- United States

- /

- Medical Equipment

- /

- NasdaqCM:DCTH

Positive CHOPIN Trial Results Might Change The Case For Investing In Delcath Systems (DCTH)

Reviewed by Sasha Jovanovic

- Earlier this week, Delcath Systems announced positive results from the CHOPIN Phase 2 trial showing its CHEMOSAT Hepatic Delivery System, when combined with immune checkpoint inhibitors, significantly improved progression-free survival in metastatic uveal melanoma patients.

- This clinical outcome, featured at the 2025 ESMO Congress, has drawn attention to the potential wider clinical adoption of Delcath's liver-directed treatments, despite the company lowering its revenue guidance for 2025 to US$83 million to US$85 million and reporting a recent quarterly revenue shortfall.

- We'll now explore how these encouraging CHOPIN trial findings could impact Delcath Systems' investment narrative and future growth drivers.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Delcath Systems Investment Narrative Recap

For shareholders of Delcath Systems, the big picture centers on belief in the widespread clinical adoption of its CHEMOSAT/HEPZATO platform as a liver-directed therapy for metastatic cancers. The positive CHOPIN Phase 2 trial results provide a clear catalyst, but ongoing pricing pressures and potential delays in treatment site activation remain the most immediate risks; the recent news strengthens clinical adoption prospects, yet does not materially diminish these operational challenges, especially in the context of revised short-term revenue guidance.

Among recent announcements, Delcath’s decision to lower its 2025 revenue guidance from US$93–96 million to US$83–85 million after a quarterly revenue shortfall is particularly relevant. This downward revision, despite clinical progress, keeps financial pressures top of mind as investors weigh whether higher treatment volumes can offset the impact of sustained pricing discounts and commercial rollout risks.

However, while recent trial results support optimism, investors should also consider ongoing uncertainty around hospital adoption rates and reimbursement complexities...

Read the full narrative on Delcath Systems (it's free!)

Delcath Systems' narrative projects $182.7 million in revenue and $54.9 million in earnings by 2028. This requires 37.5% yearly revenue growth and a $52.7 million increase in earnings from $2.2 million today.

Uncover how Delcath Systems' forecasts yield a $24.33 fair value, a 114% upside to its current price.

Exploring Other Perspectives

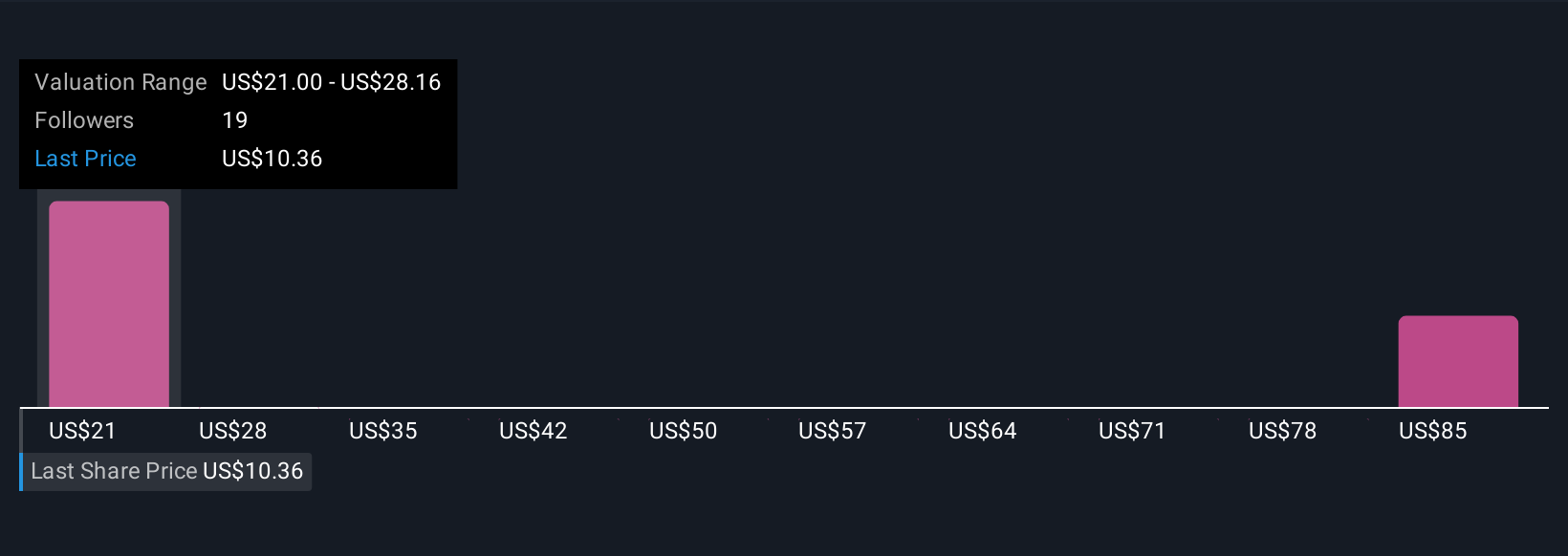

Four members of the Simply Wall St Community assigned fair values to Delcath, with estimates stretching from US$21 to nearly US$93 per share. Some expect accelerated sales growth to drive performance, but opinions differ widely, consider examining several viewpoints before making your own assessment.

Explore 4 other fair value estimates on Delcath Systems - why the stock might be worth just $21.00!

Build Your Own Delcath Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delcath Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Delcath Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delcath Systems' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DCTH

Delcath Systems

An interventional oncology company, focuses on the treatment of primary and metastatic liver cancers in the United States and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives