- United States

- /

- Healthcare Services

- /

- NasdaqGS:INNV

InnovAge Holding (INNV): Unprofitable Losses Widen 10.4% Annually, Profitability Target Within Three Years

Reviewed by Simply Wall St

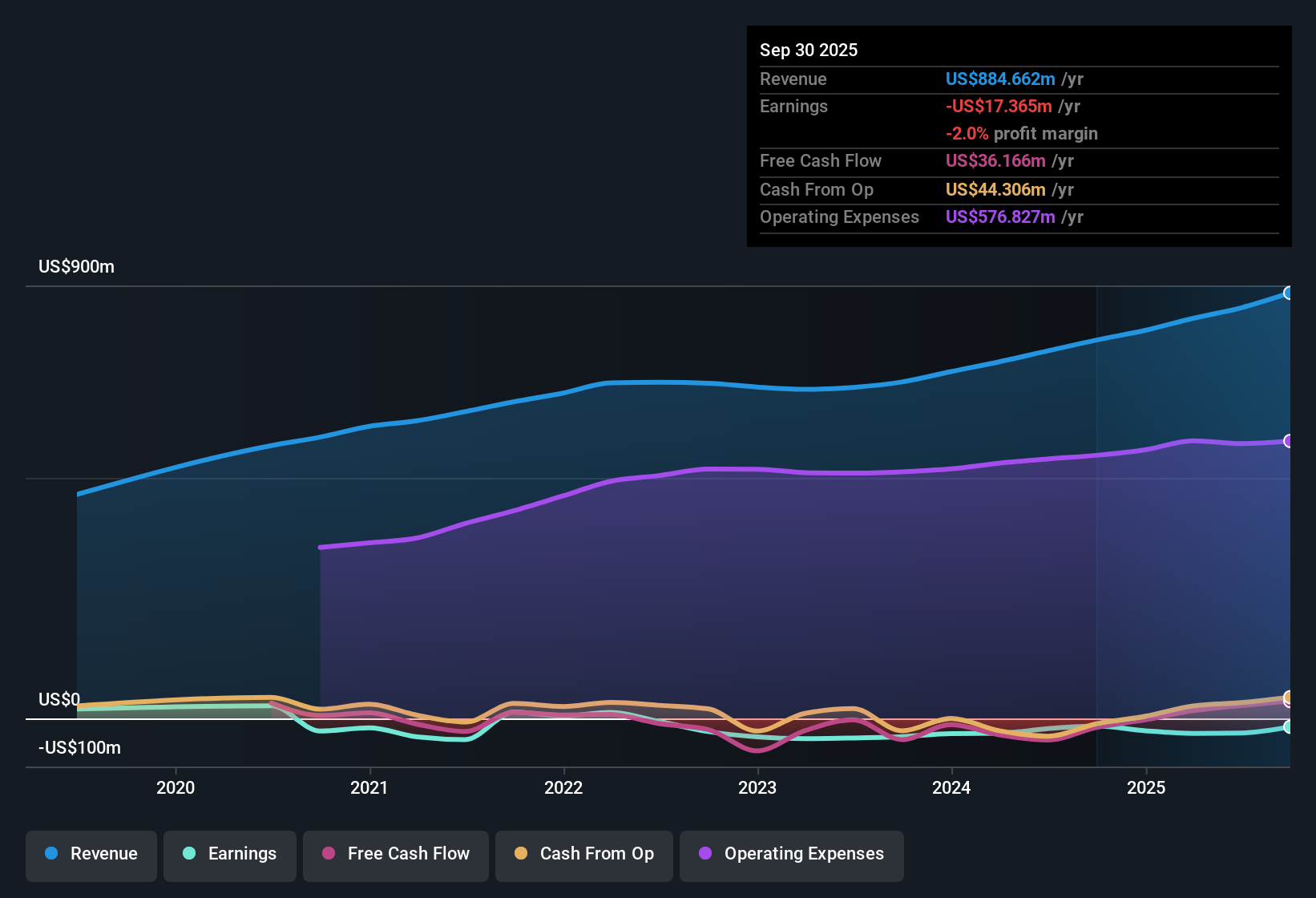

InnovAge Holding (INNV) remains unprofitable, posting an average annual increase in losses of 10.4% over the past five years. Revenue growth is projected at 8.8% per year, trailing the US market's 10.5% pace. However, earnings are forecast to climb by an impressive 45.2% annually, with the company expected to achieve profitability within the next three years. Current valuation appears attractive, as shares trade below estimated fair value, and investors are weighing this potential turnaround against recent share price volatility and a history of net losses.

See our full analysis for InnovAge Holding.Up next, we will dive into how these latest results stack up to the big narratives investors are following, and see where the new numbers might reinforce or disrupt expectations.

See what the community is saying about InnovAge Holding

Margin Improvement Hinges on Cost Control

- Profit margins are expected to climb from -3.8% now to 1.6% over the next three years, driven by technology investments and operational efficiencies that are actively reducing per-participant costs.

- Analysts' consensus view highlights that InnovAge's strategic shift toward value-based care is designed to boost margins,

- but rising costs are a serious challenge, with cost of care jumping 17.6% year-over-year while revenue only grew 13%, putting pressure on future profitability.

- Despite savings from operational improvements, escalating salaries and third-party costs could offset potential benefits, so delivering on the margin rebound depends on successful cost containment.

Consensus narrative highlights the clash between ambitious cost savings and persistently high expense growth. Analysts are watching if cost control will finally pay off. 📊 Read the full InnovAge Holding Consensus Narrative.

Expansion Drives Losses Despite Revenue Upside

- InnovAge’s de novo center expansion led to $3.5 million in quarterly losses, with management projecting $18 to 20 million in losses for FY25, even as ongoing enrollment growth continues to support revenue expansion.

- Analysts' consensus view emphasizes that while accelerated geographic growth enables scalable gains in the long run,

- the near-term spike in operating losses from new center rollouts and increased compliance expenses directly threatens profitability as the business model scales.

- Ongoing ramp-up costs create volatility around the path to breakeven. Not all new markets are guaranteed to reach positive margins quickly.

Valuation Discount Signals Investor Caution

- Shares trade at a price-to-sales ratio of 0.6x, well below both immediate peers (1.7x) and the US healthcare industry (1.2x), while the current share price of $3.99 remains 24.6% below the $5.00 analyst target.

- Analysts' consensus view points out that this discount reflects both opportunity and substantial risk,

- as the market is weighing the stock’s low valuation and impressive earnings growth forecasts against its ongoing history of net losses and recent share price volatility.

- With DCF fair value at 36.65, the gap to the current price highlights investor skepticism that InnovAge will fully close the profitability gap in line with analyst expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for InnovAge Holding on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique view on these results? Share your own analysis and shape the story in just a few minutes: Do it your way

A great starting point for your InnovAge Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

InnovAge’s inconsistent profitability, persistent net losses, and margin pressure signal that its path to steady, reliable growth remains uncertain for investors.

If you'd prefer companies consistently delivering earnings expansion and steady performance, use our stable growth stocks screener (2074 results) to quickly find alternatives with reliable growth track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INNV

InnovAge Holding

Manages and provides a range of medical and ancillary services for seniors in need of care and support to live independently in its homes and communities.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives