- United States

- /

- Healthcare Services

- /

- OTCPK:GBNH.F

Strong week for Greenbrook TMS (NASDAQ:GBNH) shareholders doesn't alleviate pain of three-year loss

Greenbrook TMS Inc. (NASDAQ:GBNH) shareholders are doubtless heartened to see the share price bounce 150% in just one week. But the last three years have seen a terrible decline. The share price has sunk like a leaky ship, down 78% in that time. So we're relieved for long term holders to see a bit of uplift. But the more important question is whether the underlying business can justify a higher price still.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Greenbrook TMS

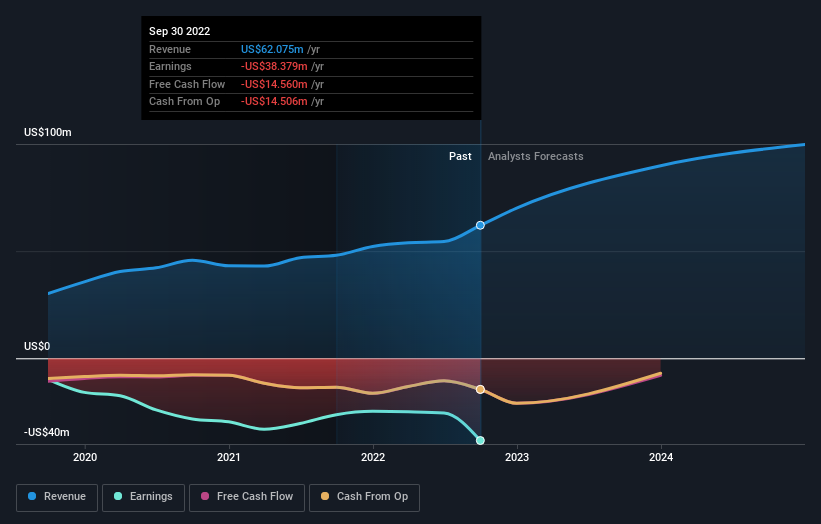

Because Greenbrook TMS made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, Greenbrook TMS grew revenue at 18% per year. That's a fairly respectable growth rate. So it's hard to believe the share price decline of 21% per year is due to the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Greenbrook TMS' financial health with this free report on its balance sheet.

A Different Perspective

The last twelve months weren't great for Greenbrook TMS shares, which performed worse than the market, costing holders 67%. Meanwhile, the broader market slid about 11%, likely weighing on the stock. The three-year loss of 21% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Greenbrook TMS better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Greenbrook TMS (at least 4 which can't be ignored) , and understanding them should be part of your investment process.

But note: Greenbrook TMS may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:GBNH.F

Greenbrook TMS

Greenbrook TMS Inc., together with its subsidiaries, controls and operates a network of outpatient mental health services centers in the United States.

Medium-low and slightly overvalued.

Market Insights

Community Narratives