- United States

- /

- Medical Equipment

- /

- NasdaqCM:DCTH

Delcath Systems (DCTH): Evaluating Valuation After CHOPIN Trial Results and Raised 2025 Revenue Guidance

Reviewed by Simply Wall St

Delcath Systems (DCTH) attracted attention after sharing positive results from its CHOPIN Phase 2 clinical trial at a prominent oncology conference. The company also raised its 2025 revenue outlook for its CHEMOSAT and HEPZATO KIT liver cancer therapies.

See our latest analysis for Delcath Systems.

These upbeat clinical and revenue updates have added fresh momentum to Delcath's story, even as the share price has delivered a modest year-to-date decline of 9.4%. Notably, the total shareholder return sits essentially flat over one year. However, zooming out reveals a remarkable 295% total return over the past three years, underscoring the company’s long-term growth potential despite interim volatility.

If breakthrough medical technologies interest you, it is an ideal moment to explore more innovative healthcare stocks using our free discovery tool: See the full list for free.

After such strong guidance and pivotal clinical data, some investors may wonder whether Delcath shares are now trading at a bargain following their recent slip, or if the market is already taking the company’s future growth potential into account.

Most Popular Narrative: 53.1% Undervalued

Delcath Systems’ fair value, as set by the leading narrative, is over double its recent closing price. This suggests an aggressive view on future upside. Here’s what is fueling those high expectations in the eyes of the consensus.

Expansion of clinical trials into major new indications (liver-dominant metastatic colorectal and breast cancer) opens larger addressable markets and positions Delcath for future revenue and earnings growth as patient populations multiply over the coming years.

Want to know what drives this bullish outlook? The valuation hangs on sky-high annual revenue growth, explosive profit margin expansion, and a future earnings multiple lower than the industry average. Discover the bold assumptions behind these numbers to find out what could send this stock soaring.

Result: Fair Value of $24.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on a single therapy and rising costs could threaten Delcath’s growth outlook if market adoption does not meet expectations.

Find out about the key risks to this Delcath Systems narrative.

Another View: Market Comparison Paints a Different Picture

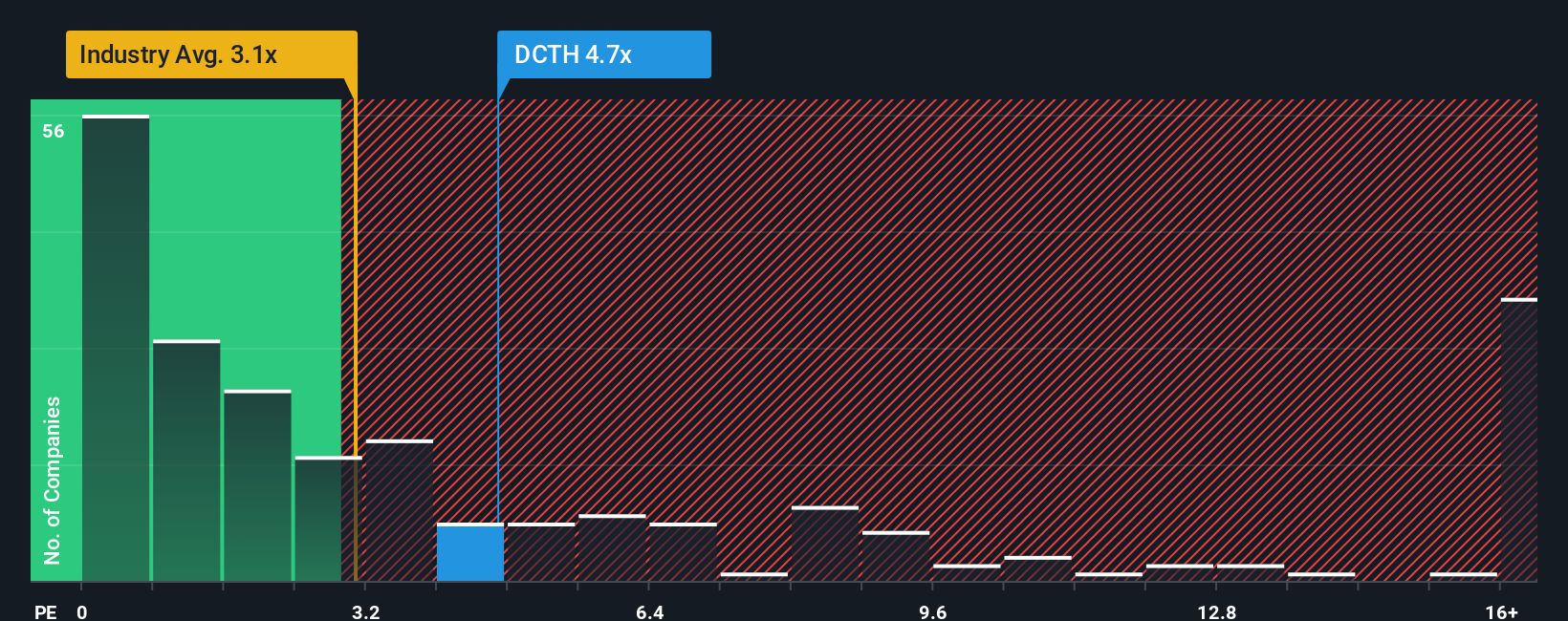

On the other hand, when looking at Delcath’s valuation based on its price-to-sales ratio, the company appears expensive, trading at 5.7 times sales, well above the industry average of 3.2. Yet, compared to the peer group’s lofty 23.2, Delcath is more reasonably valued. Its ratio is even below the fair ratio of 6.3, suggesting some room to run. Does the market see untapped potential, or is it overlooking real risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Delcath Systems Narrative

If these perspectives do not reflect your own, or you simply prefer to dig into the numbers yourself, creating a unique narrative is straightforward and takes just minutes. Do it your way

A great starting point for your Delcath Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge by checking out opportunities your peers may be missing. The right idea could transform your portfolio in 2024. Start now before the crowd catches on.

- Capitalize on emerging healthcare breakthroughs when you check out these 33 healthcare AI stocks, packed with businesses pushing the boundaries of advanced medical technology.

- Maximize your income potential by exploring these 17 dividend stocks with yields > 3% featuring companies with robust dividends and resilient payout histories.

- Be the first to spot tomorrow’s tech leaders by scanning these 24 AI penny stocks, where innovative companies are redefining AI’s future and market growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DCTH

Delcath Systems

An interventional oncology company, focuses on the treatment of primary and metastatic liver cancers in the United States and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives