- United States

- /

- Medical Equipment

- /

- NasdaqGM:HYPR

Further weakness as Hyperfine (NASDAQ:HYPR) drops 25% this week, taking one-year losses to 73%

As every investor would know, you don't hit a homerun every time you swing. But it's not unreasonable to try to avoid truly shocking capital losses. So we hope that those who held Hyperfine, Inc. (NASDAQ:HYPR) during the last year don't lose the lesson, in addition to the 73% hit to the value of their shares. That'd be enough to make even the strongest stomachs churn. Hyperfine may have better days ahead, of course; we've only looked at a one year period. Shareholders have had an even rougher run lately, with the share price down 30% in the last 90 days. Of course, this share price action may well have been influenced by the 14% decline in the broader market, throughout the period.

With the stock having lost 25% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Hyperfine

Because Hyperfine made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Hyperfine saw its revenue grow by 409%. That's well above most other pre-profit companies. So the hefty 73% share price crash makes us think the company has somehow offended market participants. Something weird is definitely impacting the stock price; we'd venture the company has destroyed value somehow. We'd recommend taking a very close look at the stock (and any available forecasts), before considering a purchase, because the share price is not correlated with the revenue growth, that's for sure. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

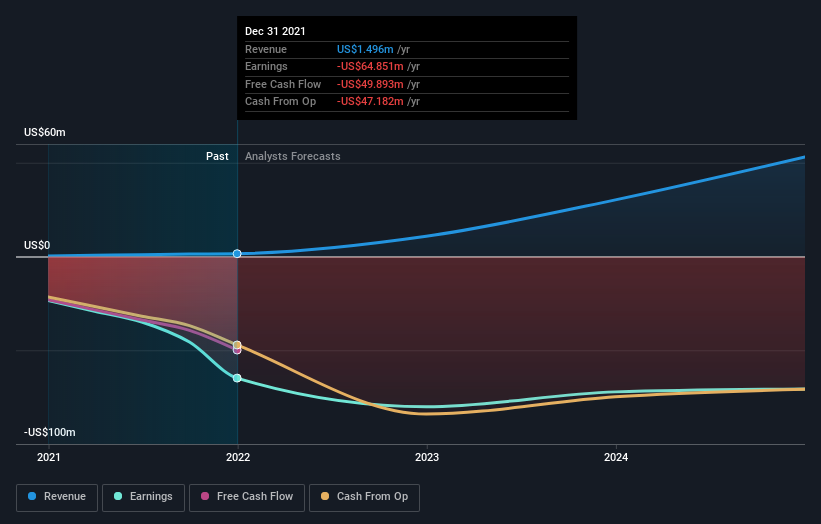

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Hyperfine's financial health with this free report on its balance sheet.

A Different Perspective

We doubt Hyperfine shareholders are happy with the loss of 73% over twelve months. That falls short of the market, which lost 10%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 30%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Hyperfine better, we need to consider many other factors. Even so, be aware that Hyperfine is showing 3 warning signs in our investment analysis , you should know about...

But note: Hyperfine may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hyperfine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:HYPR

Hyperfine

A health technology company, engages in the production, supply, service, and commercialization of magnetic resonance imaging (MRI) products.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026