- United States

- /

- Medical Equipment

- /

- NasdaqGM:EDAP

Investors Still Waiting For A Pull Back In EDAP TMS S.A. (NASDAQ:EDAP)

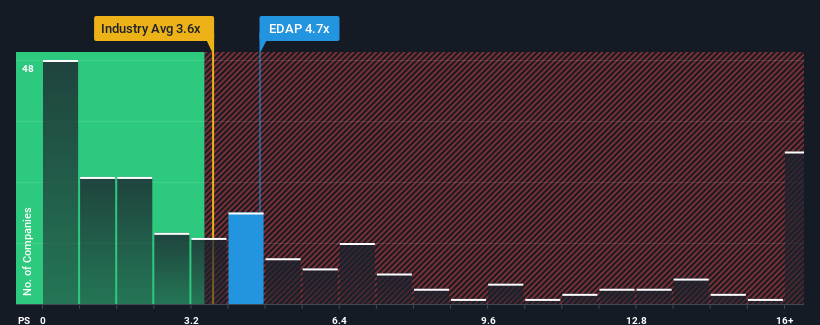

EDAP TMS S.A.'s (NASDAQ:EDAP) price-to-sales (or "P/S") ratio of 4.7x might make it look like a sell right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios below 3.6x and even P/S below 1.4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for EDAP TMS

What Does EDAP TMS' Recent Performance Look Like?

Recent times have been advantageous for EDAP TMS as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on EDAP TMS will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like EDAP TMS' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The strong recent performance means it was also able to grow revenue by 34% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 19% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 9.5% each year, which is noticeably less attractive.

With this information, we can see why EDAP TMS is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that EDAP TMS maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Medical Equipment industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for EDAP TMS you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if EDAP TMS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EDAP

EDAP TMS

Develops, manufactures, promotes, and distributes minimally-invasive medical devices for urology based upon proprietary ultrasound technology in Asia, France, the United States, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.