- United States

- /

- Healthcare Services

- /

- NasdaqGS:HSIC

Will Weaker U.S. Dental Demand Shift Henry Schein's (HSIC) Growth and Valuation Story?

Reviewed by Sasha Jovanovic

- In the past quarter, Henry Schein reported a miss on profit expectations in its Q2 earnings, primarily due to reduced demand in its U.S. dental business from high interest rates and cautious patient behavior toward non-urgent procedures.

- Despite these challenges, analysts suggest the company remains undervalued based on assumptions of improved earnings growth and margin expansion, as Henry Schein invests in digital workflow, AI solutions, and cloud-based management platforms.

- We'll examine how softer demand in core dental markets has implications for Henry Schein's outlook and the analyst investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Henry Schein Investment Narrative Recap

To be a Henry Schein shareholder today, you need conviction in the company's ability to grow earnings and expand margins, especially as it pushes deeper into digital and AI-driven healthcare services. The recent Q2 profit miss reflects the biggest short term risk, softening U.S. dental demand from higher rates and patient caution, which may weigh more heavily on results than previously expected; the most important catalyst remains management’s success in boosting high-margin technology revenues. For now, the impact of these earnings headwinds appears material, sharpening focus on how quickly pent-up dental demand recovers.

Among recent announcements, Henry Schein’s expansion of its SolutionsHub suite, particularly its partnership with Colaborate to enhance consulting for medical laboratories, stands out. This move aligns with the company’s broader catalysts by advancing its service offerings, and demonstrates how investments in technology and recurring SaaS revenue can help offset cyclical weakness in the core dental segment.

Yet, while tech-driven growth may support future results, persistent pricing pressure and heightened customer sensitivity remain risks investors should watch if Henry Schein’s...

Read the full narrative on Henry Schein (it's free!)

Henry Schein's outlook forecasts $14.4 billion in revenue and $614.4 million in earnings by 2028. This is based on analysts projecting 4.0% annual revenue growth and a $225.4 million increase in earnings from the current $389.0 million.

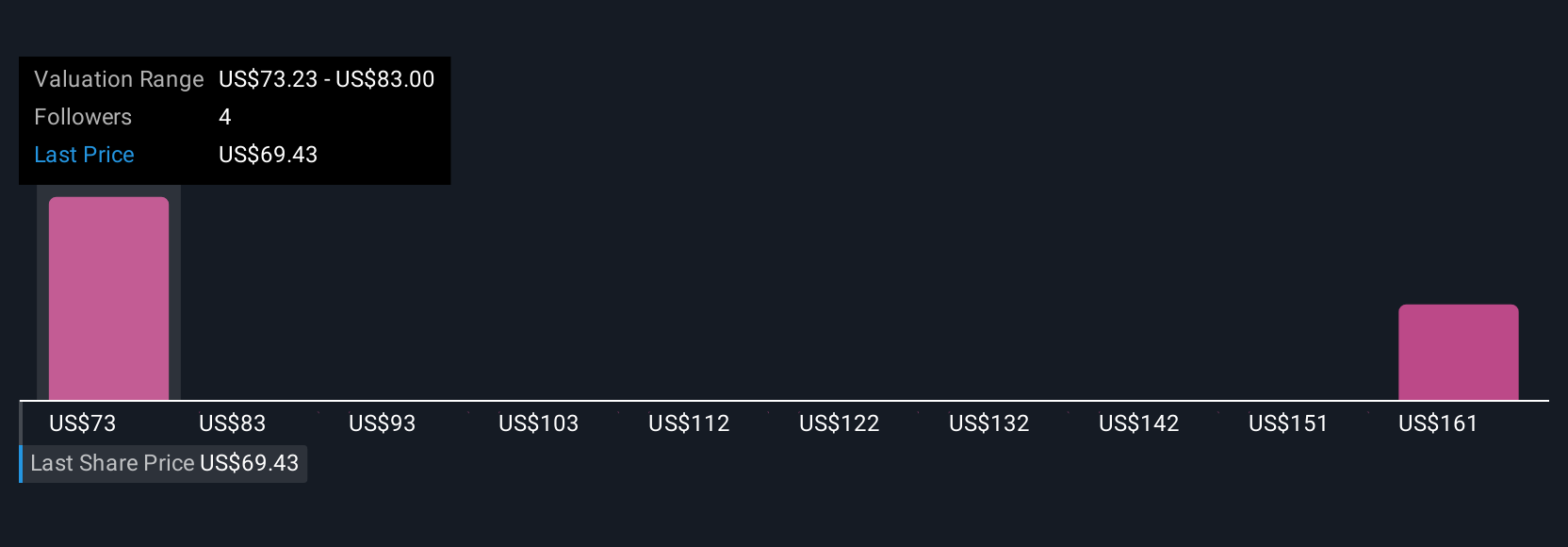

Uncover how Henry Schein's forecasts yield a $73.23 fair value, a 11% upside to its current price.

Exploring Other Perspectives

With only two estimates from the Simply Wall St Community, fair value opinions for Henry Schein span from US$73.23 up to US$170.96 per share. Some see margin expansion as an opportunity, but recurring competitive pressures may limit how quickly sentiment shifts, explore what others are forecasting.

Explore 2 other fair value estimates on Henry Schein - why the stock might be worth just $73.23!

Build Your Own Henry Schein Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Henry Schein research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Henry Schein research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Henry Schein's overall financial health at a glance.

No Opportunity In Henry Schein?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henry Schein might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSIC

Henry Schein

Provides health care products and services to office-based dental and medical practitioners, and alternate sites of care worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives