Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Digirad Corporation (NASDAQ:DRAD) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Digirad

How Much Debt Does Digirad Carry?

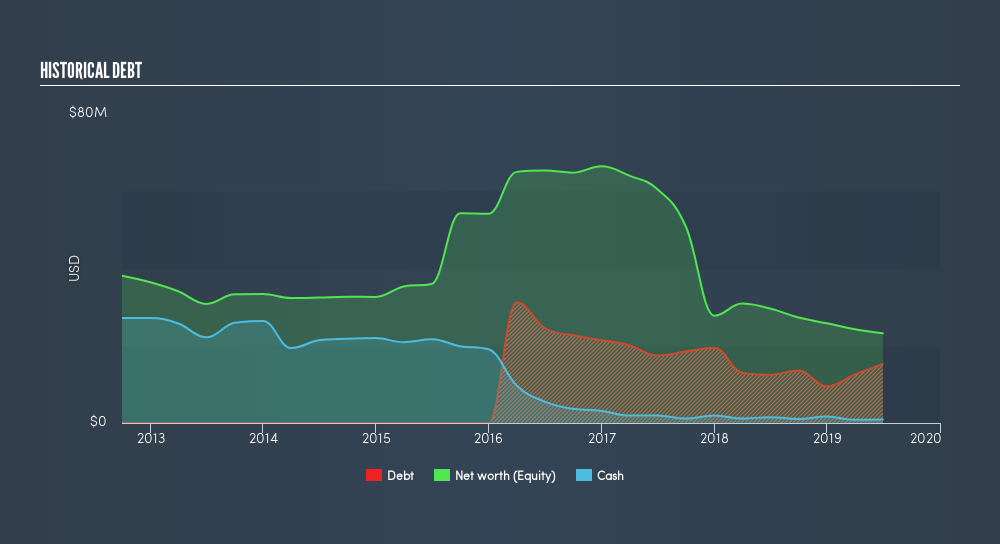

As you can see below, at the end of June 2019, Digirad had US$15.3m of debt, up from US$12.5m a year ago. Click the image for more detail. On the flip side, it has US$881.0k in cash leading to net debt of about US$14.4m.

A Look At Digirad's Liabilities

Zooming in on the latest balance sheet data, we can see that Digirad had liabilities of US$14.8m due within 12 months and liabilities of US$19.8m due beyond that. Offsetting these obligations, it had cash of US$881.0k as well as receivables valued at US$12.8m due within 12 months. So its liabilities total US$21.0m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the US$9.74m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt At the end of the day, Digirad would probably need a major re-capitalization if its creditors were to demand repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Digirad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Digirad actually shrunk its revenue by 3.2%, to US$101m. We would much prefer see growth.

Caveat Emptor

Over the last twelve months Digirad produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping US$3.5m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. For example, we would not want to see a repeat of last year's loss of-US$5.2m. And until that time we think this is a risky stock. For riskier companies like Digirad I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:STRR

Star Equity Holdings

A diversified holding company, engages in the construction business in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives