- United States

- /

- Medical Equipment

- /

- NasdaqGS:IRTC

These Analysts Think iRhythm Technologies, Inc.'s (NASDAQ:IRTC) Sales Are Under Threat

Market forces rained on the parade of iRhythm Technologies, Inc. (NASDAQ:IRTC) shareholders today, when the analysts downgraded their forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

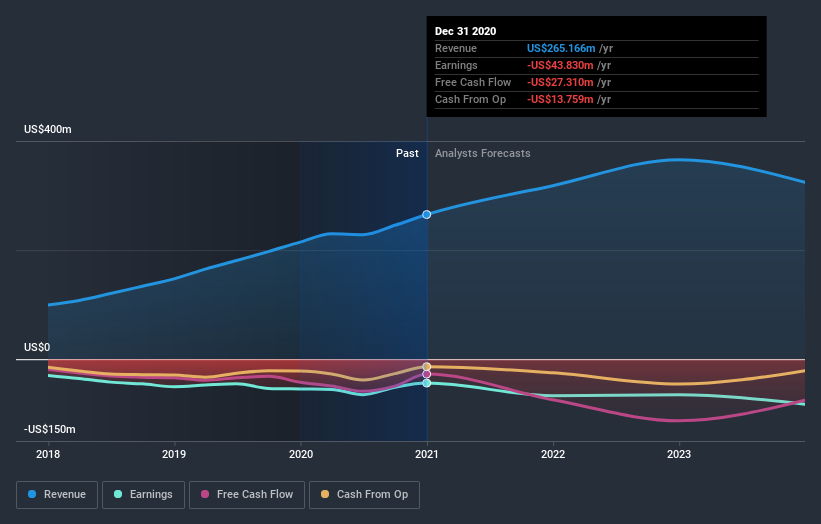

Following the downgrade, the latest consensus from iRhythm Technologies' eight analysts is for revenues of US$273m in 2021, which would reflect a reasonable 2.9% improvement in sales compared to the last 12 months. Per-share losses are expected to explode, reaching US$2.69 per share. However, before this estimates update, the consensus had been expecting revenues of US$326m and US$2.39 per share in losses. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

View our latest analysis for iRhythm Technologies

The consensus price target fell 57% to US$97.80, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic iRhythm Technologies analyst has a price target of US$288 per share, while the most pessimistic values it at US$80.00. With such a wide range in price targets, the analysts are almost certainly betting on widely diverse outcomes for the underlying business. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's pretty clear that there is an expectation that iRhythm Technologies' revenue growth will slow down substantially, with revenues to the end of 2021 expected to display 2.9% growth on an annualised basis. This is compared to a historical growth rate of 35% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 9.0% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than iRhythm Technologies.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for this year. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of iRhythm Technologies' future valuation. Given the stark change in sentiment, we'd understand if investors became more cautious on iRhythm Technologies after today.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with iRhythm Technologies' business, like dilutive stock issuance over the past year. For more information, you can click here to discover this and the 3 other flags we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade iRhythm Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if iRhythm Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:IRTC

iRhythm Technologies

A digital healthcare company, engages in the design, development, and commercialization of device-based technology that provides ambulatory cardiac monitoring services to diagnose arrhythmias in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives