- United States

- /

- Medical Equipment

- /

- NasdaqGS:ICUI

ICU Medical (ICUI): Assessing Valuation After Trade Tensions, Supply Chain Risks, and Lower Sales Outlook

Reviewed by Kshitija Bhandaru

ICU Medical (ICUI) shares came under pressure after trade tensions between the US and China escalated, which raised fresh concerns about supply chain disruptions. Investors are also weighing weak sales projections and continued earnings declines.

See our latest analysis for ICU Medical.

The latest slide in ICU Medical’s share price, which is down 15.5% over the past month and 27.8% year-to-date, adds to what has already been a challenging year for shareholders. Total shareholder return over twelve months has been negative, and sentiment has been further affected by ongoing concerns about sales and profits. After a period of significant pressure, the stock’s momentum is clearly to the downside. This shift reflects increased perceived risks rather than indications of a turnaround.

If recent healthcare volatility has you thinking about broader opportunities, it’s a smart time to explore new ideas with our See the full list for free.

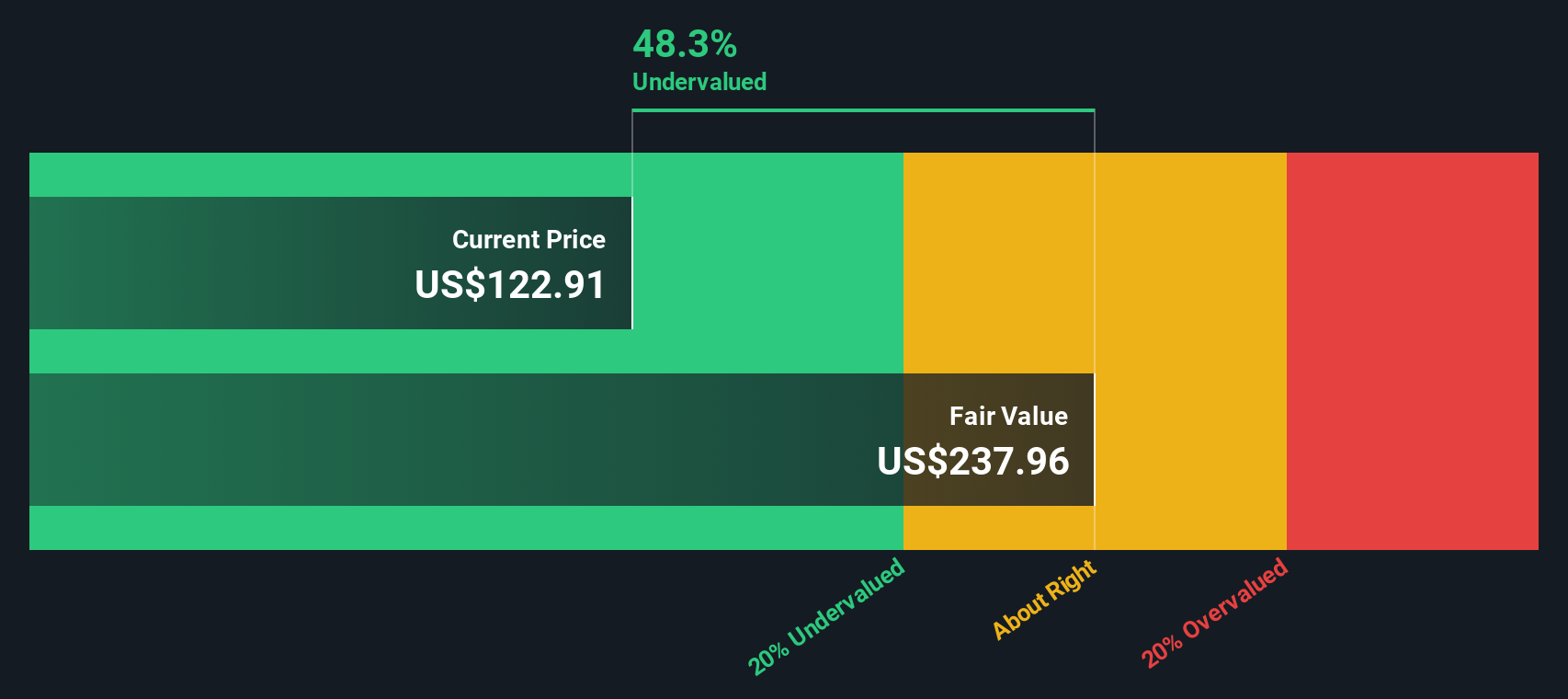

With shares trading at over a 50% discount to analyst targets and ongoing challenges clouding the outlook, the key question now is whether ICU Medical is a bargain with upside potential or if the market has already factored in future risks.

Most Popular Narrative: 35.3% Undervalued

With ICU Medical’s last close at $114.13 and the most popular narrative assigning a fair value of $176.50, the perceived upside is significant even amid today’s negative sentiment. The narrative focuses on how embedded healthcare trends and innovation could transform the company’s financial trajectory.

Rapidly progressing software and innovation pipeline, including integration of legacy ICU and Smiths platforms and upcoming launches of interconnected cloud-based infusion pump solutions, positions the company for increased recurring revenues and improved operating leverage as technology refresh cycles take effect; anticipated long-term benefit to net margins and earnings growth.

Wondering what’s fueling that sky-high price target? The narrative hinges on bold financial assumptions about future profitability, margin expansion, and sector-defying growth drivers. Ready to discover the projections even the market doesn’t fully believe? Uncover the hidden levers behind this valuation.

Result: Fair Value of $176.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures and regulatory hurdles could hamper profitability and stall the positive momentum anticipated by even the most optimistic forecasts.

Find out about the key risks to this ICU Medical narrative.

Another View: Discounted Cash Flow Perspective

A different take comes from the SWS DCF model, which estimates ICU Medical’s fair value at $239.23, well above both the current share price and analyst targets. This suggests shares could be even more undervalued than the narrative implies. Are markets underestimating long-term cash flows, or is the DCF model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ICU Medical Narrative

If you see things differently or want to base your conclusions on your own analysis, you can easily craft your personal view in just a few minutes with our tools. So why not Do it your way?

A great starting point for your ICU Medical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

While ICU Medical may be catching your eye, some of the most compelling opportunities are waiting where you least expect them. Don’t let these market stories pass you by. Let Simply Wall St’s screener put you ahead of the crowd.

- Kickstart your search for underpriced gems with these 898 undervalued stocks based on cash flows that are waiting to be recognized by the broader market.

- Capture game-changing trends by checking out these 24 AI penny stocks that are pushing the frontiers of artificial intelligence in real-world applications.

- Secure a steady stream of income by reviewing these 19 dividend stocks with yields > 3% offering yields above 3% and robust payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICUI

ICU Medical

Develops, manufactures, and sells medical devices used in infusion therapy, vascular access, and vital care applications worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives