- United States

- /

- Healthtech

- /

- NasdaqGS:TBRG

If You Had Bought Computer Programs and Systems Stock Five Years Ago, You'd Be Sitting On A 52% Loss, Today

Computer Programs and Systems, Inc. (NASDAQ:CPSI) shareholders should be happy to see the share price up 24% in the last month. But if you look at the last five years the returns have not been good. In fact, the share price is down 52%, which falls well short of the return you could get by buying an index fund.

View our latest analysis for Computer Programs and Systems

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Computer Programs and Systems became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

We don't think that the 1.2% is big factor in the share price, since it's quite small, as dividends go. In contrast to the share price, revenue has actually increased by 9.3% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

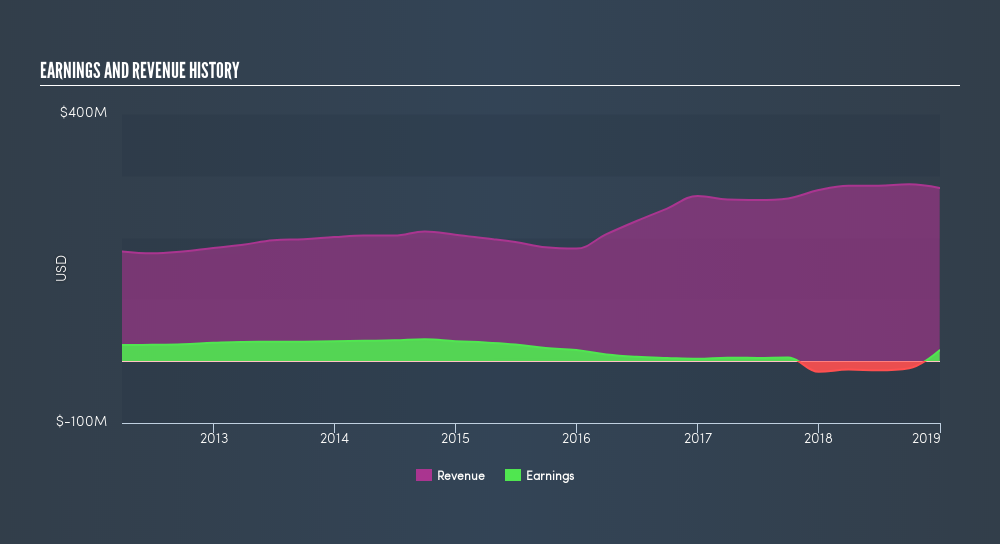

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We know that Computer Programs and Systems has improved its bottom line lately, but what does the future have in store? So we recommend checking out this freereport showing consensus forecasts

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Computer Programs and Systems, it has a TSR of -43% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Computer Programs and Systems shareholders have received a total shareholder return of 11% over one year. And that does include the dividend. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before spending more time on Computer Programs and Systems it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:TBRG

TruBridge

Provides healthcare solutions and services for community hospitals, clinics, and other healthcare systems in the United States and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives