- United States

- /

- Medical Equipment

- /

- NasdaqGS:IART

Exploring 3 Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

In the current U.S. market landscape, small-cap stocks have faced a challenging environment as broader indices like the S&P 600 reflect investor concerns over economic indicators and ongoing government shutdowns. Despite these headwinds, opportunities may exist for discerning investors who focus on companies with strong fundamentals and insider confidence, as evidenced by recent buying activity.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanmi Financial | 11.0x | 3.2x | 32.48% | ★★★★★☆ |

| PCB Bancorp | 8.9x | 2.8x | 29.92% | ★★★★★☆ |

| Peoples Bancorp | 10.0x | 1.8x | 46.23% | ★★★★★☆ |

| Limbach Holdings | 24.9x | 1.5x | 49.92% | ★★★★★☆ |

| S&T Bancorp | 11.0x | 3.7x | 39.89% | ★★★★☆☆ |

| Farmland Partners | 6.3x | 7.8x | -38.37% | ★★★★☆☆ |

| Citizens & Northern | 12.7x | 3.1x | 45.73% | ★★★☆☆☆ |

| CNB Financial | 16.9x | 3.2x | 49.88% | ★★★☆☆☆ |

| Shore Bancshares | 9.4x | 2.5x | -50.73% | ★★★☆☆☆ |

| NexPoint Real Estate Finance | 3.3x | 1.6x | -1250.02% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

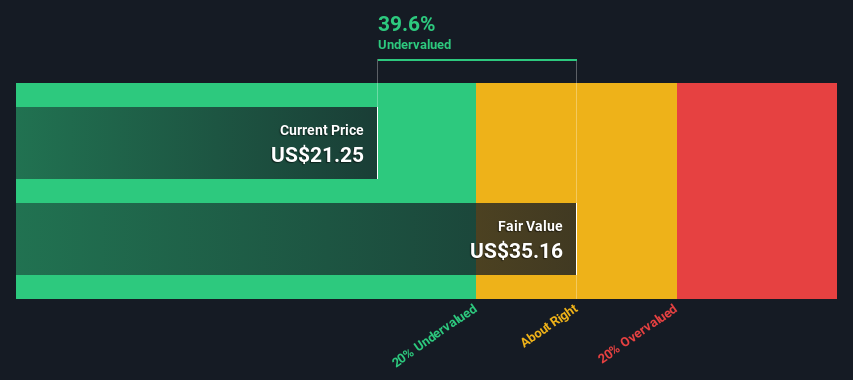

Citizens & Northern (CZNC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Citizens & Northern is a financial services company providing banking and related services, with a market capitalization of approximately $0.34 billion.

Operations: Citizens & Northern generates revenue entirely from its operations, with a consistent gross profit margin of 100%. Operating expenses are a significant cost component, with general and administrative expenses being the largest part. The net income margin has shown variability, ranging from 21.98% to 33.56% over the analyzed periods.

PE: 12.7x

Citizens & Northern, a small player in the financial sector, has demonstrated insider confidence with recent share purchases. Despite a low allowance for bad loans at 88%, earnings are projected to grow 26.6% annually. The company reported net interest income of US$22.26 million for Q3 2025, up from US$20.16 million last year, and completed a merger with Susquehanna Community Financial Inc., potentially enhancing its market position and future growth prospects.

- Click here and access our complete valuation analysis report to understand the dynamics of Citizens & Northern.

Assess Citizens & Northern's past performance with our detailed historical performance reports.

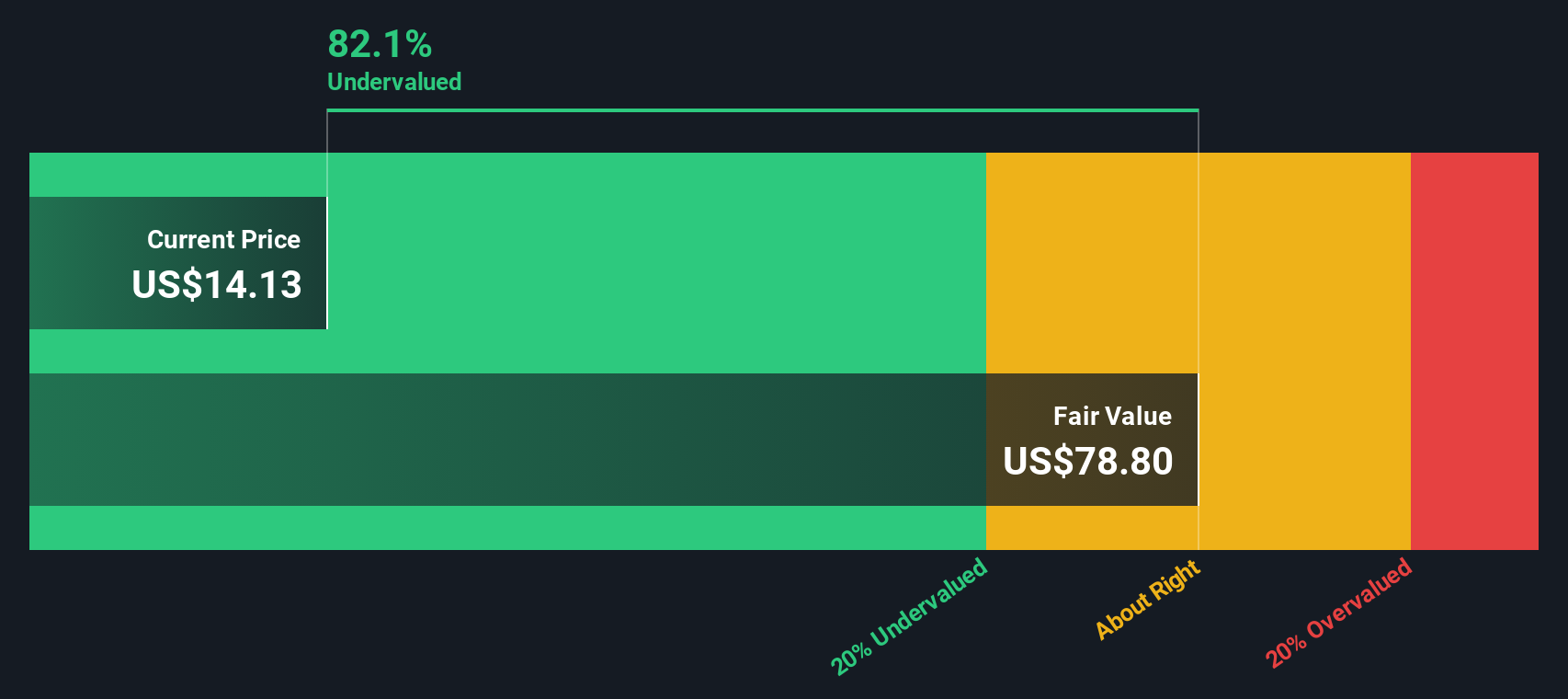

Integra LifeSciences Holdings (IART)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Integra LifeSciences Holdings operates in the medical device sector, focusing on tissue technologies and specialty surgical solutions, with a market capitalization of approximately $2.81 billion.

Operations: The company generates revenue primarily from its Codman Specialty Surgical and Tissue Technologies segments, with the former contributing significantly more. Over recent periods, the gross profit margin has shown a declining trend, reaching 57.49% in the latest quarter. Operating expenses are substantial and include significant general and administrative costs along with research and development expenditures. The net income margin has also been negative in recent quarters, indicating financial challenges.

PE: -1.9x

Integra LifeSciences Holdings, a smaller player in the medical technology sector, has experienced mixed financial outcomes. Despite reporting a net loss of US$5.4 million for Q3 2025, an improvement from last year's US$10.7 million loss, the company anticipates a challenging fourth quarter with projected revenue declines. Earnings are forecast to grow significantly at over 100% annually, indicating potential future growth despite current hurdles. The appointment of Dr. Raymond Turner as Chief Medical Officer brings extensive clinical expertise to bolster their innovation efforts and enhance patient care solutions globally.

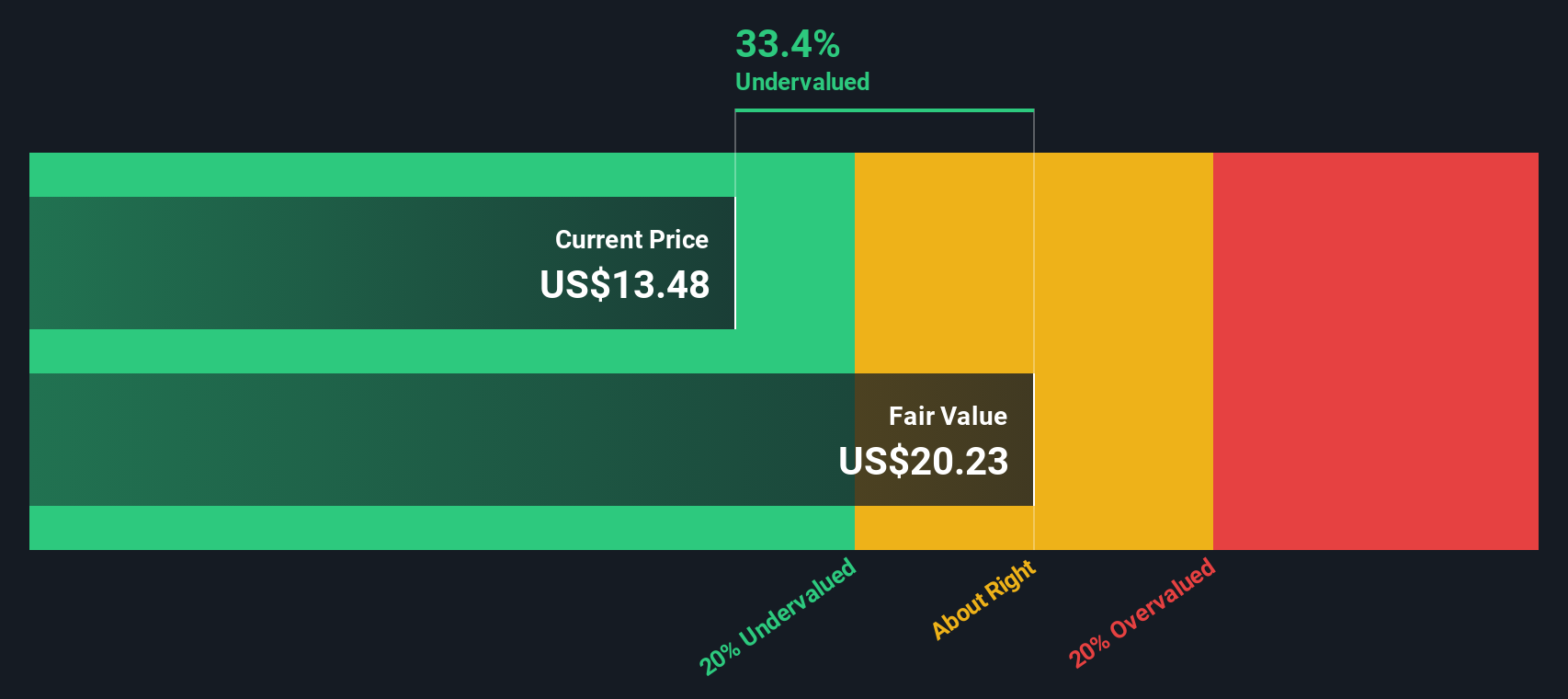

Ellington Financial (EFC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ellington Financial is a specialty finance company that primarily invests in a diverse range of residential and commercial mortgage-related assets, with a market capitalization of approximately $0.87 billion.

Operations: Ellington Financial's revenue model shows a consistent gross profit margin of 100% over recent periods, indicating no cost of goods sold. Operating expenses, primarily driven by general and administrative costs, have fluctuated but remain a significant portion of total expenses. The net income margin has varied significantly, reflecting changes in profitability despite stable gross profit margins.

PE: 11.2x

Ellington Financial, a smaller player in the U.S. market, has shown potential for value through its recent financial activities. Despite relying on external borrowing for funding, they reported net income of US$36.58 million in Q3 2025 and US$125.22 million over nine months, with earnings per share at US$0.29 and US$1.08 respectively. The company's issuance of US$400 million in senior unsecured notes aims to bolster their asset purchases and repay existing debts, indicating strategic financial maneuvers to enhance growth prospects amidst insider confidence shown through share purchases earlier this year.

- Get an in-depth perspective on Ellington Financial's performance by reading our valuation report here.

Evaluate Ellington Financial's historical performance by accessing our past performance report.

Seize The Opportunity

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 59 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IART

Integra LifeSciences Holdings

Manufactures and sells surgical instrument, neurosurgical, ear, nose, throat, and wound care products for use in neurosurgery, neurocritical care, and otolaryngology.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives