- United States

- /

- Medical Equipment

- /

- NasdaqCM:FONR

FONAR Corporation (NASDAQ:FONR) Doing What It Can To Lift Shares

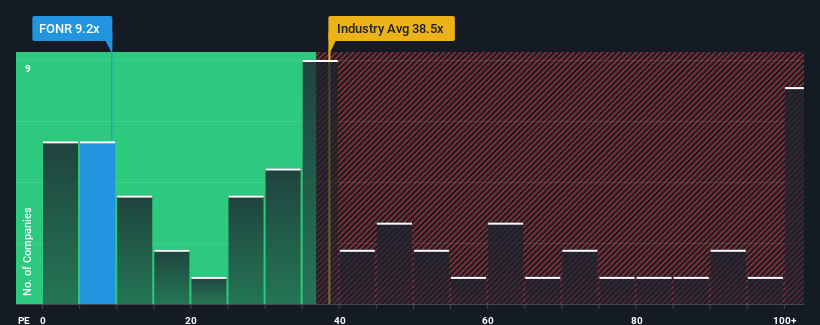

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider FONAR Corporation (NASDAQ:FONR) as an attractive investment with its 9.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been quite advantageous for FONAR as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for FONAR

Is There Any Growth For FONAR?

In order to justify its P/E ratio, FONAR would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 52% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 82% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Comparing that to the market, which is only predicted to deliver 11% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's peculiar that FONAR's P/E sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that FONAR currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for FONAR that you need to be mindful of.

You might be able to find a better investment than FONAR. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FONR

FONAR

Engages in the designing, manufacturing, and selling magnetic resonance imaging (MRI) scanners for the detection and diagnosis of human diseases, abnormalities, other medical conditions, and injuries in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives