- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

How Investors Are Reacting To Guardant Health (GH) FDA Approval for New Breast Cancer Companion Test

Reviewed by Sasha Jovanovic

- Guardant Health announced that the U.S. FDA has approved its Guardant360 CDx as a companion diagnostic to identify patients with specific ESR1 mutations who may benefit from Eli Lilly's new advanced breast cancer therapy, Inluriyo.

- This milestone marks the test’s sixth FDA companion diagnostic approval and its second for breast cancer, underscoring Guardant360 CDx's growing role in precision oncology and targeted cancer treatment selection.

- We'll now examine how the FDA's approval of Guardant360 CDx for Inluriyo may shape Guardant Health's future investment outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Guardant Health Investment Narrative Recap

To own Guardant Health, you have to believe in the long-term expansion of precision oncology, where non-invasive blood-based diagnostics drive improved cancer care and clinical adoption. The FDA’s recent approval of Guardant360 CDx for Eli Lilly’s Inluriyo highlights continued regulatory traction for Guardant’s core platform but doesn’t materially shift the most important near-term catalyst: broad commercial and clinical payer adoption of Shield, especially for colorectal cancer. The single biggest risk remains cash burn and the pressure to reach profitability amid ongoing investment.

Among recent announcements, Guardant’s partnership with Quest Diagnostics to distribute Shield for colorectal cancer screening through a major US lab network is highly relevant. This advance aligns closely with the main catalyst of accelerating clinical uptake and payer coverage of Shield, which has the potential to meaningfully expand Guardant’s addressable market.

In contrast, investors should also be aware that Guardant’s high cash burn and persistent net losses mean that future dilution risk remains...

Read the full narrative on Guardant Health (it's free!)

Guardant Health's narrative projects $1.5 billion revenue and $82.1 million earnings by 2028. This requires 22.5% yearly revenue growth and a $495.9 million increase in earnings from -$413.8 million.

Uncover how Guardant Health's forecasts yield a $62.41 fair value, in line with its current price.

Exploring Other Perspectives

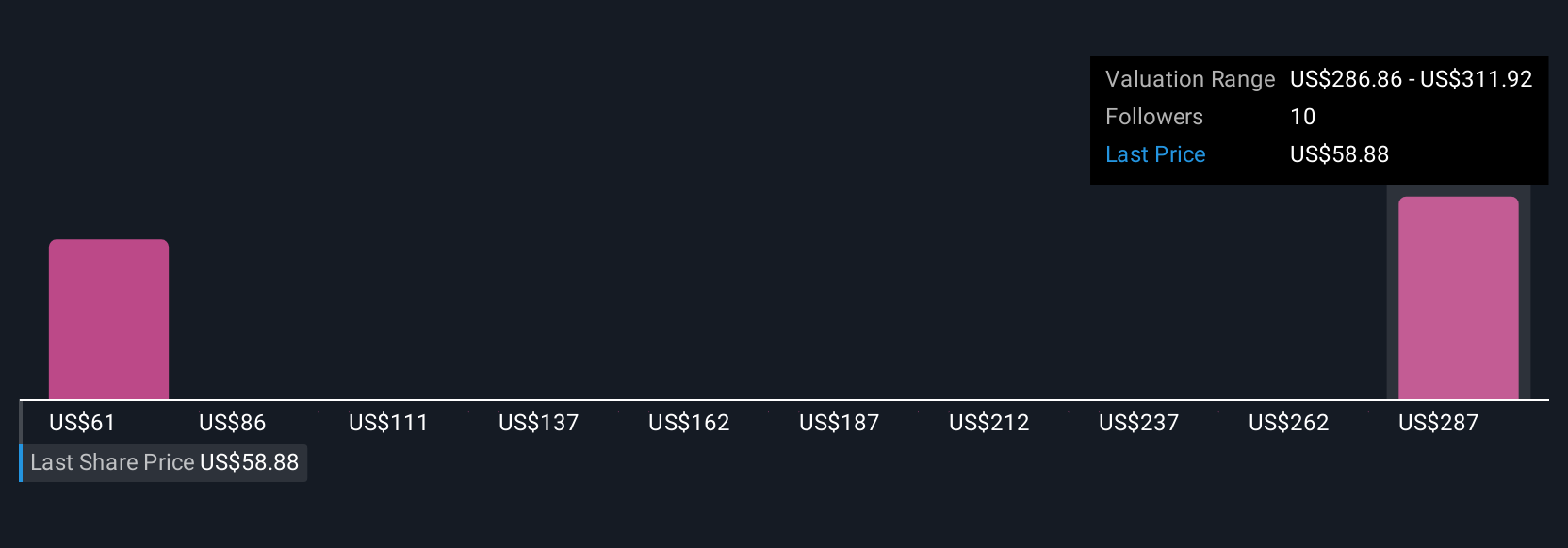

Three fair value estimates from the Simply Wall St Community range from US$62.41 to US$187.05 per share. Yet, with commercial Shield adoption still the main catalyst, your outlook on Guardant’s growth hinges on more than headline valuations, see how other investors weigh these factors.

Explore 3 other fair value estimates on Guardant Health - why the stock might be worth over 3x more than the current price!

Build Your Own Guardant Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Guardant Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guardant Health's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives