- United States

- /

- Medical Equipment

- /

- NasdaqCM:EKSO

Investors Give Ekso Bionics Holdings, Inc. (NASDAQ:EKSO) Shares A 26% Hiding

Ekso Bionics Holdings, Inc. (NASDAQ:EKSO) shares have had a horrible month, losing 26% after a relatively good period beforehand. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 17%.

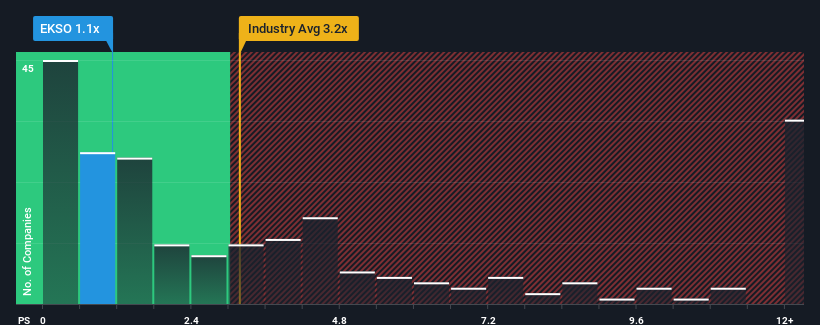

Following the heavy fall in price, Ekso Bionics Holdings may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.1x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.2x and even P/S higher than 7x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Ekso Bionics Holdings

How Has Ekso Bionics Holdings Performed Recently?

Recent times have been advantageous for Ekso Bionics Holdings as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ekso Bionics Holdings.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Ekso Bionics Holdings would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Pleasingly, revenue has also lifted 96% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 29% per year as estimated by the dual analysts watching the company. With the industry only predicted to deliver 10% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Ekso Bionics Holdings is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Ekso Bionics Holdings' P/S?

Having almost fallen off a cliff, Ekso Bionics Holdings' share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Ekso Bionics Holdings' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

It is also worth noting that we have found 4 warning signs for Ekso Bionics Holdings (1 can't be ignored!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Ekso Bionics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EKSO

Ekso Bionics Holdings

Designs, develops, sells, and rents exoskeleton products in the Americas, Germany, Europe, the Middle East, Africa, the Asia Pacific, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives