Investors who take an interest in CVRx, Inc. (NASDAQ:CVRX) should definitely note that the President, Kevin Hykes, recently paid US$8.36 per share to buy US$251k worth of the stock. However, it only increased shareholding by a small percentage, and it wasn't a huge purchase by absolute value, either.

Check out our latest analysis for CVRx

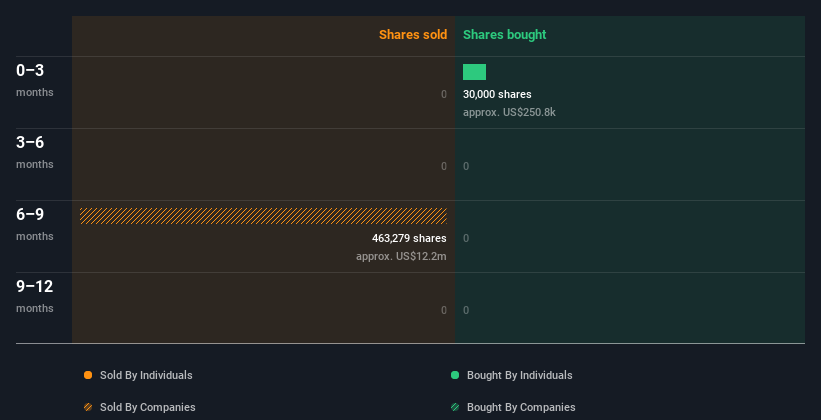

CVRx Insider Transactions Over The Last Year

In fact, the recent purchase by Kevin Hykes was the biggest purchase of CVRx shares made by an insider individual in the last twelve months, according to our records. So it's clear an insider wanted to buy, at around the current price, which is US$9.05. Of course they may have changed their mind. But this suggests they are optimistic. If someone buys shares at well below current prices, it's a good sign on balance, but keep in mind they may no longer see value. The good news for CVRx share holders is that insiders were buying at near the current price.

In the last twelve months CVRx insiders were buying shares, but not selling. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

CVRx is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Insider Ownership Of CVRx

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. We usually like to see fairly high levels of insider ownership. Based on our data, CVRx insiders have about 0.6% of the stock, worth approximately US$1.0m. We consider this fairly low insider ownership.

So What Does This Data Suggest About CVRx Insiders?

It's certainly positive to see the recent insider purchases. We also take confidence from the longer term picture of insider transactions. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. We would certainly prefer see higher levels of insider ownership but analysis of the insider transactions suggests that CVRx insiders are expecting a bright future. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Every company has risks, and we've spotted 3 warning signs for CVRx (of which 1 is a bit concerning!) you should know about.

Of course CVRx may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVRX

CVRx

A commercial-stage medical device company, focuses on developing, manufacturing, and commercializing neuromodulation solutions for patients with cardiovascular diseases.

Excellent balance sheet low.