- United States

- /

- Medical Equipment

- /

- NasdaqCM:ECOR

Why Investors Shouldn't Be Surprised By electroCore, Inc.'s (NASDAQ:ECOR) 27% Share Price Surge

Despite an already strong run, electroCore, Inc. (NASDAQ:ECOR) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 144% in the last year.

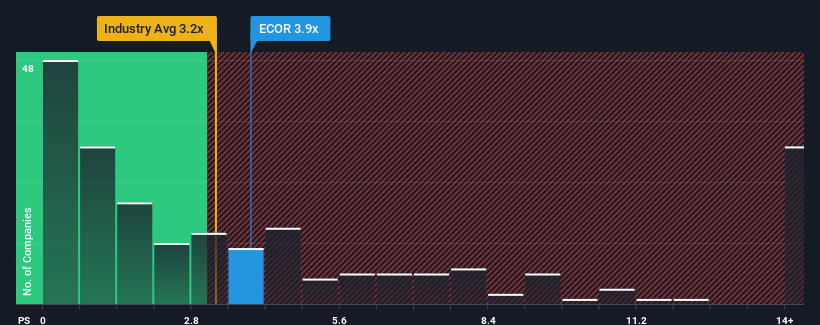

After such a large jump in price, when almost half of the companies in the United States' Medical Equipment industry have price-to-sales ratios (or "P/S") below 3.2x, you may consider electroCore as a stock probably not worth researching with its 3.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for electroCore

How electroCore Has Been Performing

Recent times have been advantageous for electroCore as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on electroCore.How Is electroCore's Revenue Growth Trending?

In order to justify its P/S ratio, electroCore would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 74% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 37% per annum as estimated by the five analysts watching the company. With the industry only predicted to deliver 9.5% per year, the company is positioned for a stronger revenue result.

With this information, we can see why electroCore is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On electroCore's P/S

electroCore shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into electroCore shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for electroCore you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ECOR

electroCore

A bioelectronic medicine and general wellness company, provides non-invasive vagus nerve stimulation (“nVNS”) technology platform in the United States, the United Kingdom, and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives