- United States

- /

- Healthcare Services

- /

- NasdaqGS:CRVL

CorVel (CRVL): Is the Current Valuation Justified After Recent Share Price Swings?

Reviewed by Simply Wall St

See our latest analysis for CorVel.

CorVel’s share price has battled intense headwinds this year, with momentum fading and a 1-year total shareholder return of -39.2%. While this week’s modest bounce may spark some short-term hope, three-year and five-year total shareholder returns of 43.7% and 138.3% show the business still has a strong track record for longer-term holders.

If you’re weighing your next move, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

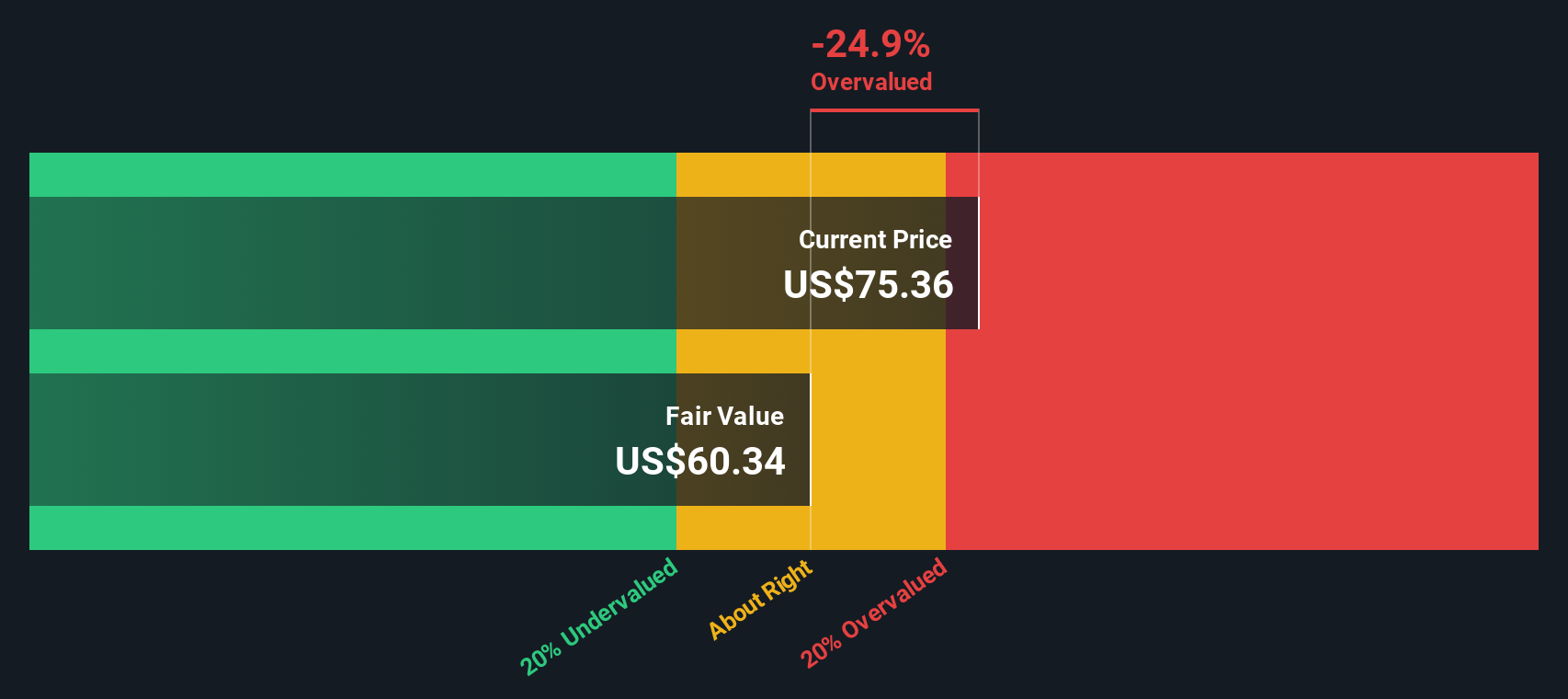

But are these declines an indication that CorVel is now undervalued, or do the recent numbers suggest that the market is accurately pricing in the company’s future growth prospects? Is there a true buying opportunity here?

Price-to-Earnings of 35.7x: Is it justified?

CorVel's current share price translates to a price-to-earnings (P/E) ratio of 35.7x. This is substantially higher than the US Healthcare industry average P/E of 22.7x and signals that the market is currently placing a steeper premium on the company compared to most of its industry peers.

The price-to-earnings multiple reflects how much investors are willing to pay for each dollar of earnings. For CorVel, this elevated ratio could suggest strong confidence in future profit growth or company-specific advantages; however, it can also mean the shares are expensive relative to current earnings.

Despite this, when compared to the peer group, CorVel actually looks attractively valued as its P/E is lower than the peer average of 59.3x. This hints that while the stock is costly versus the sector, it offers a better value proposition relative to its closest competitors. However, the P/E ratio is much higher than the industry norm, indicating expectations of superior growth or profitability may already be priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 35.7x (ABOUT RIGHT)

However, sustained earnings pressure or a lack of clear profit growth could limit upside potential and challenge the case for a valuation rebound.Find out about the key risks to this CorVel narrative.

Another View: What Does Our DCF Model Say?

Taking a different approach, our DCF model values CorVel at $88.11 per share. The current price of $73.29 is about 16.8% below this estimate. This perspective suggests that, despite its high price-to-earnings ratio, the stock might be undervalued by the market.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CorVel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CorVel Narrative

If you’d rather draw your own conclusions or take a different view, it’s easy to explore the numbers yourself and shape a narrative in just a few minutes. Do it your way

A great starting point for your CorVel research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Maximize your investing potential by tapping into fresh growth themes and standout opportunities other investors are already taking advantage of on Simply Wall Street.

- Uncover new possibilities in quantum computing by checking out these 27 quantum computing stocks and see which companies are positioned for significant technological gains.

- Boost your portfolio’s resilience and income with consistent payers by exploring these 15 dividend stocks with yields > 3% offering yields above market averages.

- Tap into the next wave in AI-driven healthcare by seeing which innovators are thriving among these 30 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRVL

CorVel

Provides workers’ compensation, general and auto liability, and hospital bill auditing and payment integrity solutions.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success