Key Takeaways

- Accelerated global adoption of Zio and digital health integration is expanding iRhythm's market reach, operational efficiency, and recurring revenue streams.

- Investment in AI, device innovation, and international clinical partnerships is enhancing technological differentiation and supporting long-term margin growth.

- Ongoing reimbursement, regulatory, competitive, and innovation pressures strain margins, hinder profitability, and create persistent revenue and cash flow uncertainty amidst evolving market and macroeconomic risks.

Catalysts

About iRhythm Technologies- A digital healthcare company, engages in the design, development, and commercialization of device-based technology that provides ambulatory cardiac monitoring services to diagnose arrhythmias in the United States.

- The rapid expansion of ambulatory cardiac monitoring for high-risk, aging, and undiagnosed populations-with Zio capturing primary care channel growth and new value-based care partners-creates a significant opportunity to increase iRhythm's addressable market and topline revenue.

- Widespread adoption of digital health solutions (including Epic Aura integration and home enrollment capabilities) is streamlining workflows and enabling more remote monitoring; this positions iRhythm to drive higher utilization, improved operating efficiency, and gross margin expansion.

- The shift toward value-based care and preventative medicine is accelerating early arrhythmia detection, which, supported by robust real-world clinical evidence of Zio's cost-effectiveness and superior diagnostic performance, is likely to support expanded reimbursement, deeper market penetration, and growing recurring revenues.

- Ongoing expansion into large international markets (notably Japan and Europe) is forecast to drive substantial future revenue growth, especially as iRhythm builds localized clinical evidence to achieve favorable reimbursement and leverages strategic distribution partners.

- Continuous investment in AI-based analytics, next-generation device innovation, and potential multi-parameter monitoring platforms underpins sustainable technological differentiation, boosts customer lifetime value, and supports future margin expansion.

iRhythm Technologies Future Earnings and Revenue Growth

Assumptions

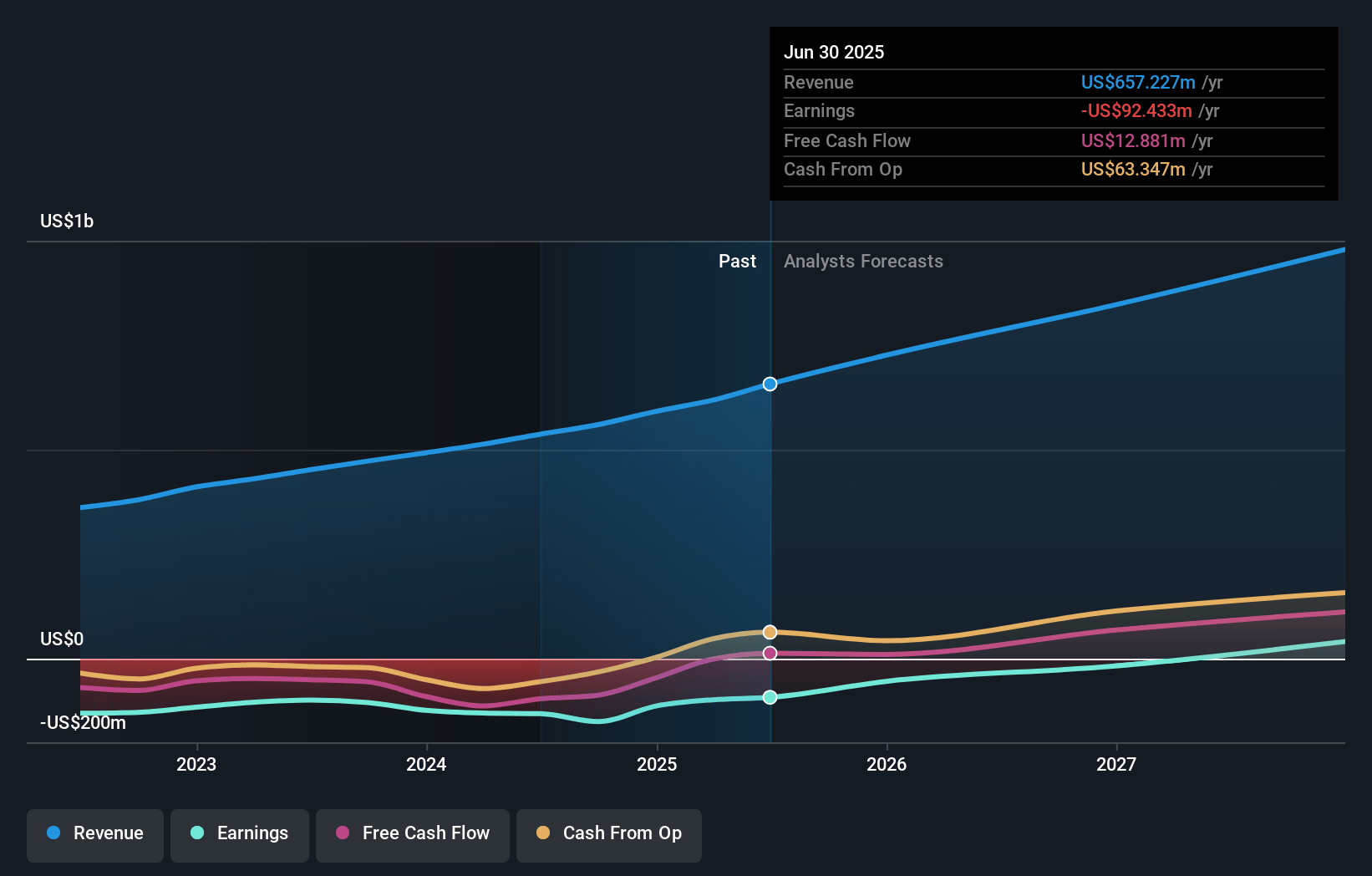

How have these above catalysts been quantified?- Analysts are assuming iRhythm Technologies's revenue will grow by 17.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -15.9% today to 2.4% in 3 years time.

- Analysts expect earnings to reach $23.9 million (and earnings per share of $0.63) by about July 2028, up from $-98.3 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $9.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 256.2x on those 2028 earnings, up from -43.5x today. This future PE is greater than the current PE for the US Medical Equipment industry at 31.3x.

- Analysts expect the number of shares outstanding to grow by 2.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.4%, as per the Simply Wall St company report.

iRhythm Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Reimbursement uncertainties and pricing pressure, particularly highlighted by the below-expected reimbursement rate for Zio in Japan and ongoing low single-digit U.S. pricing headwinds, present long-term risk to revenue growth and margin expansion as payers (including Medicare, NHS, and Japanese MHLW) increasingly look to contain costs.

- Regulatory and compliance risks remain elevated, evidenced by current focus on FDA warning letter remediation, ongoing DOJ subpoena activities, and the need for extensive quality system upgrades-extended regulatory scrutiny could delay new product approvals (like Zio MCT) or hinder international expansion, impacting both revenue growth and operating margins.

- Market share gains in mobile cardiac telemetry (MCT) have been opportunistic due to recent competitor disruptions rather than organic growth or differentiation, suggesting that success may be difficult to sustain as the competitive landscape normalizes, creating potential volatility in revenue composition and growth rates.

- High dependence on innovation to stay competitive in a rapidly evolving market (e.g., multiparameter and AI-driven sensors) requires ongoing heavy investment in R&D, which, combined with rising legal and compliance costs, continues to result in persistent net losses and delays achieving sustainable profitability.

- Macroeconomic and industry-wide risks-including potential adverse tariff impacts, global supply chain pressures, and slow progress in non-U.S. market reimbursement-could erode gross margins and exacerbate cash flow challenges, especially as the company projects remaining free cash flow negative through at least the end of 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $145.667 for iRhythm Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $167.0, and the most bearish reporting a price target of just $130.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $997.1 million, earnings will come to $23.9 million, and it would be trading on a PE ratio of 256.2x, assuming you use a discount rate of 7.4%.

- Given the current share price of $133.92, the analyst price target of $145.67 is 8.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.