- United States

- /

- Medical Equipment

- /

- NasdaqGS:DXCM

DexCom (DXCM) Is Down 10.8% After Short-Seller Report Raises G7 Device Safety Concerns

Reviewed by Simply Wall St

- In recent days, DexCom faced critical scrutiny after a short-seller report alleged unauthorized design changes and safety concerns linked to its G7 glucose monitoring device, alongside executive changes and questions about company practices.

- This wave of controversy, which has drawn regulatory attention and sparked heightened investor caution, comes just after DexCom presented new clinical data at a major diabetes conference highlighting the benefits of its technology.

- We will examine how the allegations around the G7 device’s safety and leadership shifts are now impacting DexCom’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

DexCom Investment Narrative Recap

To own DexCom shares today, you need to believe in the long-term opportunity from expanding continuous glucose monitoring adoption, including coverage for new patient groups and ongoing product innovation. The most important short-term catalyst, adoption in the broader type 2 diabetes population, remains, but new allegations of safety issues with the G7 device, alongside abrupt executive changes, have brought intense regulatory and reputational risk to the forefront, which could materially impact DexCom’s momentum if concerns persist or escalate.

Of the recent company announcements, DexCom’s presentation at the EASD Conference is most relevant, as it highlighted new clinical trial data supporting the health benefits and cost-effectiveness of its CGM technology, evidence that directly addresses questions about product reliability raised by critics and may be key to sustaining payer and prescriber support for broader adoption.

Yet, despite the company’s clinical achievements, the risk of regulatory action and ongoing trust challenges are issues investors should not overlook, especially given…

Read the full narrative on DexCom (it's free!)

DexCom's outlook anticipates $6.5 billion in revenue and $1.4 billion in earnings by 2028. This scenario relies on a 14.8% annual revenue growth rate and a $828.5 million increase in earnings from the current $571.5 million.

Uncover how DexCom's forecasts yield a $102.08 fair value, a 51% upside to its current price.

Exploring Other Perspectives

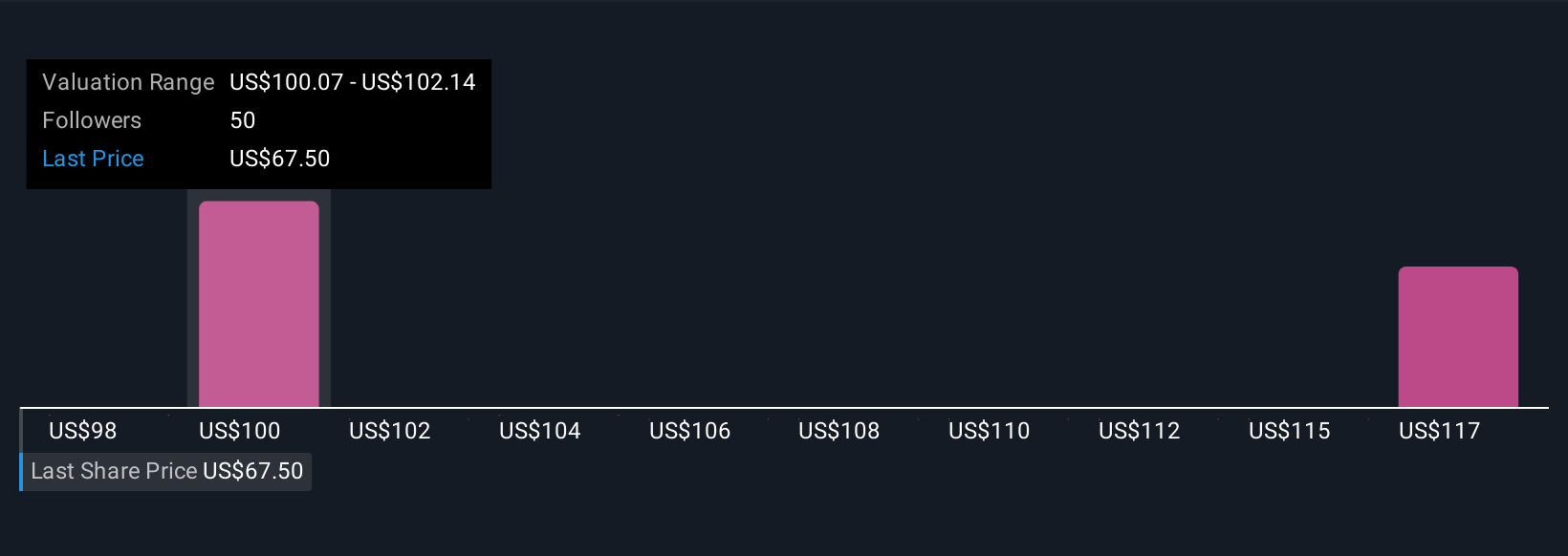

Four community members in the Simply Wall St Community estimate DexCom’s fair value between US$98 and US$118.79 per share. With regulatory scrutiny and reputation at risk after recent G7 device allegations, you may want to see how other investors are viewing DexCom’s outlook.

Explore 4 other fair value estimates on DexCom - why the stock might be worth just $98.00!

Build Your Own DexCom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DexCom research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free DexCom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DexCom's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXCM

DexCom

A medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives