- United States

- /

- Healthcare Services

- /

- NasdaqGS:HQY

Examining HealthEquity (HQY) Valuation: Is There Untapped Value in Today’s Market?

Reviewed by Kshitija Bhandaru

HealthEquity (HQY) stock has shifted direction recently, prompting closer attention from investors considering its steady returns over the past few years. The conversation now centers on how HealthEquity is positioned in a changing healthcare landscape.

See our latest analysis for HealthEquity.

Over the past year, HealthEquity’s stock has held steady despite near-term share price headwinds, with a 1-year total shareholder return of about 6% and a solid 3-year figure above 31% highlighting its resilience and compounding power. Recent price action suggests investors are reassessing the risk-reward balance as industry dynamics evolve, which hints at potential for renewed momentum down the line.

If you’re curious to see what other healthcare stocks have been making moves lately, check out our dedicated screener for the sector: See the full list for free.

With HealthEquity trading at a discount to analyst price targets despite consistent long-term growth, investors are left to consider whether there is real value in today's price or if the market has already priced in future gains.

Most Popular Narrative: 27.6% Undervalued

The latest narrative points to a significant gap between HealthEquity’s current price and what analysts see as fair value, stirring debate over whether the market is overlooking the company's long-term earnings potential.

The recent regulatory expansion, allowing direct primary care, pre-deductible telehealth, and millions of new ACA bronze/catastrophic plan members to qualify for HSAs, creates the largest addressable market increase in two decades. This is poised to accelerate new account openings and AUM growth, meaningfully boosting future revenue. HealthEquity is leveraging digital transformation through its secure, AI-powered mobile app and automation initiatives, enhancing member experience and engagement while driving operating leverage and reducing service costs. These efforts support higher net margins and improved earnings over time.

What assumptions are driving this bullish view? There is a pivotal financial forecast and a bold margin expansion built into these numbers. Unlock the full mosaic to see the revenue growth and profit dynamics that fuel this price target.

Result: Fair Value of $122.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued labor market weakness or declining interest rates could put pressure on HealthEquity's revenue growth and challenge the optimistic margin forecasts that drive this outlook.

Find out about the key risks to this HealthEquity narrative.

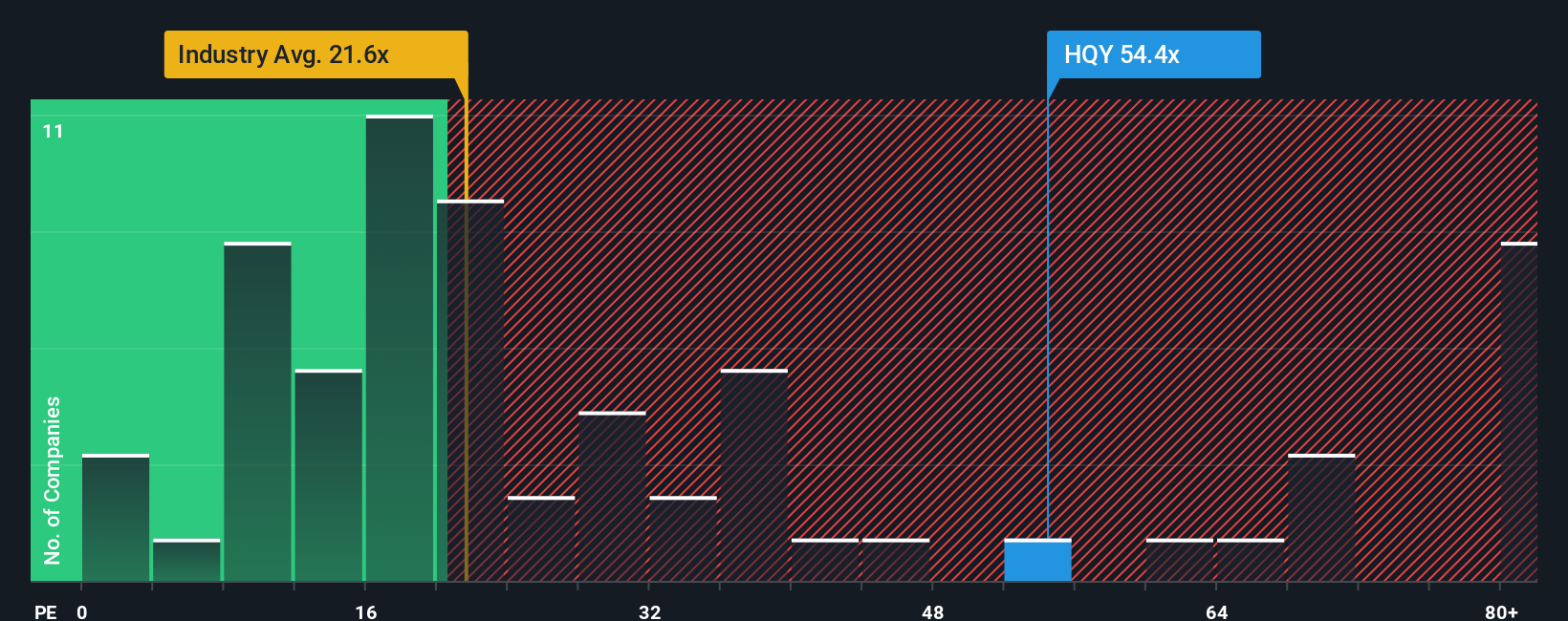

Another View: Industry Multiples Send a Different Signal

While analysts see HealthEquity as undervalued based on projected earnings, the current stock price is trading at 52.3 times earnings, far above the US Healthcare industry average of 21.4 and the peer average of 18.5. Even compared to the fair ratio of 32.5, the premium is substantial. This raises important questions about valuation risk and whether market optimism could fade if growth slows.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HealthEquity Narrative

If you want to take a different perspective or enjoy analyzing the data on your own terms, it's easy to build your own take in minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding HealthEquity.

Looking for More Investment Ideas?

Let your next move count. The smartest investors spot opportunities before the crowd, and these handpicked stock ideas are waiting for you. Don’t miss your chance to put fresh winners on your radar.

- Fuel your portfolio growth by uncovering undervalued gems when you check out these 896 undervalued stocks based on cash flows. Seize attractive entry points before they're widely recognized.

- Unlock future income streams with these 19 dividend stocks with yields > 3%, highlighting stocks boasting robust dividends above 3% and the potential for steady returns.

- Step into the innovative world of artificial intelligence with these 24 AI penny stocks to spot companies poised to shape tomorrow’s tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HealthEquity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HQY

HealthEquity

Provides technology-enabled services platforms to consumers and employers in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives