- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

A Look at Guardant Health’s Valuation Following Expanded FDA Approval for Guardant360 CDx in Breast Cancer

Reviewed by Kshitija Bhandaru

Guardant Health (GH) just received expanded FDA approval for its Guardant360 CDx blood test. The test is now cleared to identify advanced breast cancer patients with ESR1 mutations who might benefit from Eli Lilly’s Inluriyo treatment.

See our latest analysis for Guardant Health.

Momentum has picked up for Guardant Health following a series of positive developments, including its FDA approval expansion for Guardant360 CDx and a high-profile partnership with Quest Diagnostics. The company’s 1-year total shareholder return of 1.8% suggests early recovery, though longer-term total returns remain muted as the market waits to see if recent traction can translate into sustained growth.

If Guardant’s cancer diagnostics breakthroughs have you interested in the broader sector, now is the perfect moment to check out See the full list for free.

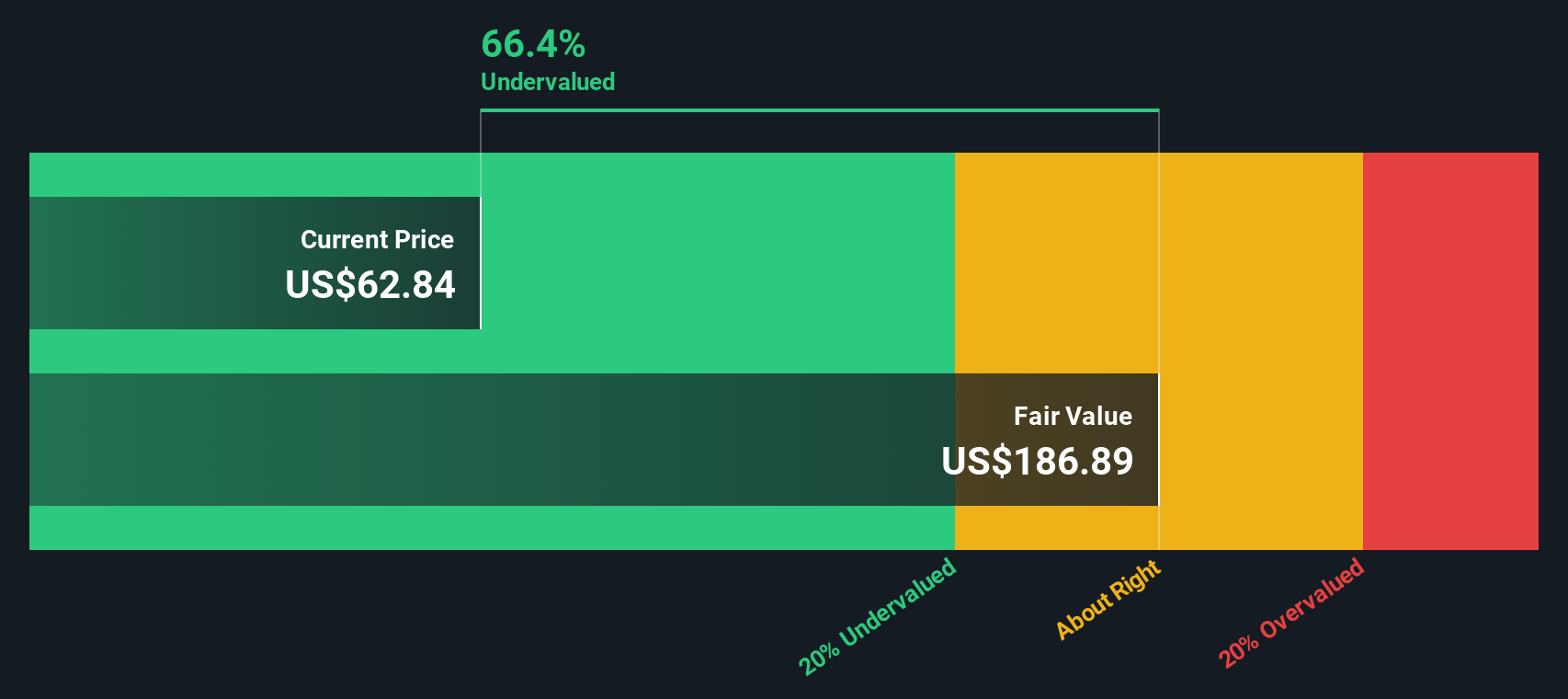

With new approvals accelerating clinical adoption and shares trading at a notable discount to analyst targets, the key question for investors is whether Guardant Health is genuinely undervalued or if the market already anticipates its future growth.

Most Popular Narrative: Fairly Valued

With Guardant Health’s narrative fair value at $62.41 and the stock last closing at $62.84, there is little gap between expected and current pricing, leaving investors to weigh the assumptions driving analyst consensus.

Accelerating adoption of non-invasive blood-based cancer diagnostics is driving substantial growth across Guardant Health's key product lines (Guardant360 Liquid, Reveal, and Shield). This expansion increases the company's total addressable market and supports high double-digit revenue growth, with continued strong volume momentum and share gains documented for both new and established oncology applications.

Craving the analysis behind this almost perfect alignment of price and projected value? The narrative relies on aggressive topline forecasts and bold assumptions about when margins turn positive. Curious how these puzzle pieces fit together to justify such an unusual future profit multiple? Prepare to be surprised.

Result: Fair Value of $62.41 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, high cash burn and uncertainty around broad payer adoption could disrupt Guardant’s progress. This may put its growth and future profits to the test.

Find out about the key risks to this Guardant Health narrative.

Another View: Big Discount Based on the SWS DCF Model

While analyst consensus sees Guardant Health as fairly valued, our DCF model shows a dramatic difference. It estimates the company’s fair value at $186.89 per share. This suggests the current price trades at a steep discount. Does the market doubt the long-term growth prospects, or is this an overlooked opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Guardant Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Guardant Health Narrative

If you see things differently or want to draw your own conclusions, you can put together your own narrative using the data in just a few minutes, and even share your insights. Do it your way

A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Ready to level up your stock search? Uncover original investment angles and opportunities with these hand-picked screens from Simply Wall Street before the crowd rushes in.

- Supercharge your hunt for high-income opportunities by tapping into these 19 dividend stocks with yields > 3% with yields above 3% for those seeking steady returns without compromise.

- Gain a cutting edge in tomorrow’s markets with these 24 AI penny stocks targeting breakthrough innovation in artificial intelligence across diverse industries worldwide.

- Spot untapped potential early by scanning these 3566 penny stocks with strong financials showing strong financials, positioning you for growth that others might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives