- United States

- /

- Healthcare Services

- /

- NasdaqGS:HQY

HealthEquity (HQY): Assessing Valuation After a Recent Pullback in a Longer-Term Growth Story

Reviewed by Simply Wall St

HealthEquity (HQY) has pulled back about 5% over the past month even though its revenue and net income are still growing at a healthy clip. That disconnect is what makes the stock interesting now.

See our latest analysis for HealthEquity.

Zooming out, the recent 1 month share price pullback sits against a steady backdrop where the share price has barely moved year to date, while the 3 year total shareholder return of more than 50% shows that longer term momentum is still very much intact.

If HealthEquity has you thinking about longer term healthcare trends, it is also worth exploring other names across healthcare stocks to see where the next wave of opportunities might be emerging.

With solid double digit earnings growth and a sizable gap to analyst price targets, investors now face a key question: is HealthEquity quietly undervalued, or is the market already baking in the next leg of its growth story?

Most Popular Narrative: 22.1% Undervalued

With HealthEquity last closing at $95.31 against a narrative fair value of about $122, the story hinges on robust growth and richer margins ahead.

The recent regulatory expansion, allowing direct primary care, pre deductible telehealth, and millions of new ACA bronze/catastrophic plan members to qualify for HSAs, creates the largest addressable market increase in two decades, poised to accelerate new account openings and AUM growth, meaningfully boosting future revenue. HealthEquity is leveraging digital transformation through its secure, AI powered mobile app and automation initiatives, enhancing member experience and engagement while driving operating leverage and reducing service costs, supporting higher net margins and improved earnings over time.

Want to see the math behind that upside call? The revenue runway, margin reset, and punchy profit multiple that power this fair value are all laid bare inside.

Result: Fair Value of $122.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a weaker labor market or a sharp drop in interest rates could slow new HSA growth and dent margins, which would challenge that upside case.

Find out about the key risks to this HealthEquity narrative.

Another View On Valuation

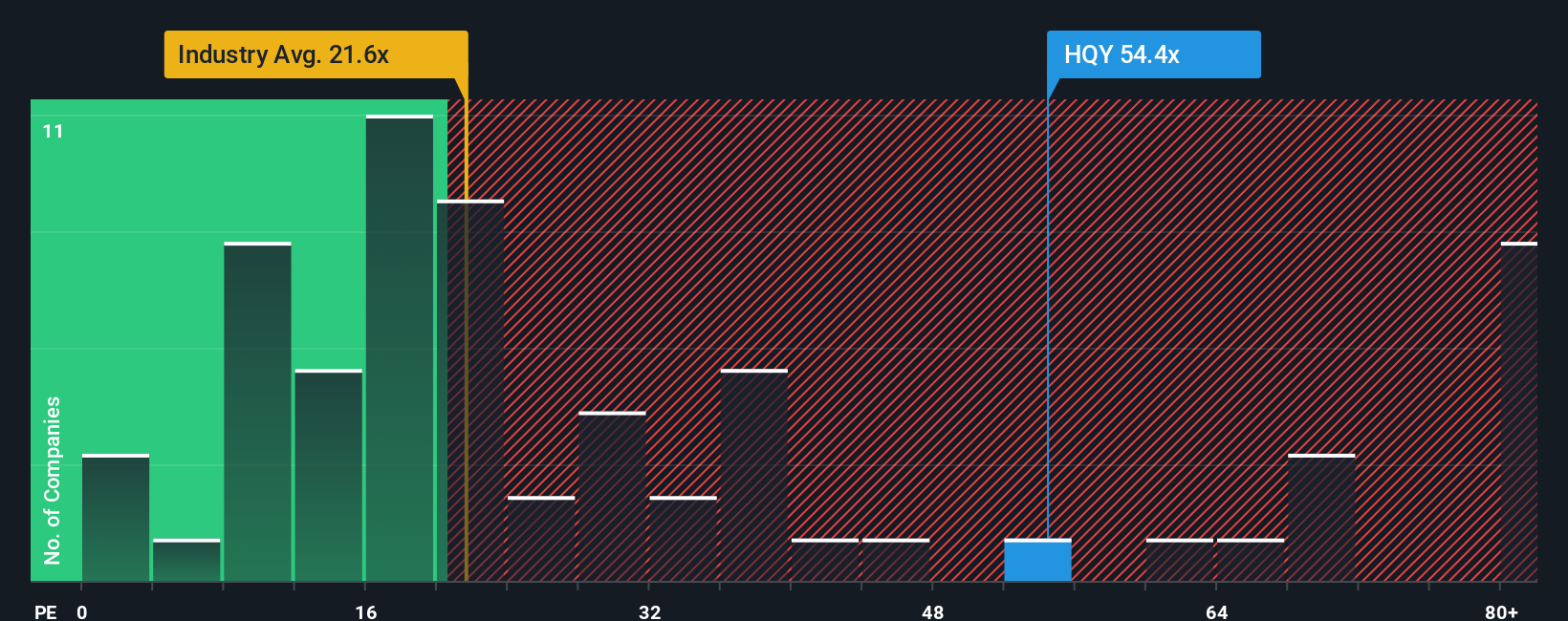

On earnings, HealthEquity looks far less forgiving. The stock trades on a rich 42.4 times earnings, almost double both the US healthcare sector at 23.6 times and a 28.8 times fair ratio that the market could drift toward. This would mean meaningful downside if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HealthEquity Narrative

If you are not fully sold on this angle, or simply want to dig into the numbers yourself, you can build a fresh view in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding HealthEquity.

Looking for more investment ideas?

Do not stop with one opportunity; use the Simply Wall Street Screener to uncover focused, data driven stock ideas that match your strategy before the market moves first.

- Explore potential multi baggers early by running through these 3635 penny stocks with strong financials that already show resilient fundamentals beneath their tiny share prices.

- Consider structural tailwinds in automation and machine learning by zeroing in on these 24 AI penny stocks positioned to scale as AI adoption accelerates worldwide.

- Identify value opportunities ahead of the crowd by targeting these 912 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in today’s share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HealthEquity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HQY

HealthEquity

Provides technology-enabled services platforms to consumers and employers in the United States.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion