- United States

- /

- Medical Equipment

- /

- NasdaqGS:GEHC

Does GEHC’s AI-Powered Vivid Pioneer Launch Mark a Turning Point for Its Cardiology Ambitions?

Reviewed by Simply Wall St

- In late August 2025, GE HealthCare announced the launch of the Vivid Pioneer, its most advanced, AI-powered cardiovascular ultrasound system, following recent CE Mark and U.S. FDA 510(k) clearance, alongside a new suite of cardiology innovations featuring automation and enhanced diagnostic tools.

- This comprehensive rollout targets the global burden of cardiovascular disease by enabling earlier detection and faster, more consistent diagnoses, underlining the company's push into AI-enhanced medical imaging across the full cardiology care pathway.

- We'll examine how the introduction of AI-powered cardiovascular imaging platforms could influence GE HealthCare Technologies' growth and competitive outlook.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

GE HealthCare Technologies Investment Narrative Recap

To be a shareholder in GE HealthCare Technologies, one needs to have conviction in the company’s ability to leverage advanced medical imaging platforms, particularly the integration of AI, to drive growth within a competitive global healthcare market. While the late August launch of the Vivid Pioneer cardiovascular ultrasound system strengthens GE HealthCare’s innovation credentials and aligns with critical short-term catalysts like expanding high-impact product pipelines, the material effect may still be tempered by persistent risks, especially from tariffs and regulatory uncertainties in key markets like China.

The announcement of GE HealthCare’s cardiology innovations, including the ViewPoint EchoPilot and CardIQ Suite, spotlights how the company continues to roll out AI-powered diagnostic tools aimed at improving workflow efficiency and diagnostic accuracy, directly supporting catalysts centered on product innovation and expansion into recurring digital revenue streams.

By contrast, investors should be aware that despite strong innovation, the impact of tariffs on adjusted EPS and free cash flow remains an unresolved risk...

Read the full narrative on GE HealthCare Technologies (it's free!)

GE HealthCare Technologies' outlook predicts $22.7 billion in revenue and $2.5 billion in earnings by 2028. This scenario assumes a 4.3% annual revenue growth rate and a $0.3 billion earnings increase from the current $2.2 billion.

Uncover how GE HealthCare Technologies' forecasts yield a $87.25 fair value, a 15% upside to its current price.

Exploring Other Perspectives

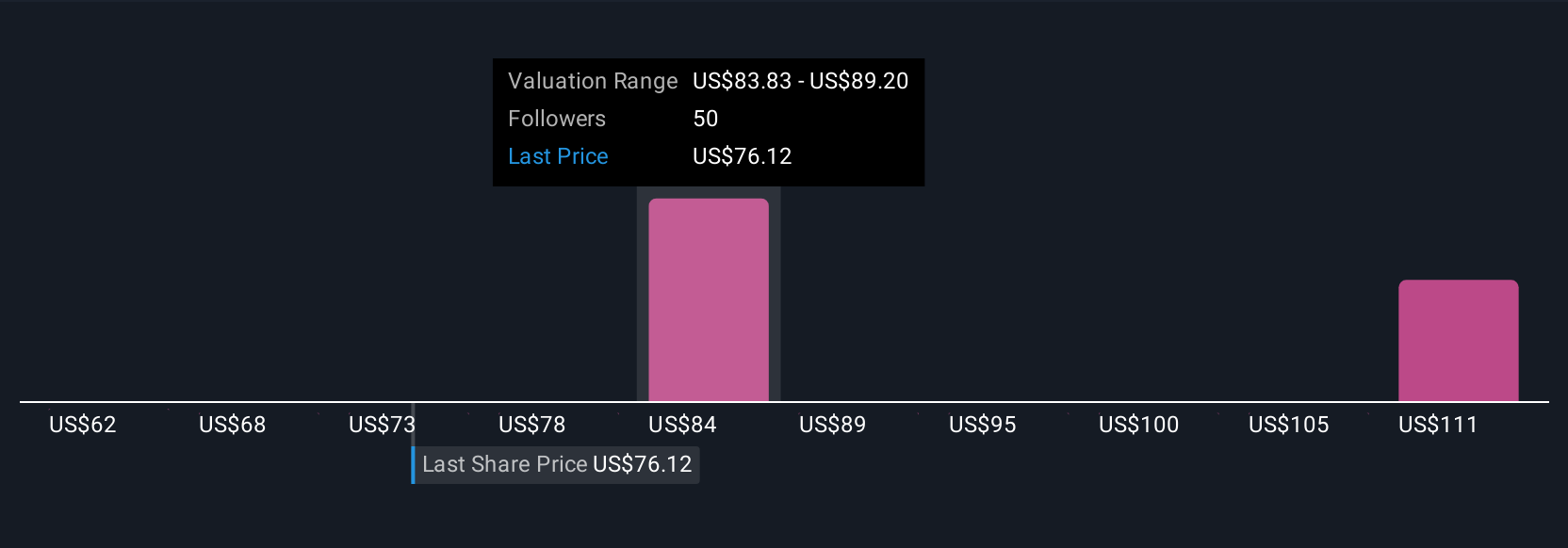

Three Simply Wall St Community members estimate GE HealthCare’s fair value between US$62.35 and US$123.09, reflecting wide-ranging views. With tariffs continuing to affect margins and cash flow, you can see how investor expectations on long-term performance may differ greatly.

Explore 3 other fair value estimates on GE HealthCare Technologies - why the stock might be worth as much as 63% more than the current price!

Build Your Own GE HealthCare Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE HealthCare Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free GE HealthCare Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE HealthCare Technologies' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 30 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GEHC

GE HealthCare Technologies

Engages in the development, manufacture, and marketing of products, services, and complementary digital solutions used in the diagnosis, treatment, and monitoring of patients in the United States, Canada, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026