- United States

- /

- Semiconductors

- /

- NYSE:VLN

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As November 2024 comes to a close, the U.S. stock market is celebrating record highs with the S&P 500 and Dow Jones Industrial Average posting their biggest monthly gains of the year. For investors willing to explore beyond large-cap stocks, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities. Despite being considered a relic by some, these stocks can still provide significant potential when backed by strong financials, making them an interesting area for those seeking hidden value in under-the-radar companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.80 | $5.81M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.62 | $2.03B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $136.98M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2408 | $8.86M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.59 | $52.47M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.81 | $142.8M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9429 | $84.8M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.87 | $413.23M | ★★★★☆☆ |

Click here to see the full list of 708 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

MacroGenics (NasdaqGS:MGNX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MacroGenics, Inc. is a biopharmaceutical company focused on developing, manufacturing, and commercializing antibody-based therapeutics for cancer treatment in the United States with a market cap of $225.32 million.

Operations: The company's revenue of $141.33 million is derived from its efforts in developing and commercializing monoclonal antibody-based therapeutics.

Market Cap: $225.32M

MacroGenics has demonstrated significant revenue growth, reporting US$110.71 million for Q3 2024 compared to US$10.4 million the previous year, though it remains unprofitable with a net loss of US$51.55 million over nine months in 2024. The company is debt-free and maintains strong short-term assets exceeding liabilities, providing a cash runway of over three years based on current free cash flow. Despite leadership changes with CEO Scott Koenig stepping down in early 2025, MacroGenics continues advancing its antibody-based therapeutics portfolio, highlighted by promising Phase 2 study results for vobramitamab duocarmazine targeting prostate cancer.

- Click here and access our complete financial health analysis report to understand the dynamics of MacroGenics.

- Learn about MacroGenics' future growth trajectory here.

Valens Semiconductor (NYSE:VLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Valens Semiconductor Ltd. provides semiconductor products for the audio-video and automotive industries, with a market cap of $209.39 million.

Operations: The company's revenue is derived from two primary segments: Automotive, generating $22.67 million, and Audio-Video, contributing $40.47 million.

Market Cap: $209.39M

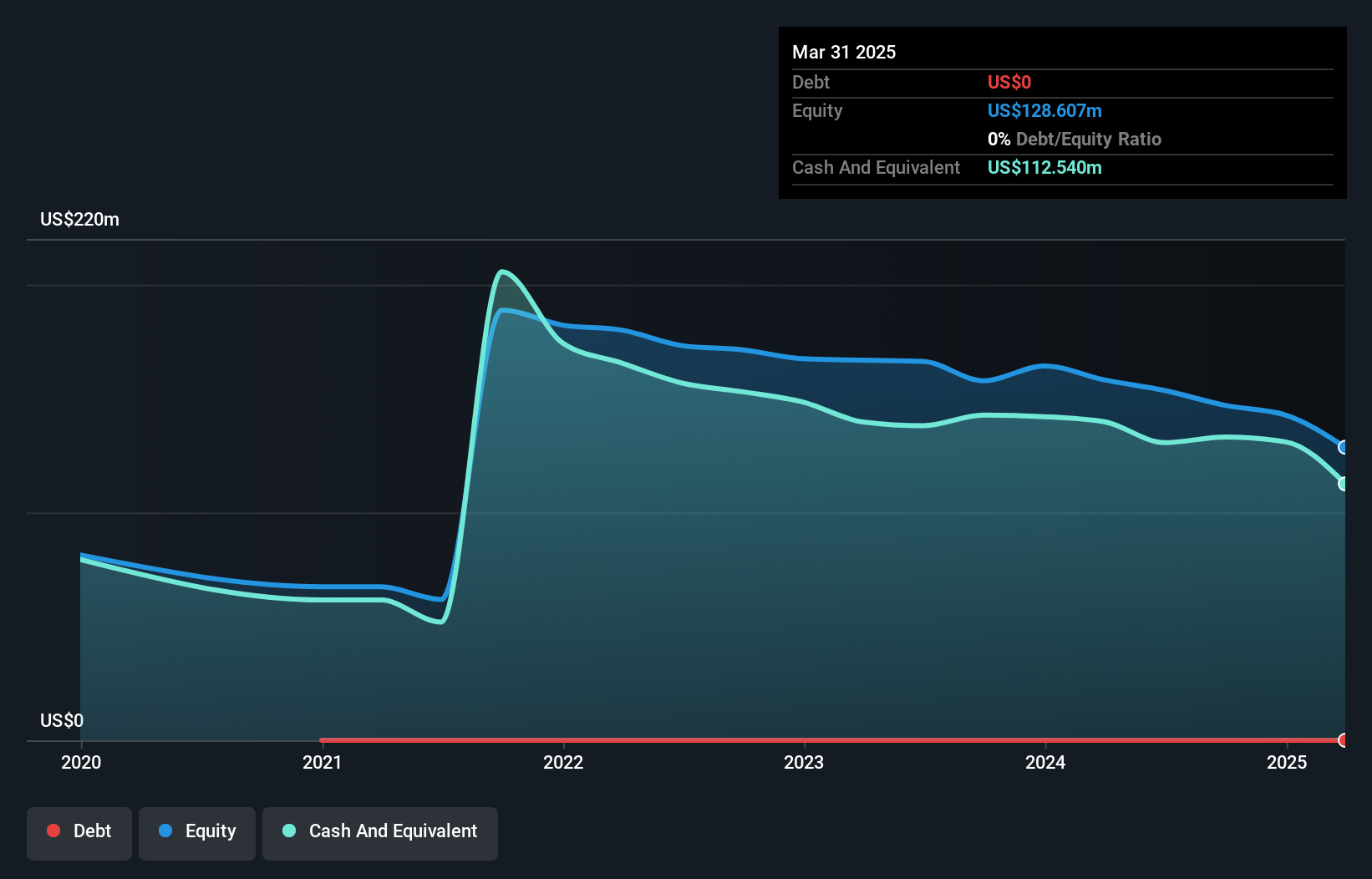

Valens Semiconductor, with a market cap of US$209.39 million, operates in the automotive and audio-video segments, reporting revenues of US$22.67 million and US$40.47 million respectively. Despite being unprofitable, it has reduced losses over five years and remains debt-free with a solid cash runway exceeding three years. Recent strategic moves include a share repurchase program worth up to US$10 million and organizational changes to capitalize on high-growth markets like medical endoscopy. The company forecasts significant revenue growth by 2029, driven by innovative chipsets for automotive and industrial applications amidst ongoing leadership transitions.

- Navigate through the intricacies of Valens Semiconductor with our comprehensive balance sheet health report here.

- Gain insights into Valens Semiconductor's outlook and expected performance with our report on the company's earnings estimates.

Yalla Group (NYSE:YALA)

Simply Wall St Financial Health Rating: ★★★★★★

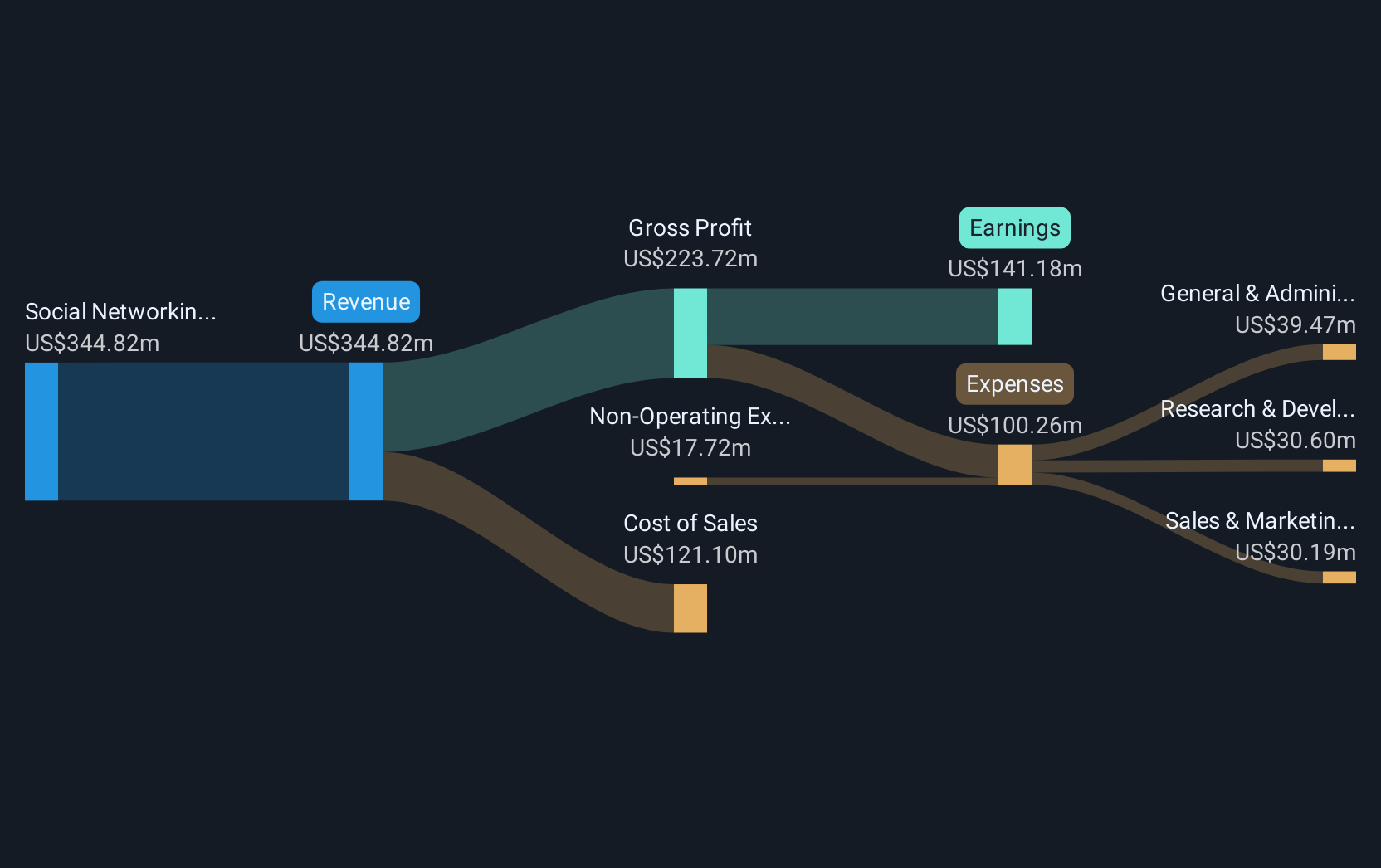

Overview: Yalla Group Limited operates a social networking and gaming platform primarily in the Middle East and North Africa region, with a market cap of approximately $695.84 million.

Operations: The company generates revenue of $329.77 million from its social networking and entertainment platform.

Market Cap: $695.84M

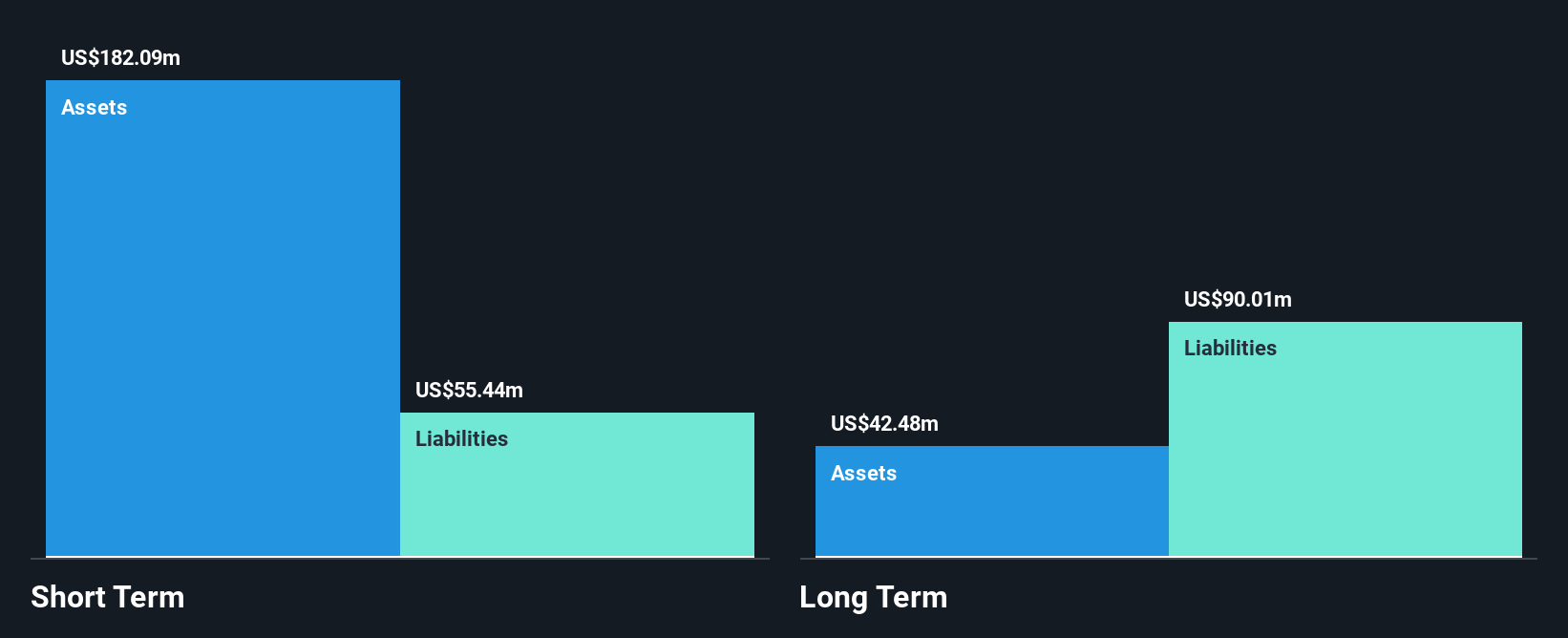

Yalla Group, with a market cap of US$695.84 million, has shown robust financial performance, reporting third-quarter revenue of US$88.92 million and net income of US$39.85 million. The company trades at 82% below its estimated fair value and maintains high-quality earnings with a strong net profit margin improvement from last year. Yalla is debt-free, covering short-term liabilities comfortably with assets totaling US$611.6 million against liabilities of US$94.5 million. Despite shareholder dilution over the past year, Yalla's earnings growth outpaced industry averages significantly, although it is slightly below its five-year growth trajectory.

- Unlock comprehensive insights into our analysis of Yalla Group stock in this financial health report.

- Review our growth performance report to gain insights into Yalla Group's future.

Summing It All Up

- Unlock our comprehensive list of 708 US Penny Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLN

Valens Semiconductor

Engages in the provision of semiconductor products for the audio-video and automotive industries.

Flawless balance sheet very low.