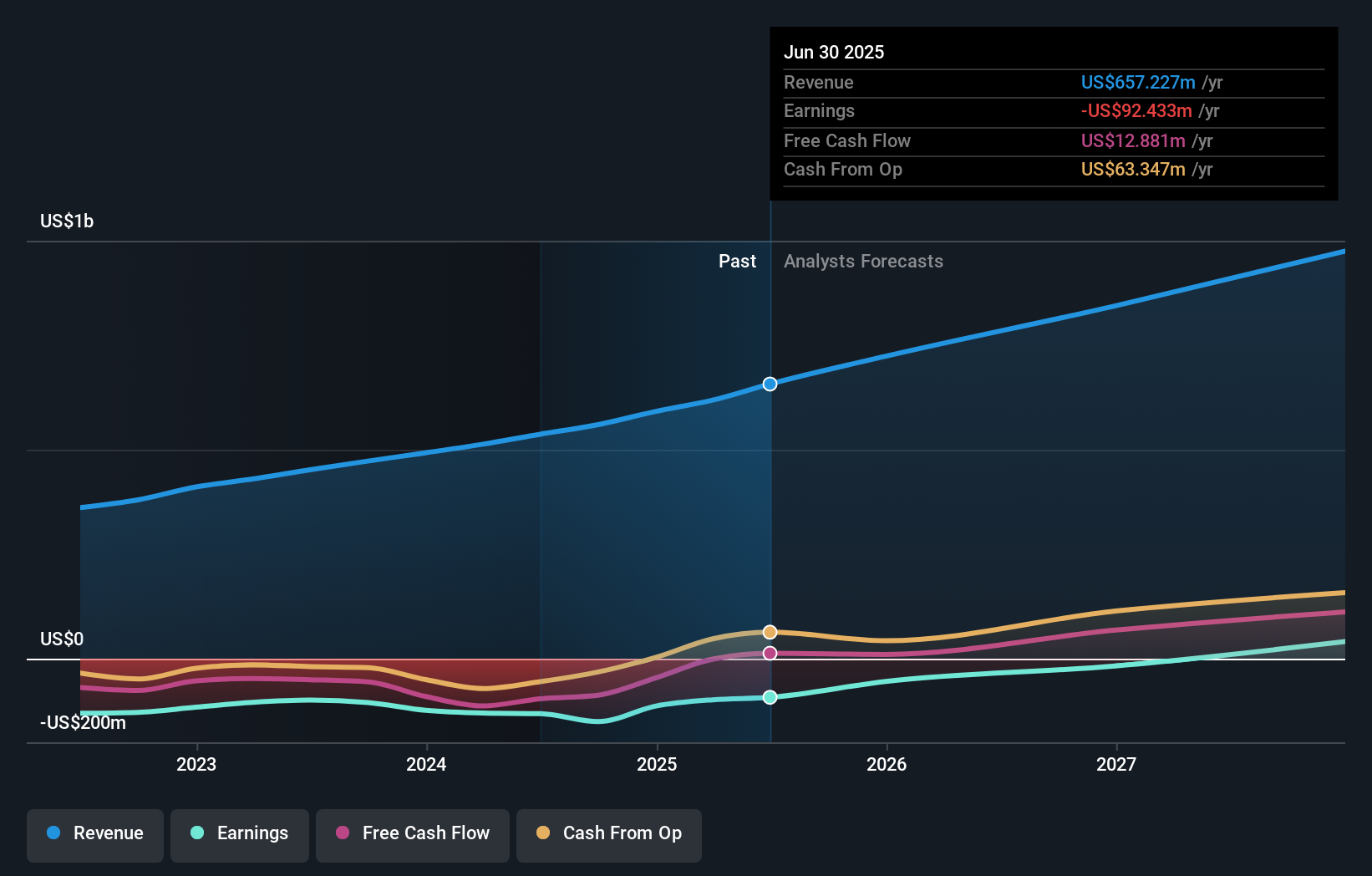

iRhythm Technologies is forecast to achieve $997.1 million in revenue and $23.9 million in earnings by 2028. This outlook assumes a 17.3% annual revenue growth rate and an improvement in earnings of $122.2 million from the current -$98.3 million.

Uncover how iRhythm Technologies' forecasts yield a $146.83 fair value, a 11% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided three fair value estimates for iRhythm Technologies, ranging from US$74.68 to US$146.83. While community sentiment reflects wide-ranging outlooks, regulatory risks tied to FDA oversight and reimbursement remain a central topic for the company’s future performance, be sure to check out the variety of investor views on these issues.

Explore 3 other fair value estimates on iRhythm Technologies - why the stock might be worth less than half the current price!

Build Your Own iRhythm Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your iRhythm Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free iRhythm Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate iRhythm Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iRhythm Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRTC

iRhythm Technologies

A digital healthcare company, engages in the design, development, and commercialization of device-based technology that provides ambulatory cardiac monitoring services to diagnose arrhythmias in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives