- United States

- /

- Medical Equipment

- /

- NasdaqGS:COO

Did Wells Fargo’s Downgrade Signal a Turning Point for Cooper Companies’ (COO) Core Growth Story?

Reviewed by Sasha Jovanovic

- In recent days, Wells Fargo downgraded Cooper Companies to Equal Weight from Overweight, highlighting concerns about a slowdown in its core contact lens markets. This shift in analyst outlook underscores emerging uncertainty around consumer demand and growth momentum in key segments for the company.

- We'll now examine how signs of slowing market demand may affect Cooper Companies' previously established investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Cooper Companies Investment Narrative Recap

Owning Cooper Companies is often seen as a belief in the long-term growth of the global contact lens market and the company’s ability to drive sales through premium daily lens offerings like MyDAY. The recent Wells Fargo downgrade raises fresh questions about near-term demand trends, which could pressure short-term revenue acceleration, the primary catalyst, while intensifying concerns about market growth deceleration, the central risk to the current business outlook. If these headwinds persist, they could limit the upside potential for both earnings and free cash flow in the upcoming quarters. Of recent company moves, the accelerated global rollout of MyDAY, now possible after resolving manufacturing constraints, stands out. With 30 new private label contracts and expanded fitting sets in place, this initiative is designed to be a catalyst for revenue and margin growth by fulfilling pent-up demand, yet any further consumer softness or slow conversion rates could blunt these benefits. But while accelerating MyDAY is the focus, investors should also keep a close eye on signs of prolonged market sluggishness that might…

Read the full narrative on Cooper Companies (it's free!)

Cooper Companies is projected to achieve $4.9 billion in revenue and $786.2 million in earnings by 2028. This assumes annual revenue growth of 6.4% and a $378.4 million increase in earnings from current earnings of $407.8 million.

Uncover how Cooper Companies' forecasts yield a $83.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

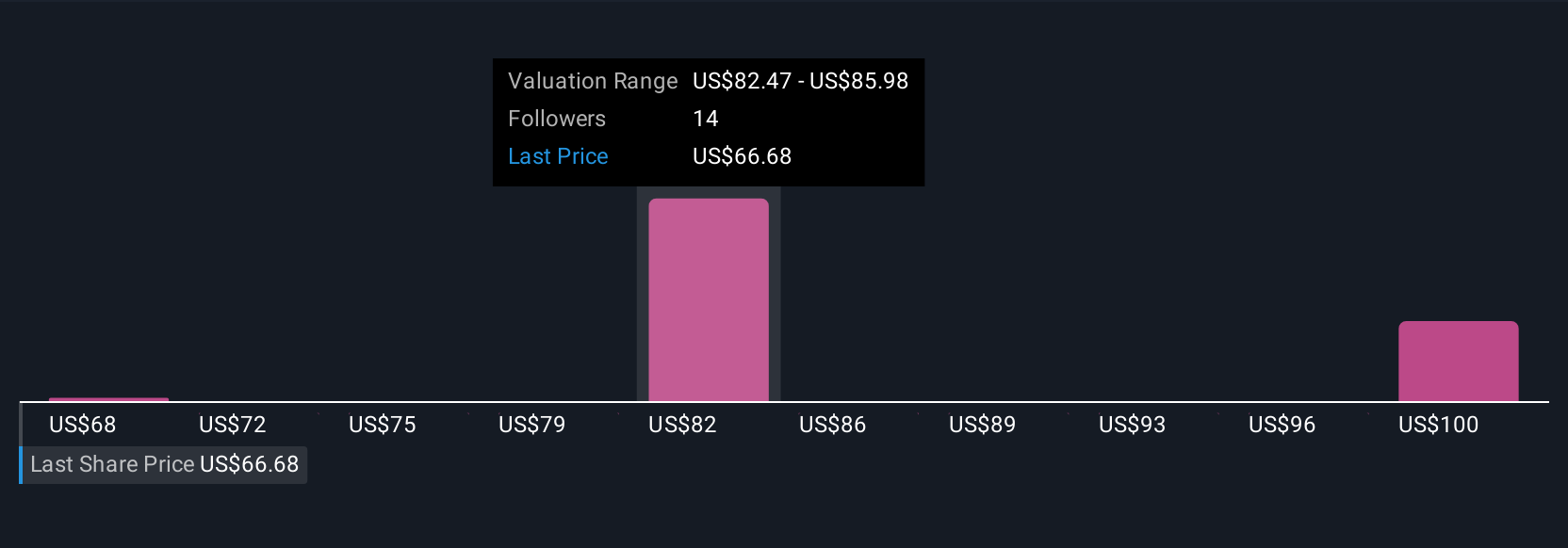

Three individual fair value estimates from the Simply Wall St Community span US$68.44 to US$98.90 per share. With this diversity of outlooks, consider how ongoing concerns about slowing contact lens market growth can shape future results and investor sentiment.

Explore 3 other fair value estimates on Cooper Companies - why the stock might be worth 5% less than the current price!

Build Your Own Cooper Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cooper Companies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cooper Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cooper Companies' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COO

Cooper Companies

Develops, manufactures, and markets contact lens wearers.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives