- United States

- /

- Healthcare Services

- /

- NasdaqGS:CRVL

Should Rising Earnings and Share Buybacks Influence CorVel's (CRVL) Capital Allocation Narrative?

Reviewed by Sasha Jovanovic

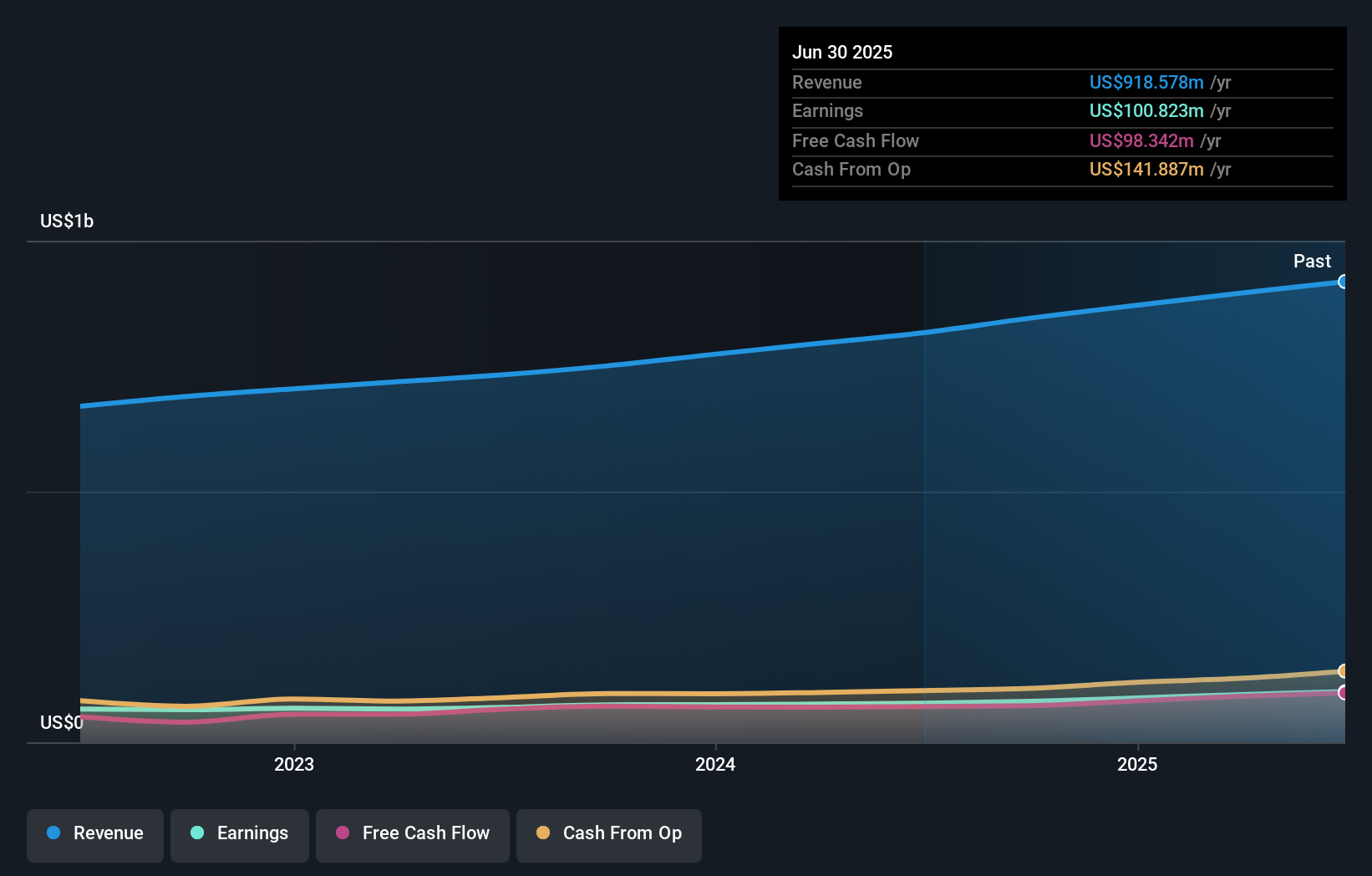

- CorVel Corporation recently reported second quarter and six-month financial results showing increases in sales, net income, and earnings per share compared to the prior year, and continued its share buyback program with the repurchase of 143,440 shares for US$12.8 million completed in September 2025.

- Additionally, CorVel filed a shelf registration for 1,775,459 shares valued at approximately US$134 million for an ESOP-related offering, highlighting ongoing capital management activities by the company.

- We'll explore how CorVel's improved earnings and continued share repurchases influence its overall investment narrative and business outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is CorVel's Investment Narrative?

To be comfortable as a CorVel shareholder, you need to believe in the company’s ability to continue translating steady operational growth into real shareholder value, even as the market prices in high performance expectations. The latest results back up this story, showing further increases in sales and profits while management presses on with share buybacks. The just-announced ESOP-related shelf registration, while substantial at US$134 million, is unlikely to change any of the key short-term catalysts for now; it shows ongoing capital planning but doesn’t significantly alter the risk or reward equation in the near term. Instead, the focus remains on CorVel’s ability to sustain its profit margins amid industry change and relative valuation pressures, particularly after a sharp 32% decline in its share price this year. Recent insider selling activity and the transition to new executive leadership underline some of the biggest uncertainties currently facing the business.

In contrast, some of these uncertainties around leadership changes and insider activity are still on the horizon for investors to watch.

Exploring Other Perspectives

Explore another fair value estimate on CorVel - why the stock might be worth just $88.11!

Build Your Own CorVel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CorVel research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CorVel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CorVel's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRVL

CorVel

Provides workers’ compensation, general and auto liability, and hospital bill auditing and payment integrity solutions.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives