- United States

- /

- Healthtech

- /

- NasdaqCM:FORA

There's Reason For Concern Over Forian Inc.'s (NASDAQ:FORA) Massive 30% Price Jump

The Forian Inc. (NASDAQ:FORA) share price has done very well over the last month, posting an excellent gain of 30%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

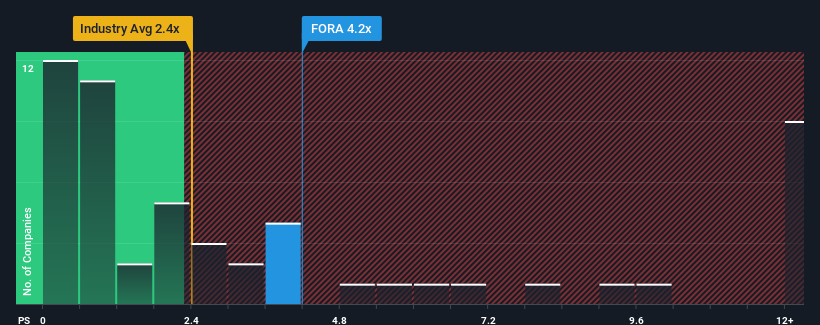

Since its price has surged higher, you could be forgiven for thinking Forian is a stock not worth researching with a price-to-sales ratios (or "P/S") of 4.2x, considering almost half the companies in the United States' Healthcare Services industry have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Forian

What Does Forian's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Forian's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Forian.How Is Forian's Revenue Growth Trending?

In order to justify its P/S ratio, Forian would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.9%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 74% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 10% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 10%, which is not materially different.

In light of this, it's curious that Forian's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Forian's P/S?

Forian shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting Forian's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Plus, you should also learn about these 2 warning signs we've spotted with Forian.

If you're unsure about the strength of Forian's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FORA

Forian

Provides a suite of data management capabilities, and information and analytics solutions to optimize and measure operational, clinical, and financial performance for customers in the life science, healthcare, and financial services industries.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives