- United States

- /

- Medical Equipment

- /

- NasdaqGS:ICUI

Stronger Earnings Guidance Might Change the Case for Investing in ICU Medical (ICUI)

Reviewed by Sasha Jovanovic

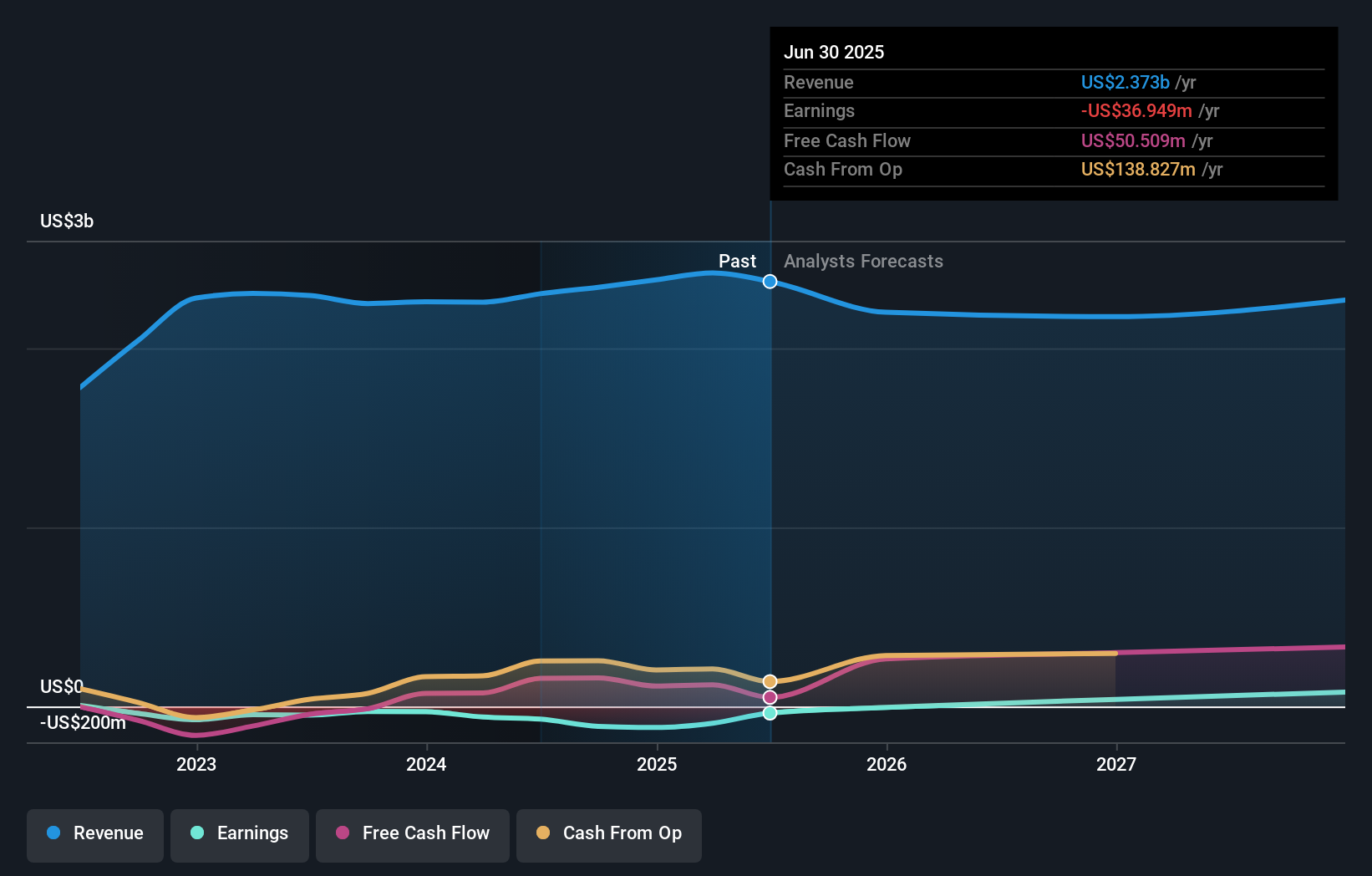

- ICU Medical recently reported that, despite a year-on-year revenue decline, it surpassed analysts’ earnings per share estimates and improved its full-year EPS guidance.

- This outcome suggests the company’s profitability and operational effectiveness have outperformed market expectations, offering a positive signal amid industry challenges.

- We’ll now assess how ICU Medical’s stronger earnings guidance may influence the company’s investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

ICU Medical Investment Narrative Recap

For investors considering ICU Medical, the central thesis hinges on confidence in the company’s ability to capitalize on structural healthcare demand and improve operational execution, even against tariff and integration headwinds. The recent earnings outperformance and higher full-year EPS guidance provide a modest near-term boost to sentiment but have not removed the most important short-term catalyst, the margin improvements expected from integration synergies, or the continuing risk from persistent tariff exposure, which remains a real threat to future profitability.

The April 2025 FDA clearance for the updated Plum Solo IV pump and software stands out as directly relevant to ICU Medical’s operating and earnings momentum. This announcement aligns with investor expectations for product innovation and supports the narrative that new product approvals could help offset some financial pressure, especially as the margin expansion tied to integration and portfolio enhancements becomes the most scrutinized catalyst going forward.

However, despite these recent achievements, investors need to stay attentive to the lingering risks from structural cost pressures, particularly as...

Read the full narrative on ICU Medical (it's free!)

ICU Medical's narrative projects $2.4 billion in revenue and $106.0 million in earnings by 2028. This requires a -0.1% yearly revenue decline and a $142.9 million increase in earnings from -$36.9 million currently.

Uncover how ICU Medical's forecasts yield a $176.50 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Fair value takes from 1 member of the Simply Wall St Community all suggest US$176.50, signaling consensus but limited range. While some participants are optimistic about the impact of ongoing integration efforts, concerns over persistent tariff-related cost challenges may temper near-term expectations for margin gains.

Explore another fair value estimate on ICU Medical - why the stock might be worth just $176.50!

Build Your Own ICU Medical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICU Medical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ICU Medical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICU Medical's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICUI

ICU Medical

Develops, manufactures, and sells medical devices used in infusion therapy, vascular access, and vital care applications worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives