- United States

- /

- Healthcare Services

- /

- NasdaqGS:HQY

A Look at HealthEquity’s (HQY) Valuation After New HSA and Affordable Care Initiatives

Reviewed by Simply Wall St

HealthEquity (HQY) just unveiled two consumer initiatives aimed at boosting access to affordable healthcare, including a GLP-1 weight management solution and a direct HSA enrollment platform. Both launches are timed with open enrollment and regulatory changes that affect HSA eligibility.

See our latest analysis for HealthEquity.

HealthEquity’s new initiatives come as the stock shows steady long-term momentum, with a 1-year total shareholder return of nearly 9% and an impressive 83% five-year total return, despite modest recent share price moves. Investors seem to recognize the company’s ability to capture new demand as healthcare costs rise and HSA eligibility expands. This suggests underlying growth potential, even if short-term price returns have been muted.

If this kind of healthcare innovation has you searching for more opportunities, you’ll want to check out See the full list for free..

With shares still trading at a substantial discount to analyst price targets, is HealthEquity poised for further upside as its new initiatives expand growth, or does the current valuation already reflect future opportunity?

Most Popular Narrative: 22% Undervalued

With HealthEquity's most popular narrative assigning a fair value well above the current price, the gap between market and narrative estimates stands out. The stage is set for a debate: are analysts too optimistic, or is the market overlooking fundamental shifts?

The recent regulatory expansion, allowing direct primary care, pre-deductible telehealth, and millions of new ACA bronze/catastrophic plan members to qualify for HSAs, creates the largest addressable market increase in two decades. This is poised to accelerate new account openings and AUM growth, meaningfully boosting future revenue. HealthEquity is leveraging digital transformation through its secure, AI-powered mobile app and automation initiatives, enhancing member experience and engagement while driving operating leverage and reducing service costs. These efforts support higher net margins and improved earnings over time.

Want to know what’s driving this bullish outlook? The full narrative reveals bold assumptions about future cash generation, margin expansion, and a premium profit multiple. Ready to see the detailed projections behind that fair value?

Result: Fair Value of $122.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competition and the company’s exposure to shifting interest rates could both temper HealthEquity’s projected growth if conditions worsen.

Find out about the key risks to this HealthEquity narrative.

Another View: What About the Market’s Multiple?

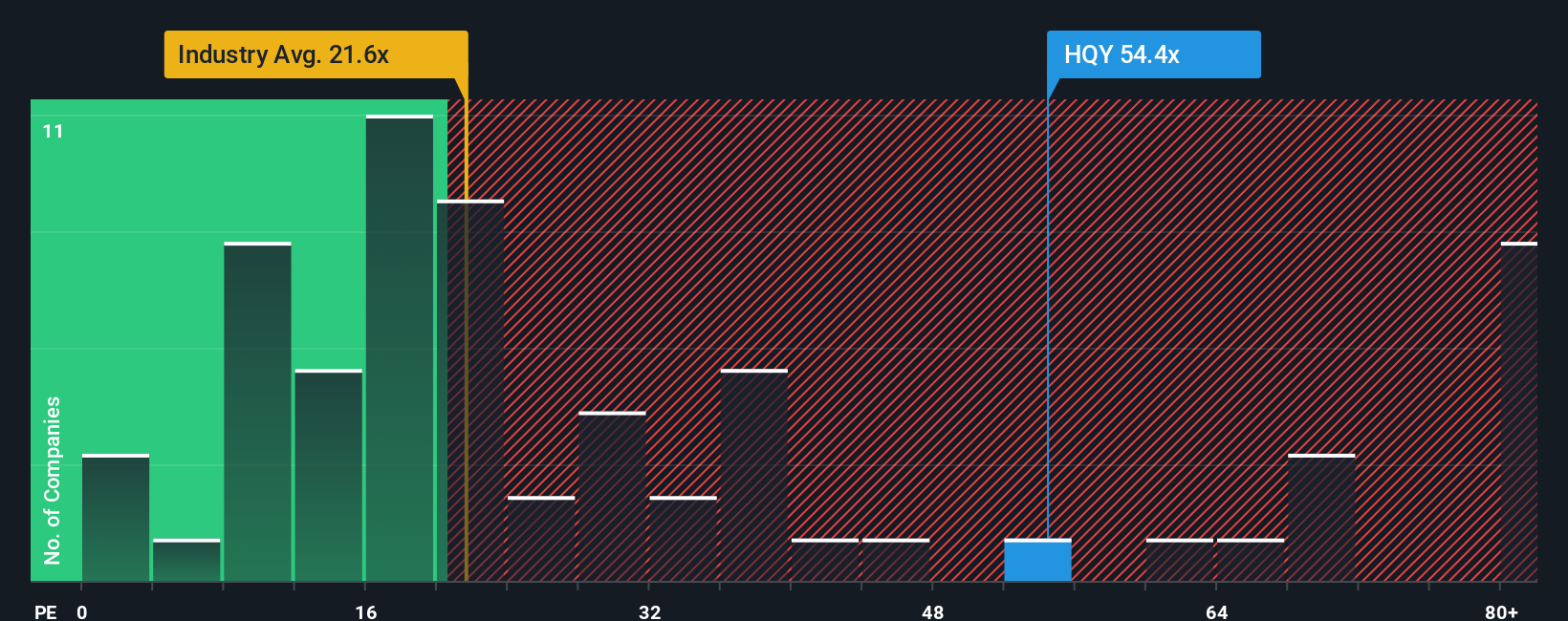

Looking from a different angle, HealthEquity’s price-to-earnings ratio is a steep 56.4x, much higher than both the industry average of 21.5x and its peers at 17.7x. It also sits well above the fair ratio, estimated at 32.9x. This gap could signal froth and raises the question: does it limit future upside, or is the growth potential worth the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HealthEquity Narrative

If you’re looking to draw your own conclusions or want to analyze the numbers firsthand, you can build a personal narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding HealthEquity.

Looking for More Investment Ideas?

Smart investors keep an eye out for fresh opportunities. Don’t miss your chance to get ahead by exploring these market movers now:

- Start building your passive income by checking out these 17 dividend stocks with yields > 3% that offer strong yields and steady performance in all market conditions.

- Target the next surge in sector innovation with these 26 AI penny stocks put on your radar for groundbreaking advancements and scalable growth potential.

- Position your portfolio for future gains by spotting these 871 undervalued stocks based on cash flows backed by solid fundamentals before the market wakes up to their true value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HealthEquity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HQY

HealthEquity

Provides technology-enabled services platforms to consumers and employers in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives