- United States

- /

- Medical Equipment

- /

- NasdaqGS:ICUI

ICU Medical (ICUI) Is Up 6.8% After Narrowing 2025 Net Loss Guidance — Has Operational Discipline Peaked?

Reviewed by Sasha Jovanovic

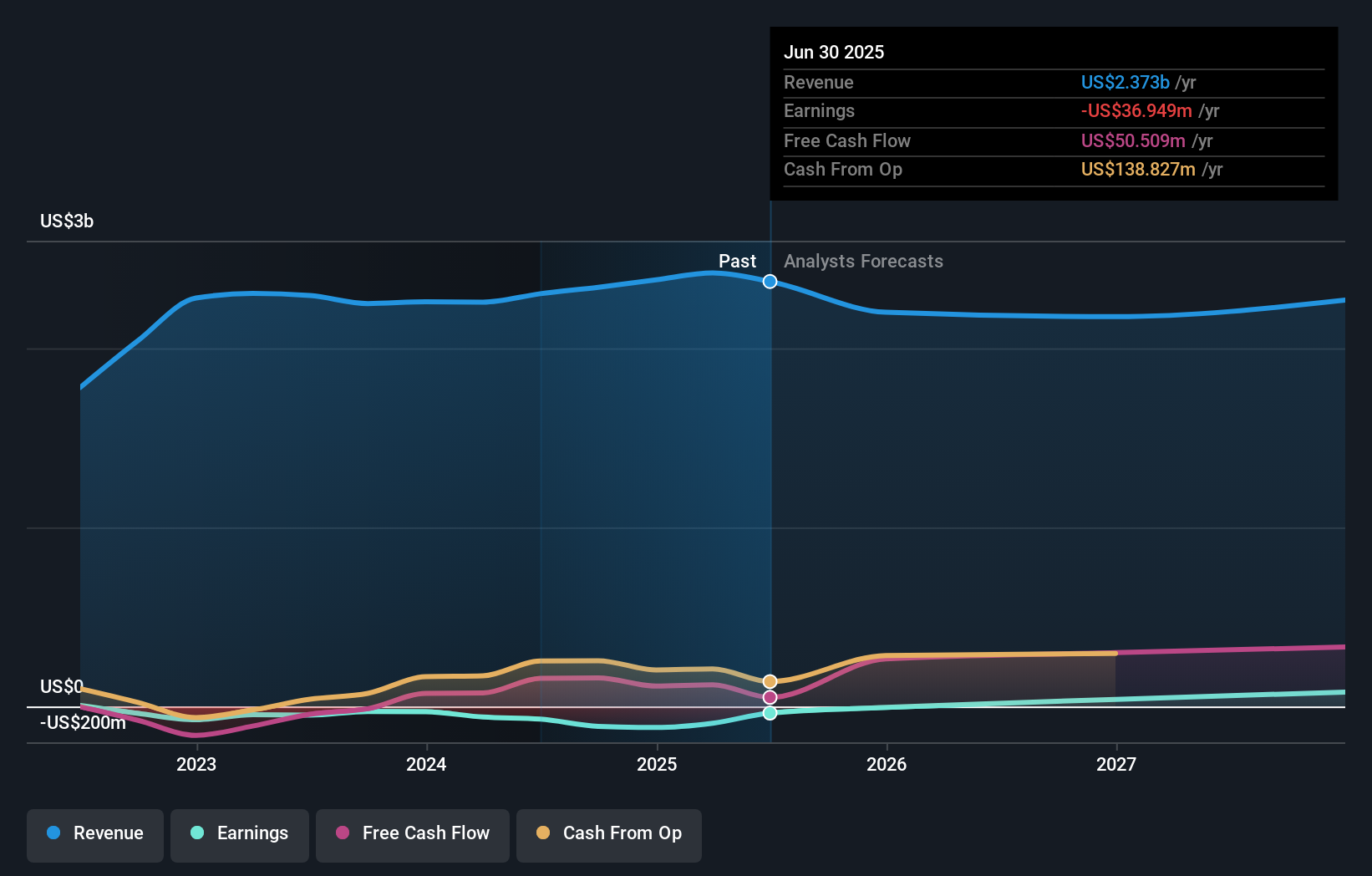

- ICU Medical released its third-quarter 2025 results, reporting sales of US$536.99 million and a net loss of US$3.4 million, while also updating its fiscal year guidance to a smaller projected GAAP net loss of between US$8 million and zero.

- The company’s earnings improvement and narrowed loss outlook mark a sharp contrast to the same period last year, highlighting progress in cost controls and operational execution.

- We’ll examine how ICU Medical’s improved loss outlook and focus on operational efficiencies are influencing its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

ICU Medical Investment Narrative Recap

To be a shareholder in ICU Medical right now, you need to believe in its ability to drive sustainable profit growth by delivering operational improvements while navigating industry headwinds. The recent Q3 results, featuring a narrowed net loss and improved guidance, provide encouraging signs for the company’s most important short term catalyst: achieving near-term profitability through expense discipline and margin gains. However, risks related to tariffs and integration costs remain, and this latest news only partially addresses those challenges, leaving the longer-term picture unchanged for now.

Among recent announcements, the November update to full-year 2025 guidance stands out, as ICU Medical lowered its projected GAAP net loss to US$8 million or zero, down from a previously expected loss as high as US$43 million. This sharper focus on cost-reduction and operational execution is closely linked with the company’s efforts to offset margin pressures from external risks, a key variable in the profit turnaround that shareholders are closely monitoring.

In contrast, even as cost improvements have reshaped the company’s guidance, investors should be aware that structural tariff headwinds on margins...

Read the full narrative on ICU Medical (it's free!)

ICU Medical's outlook forecasts $2.4 billion in revenue and $106.0 million in earnings by 2028. This implies a slight annual revenue decline of 0.1% and a $142.9 million increase in earnings from the current loss of $-36.9 million.

Uncover how ICU Medical's forecasts yield a $176.50 fair value, a 27% upside to its current price.

Exploring Other Perspectives

All ten fair value estimates from the Simply Wall St Community cluster at US$176.50 per share. While participant outlooks can converge, ongoing tariff pressures remain a live concern that could shape future sentiment and performance. Explore a range of viewpoints to understand how opinions differ and what it means for you.

Explore another fair value estimate on ICU Medical - why the stock might be worth just $176.50!

Build Your Own ICU Medical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICU Medical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ICU Medical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICU Medical's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICUI

ICU Medical

Develops, manufactures, and sells medical devices used in infusion therapy, vascular access, and vital care applications worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives