- United States

- /

- Medical Equipment

- /

- NasdaqCM:ESTA

Is Positive Long-Term Mia Femtech Data Shifting the Investment Case for Establishment Labs Holdings (ESTA)?

Reviewed by Sasha Jovanovic

- Earlier this month, Establishment Labs Holdings Inc. reported the publication of three-year results from a 100-patient prospective study on the safety and effectiveness of its Mia Femtech device in the Aesthetic Surgery Journal, highlighting a very low complication rate and high follow-up participation.

- This study found no cases of serious complications such as capsular contracture, implant rupture, or BIA-ALCL, and showed both patient satisfaction and surgeon satisfaction at strikingly high levels after three years.

- We'll explore how these positive clinical findings for Mia Femtech could shape expectations of physician adoption and patient demand in Establishment Labs Holdings's investment story.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Establishment Labs Holdings Investment Narrative Recap

To be a shareholder in Establishment Labs Holdings, you need to believe the company can drive accelerating adoption of its innovative implants and minimally invasive procedures like Mia Femtech, especially in key global markets, and eventually achieve consistent profitability. This month’s strong clinical results for Mia strengthen the case for near-term physician adoption, but do not materially change the main short-term catalyst: commercial ramp in the US. Meanwhile, product concentration remains the biggest risk, especially if surgeon or patient preferences shift.

Of recent company announcements, the October study publication showcasing Mia Femtech’s low complication and reoperation rates, and high satisfaction scores, stands out as most relevant. These results could support wider adoption among surgeons and patients, but must be considered alongside ongoing initiatives like the Brasil launch of the Preservé platform, which also targets the minimally invasive segment and broadens the addressable market. However, compared with Mia’s update, Preservé's launch serves as a slower-burn catalyst.

Yet, despite these growth angles, investors should keep in mind that if demand shifts away from the Motiva implant portfolio...

Read the full narrative on Establishment Labs Holdings (it's free!)

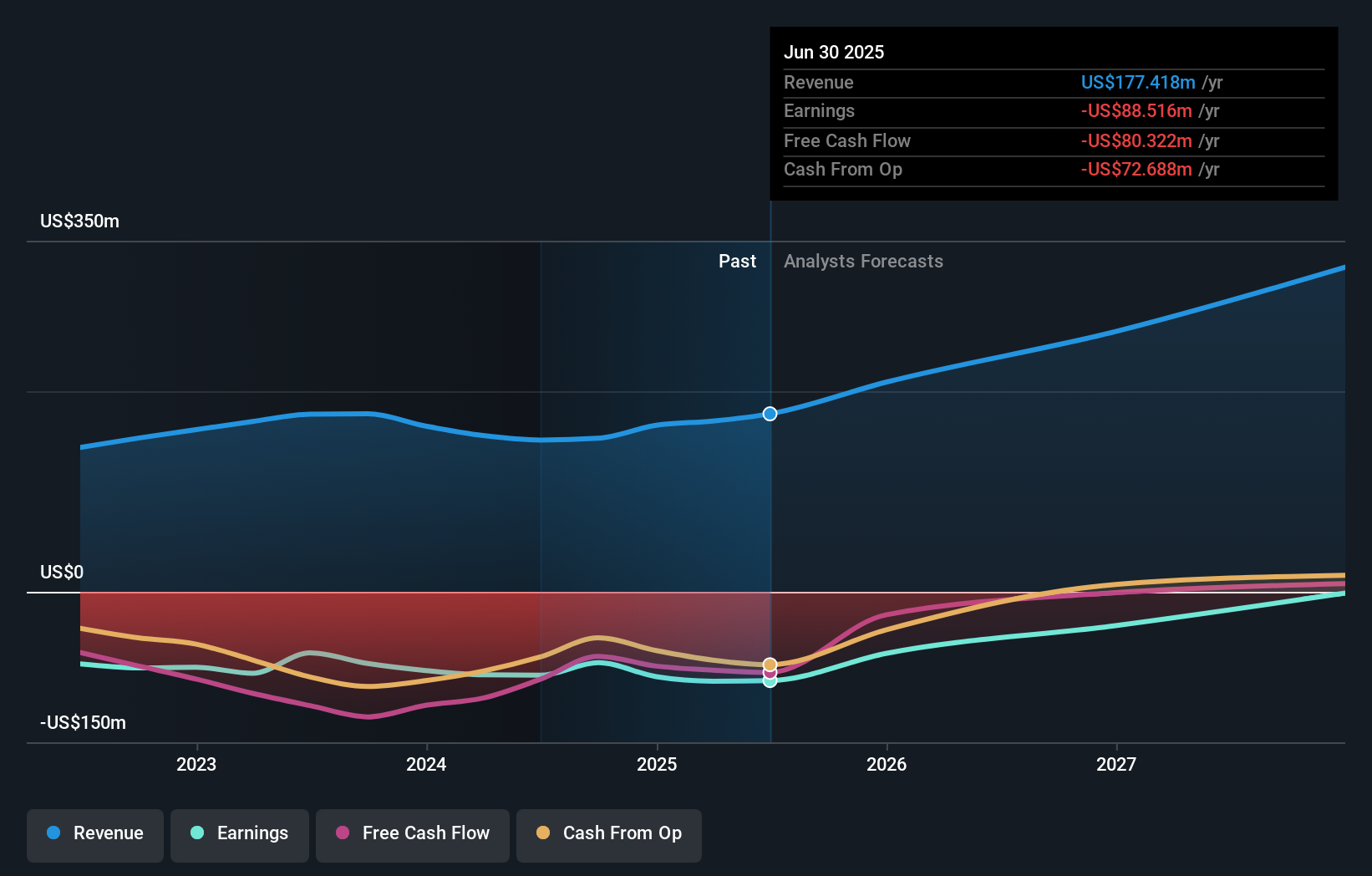

Establishment Labs Holdings is projected to reach $381.9 million in revenue and $27.5 million in earnings by 2028. This forecast assumes annual revenue growth of 29.1% and an increase in earnings of $116 million from the current level of -$88.5 million.

Uncover how Establishment Labs Holdings' forecasts yield a $55.44 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Retail fair value estimates from three Simply Wall St Community members range widely from US$31.12 to US$55.44 per share. While opinions differ, ongoing high SG&A and R&D spending means some expect margin pressure and delayed profitability, highlighting multiple views on future performance.

Explore 3 other fair value estimates on Establishment Labs Holdings - why the stock might be worth as much as 13% more than the current price!

Build Your Own Establishment Labs Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Establishment Labs Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Establishment Labs Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Establishment Labs Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Establishment Labs Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESTA

Establishment Labs Holdings

A medical technology company, manufactures and markets medical devices for aesthetic and reconstructive plastic surgeries.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives