- United States

- /

- Medical Equipment

- /

- NasdaqGS:COO

Activist Push for Vision Care Focus Could Be a Game Changer for Cooper Companies (COO)

Reviewed by Sasha Jovanovic

- On November 19, 2025, activist investor Browning West LP sent a letter to Cooper Companies' board, urging significant operational changes and board refreshment due to underperformance versus key benchmarks, concerns over business structure, compensation policies, and expertise.

- An insight from this development is Browning West's recommendation to evaluate making Cooper Companies a pure-play vision care business, which could reshape its corporate structure and focus.

- We'll consider how Browning West's push for a potential CooperSurgical spinoff and board changes could impact the company's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Cooper Companies Investment Narrative Recap

To own shares in Cooper Companies, you need to believe in its ability to leverage leading positions in the vision care market, capitalize on sustained product innovation, and improve operating efficiency or focus. The recent letter from Browning West LP introduces uncertainty around corporate structure, but the main catalyst in the near term remains the execution and global rollout of the MyDAY product line; for now, the activist push does not materially impact this immediate revenue growth driver. The potential for meaningful operational change does raise the importance of monitoring evolving board dynamics as a key risk to the business story right now.

One recent announcement closely aligned with these developments is the October 2025 letter from Jana Partners LLC, which similarly urged Cooper Companies to consider exploring strategic alternatives across its business units. Both instances of investor activism underscore that structural simplification and renewed executive focus could become central themes for the company’s investment case, overlapping with key short-term catalysts in its vision care segment.

On the other hand, investors should be aware that increasing competitive pricing pressure in the Asia Pacific region could limit the company's ability to...

Read the full narrative on Cooper Companies (it's free!)

Cooper Companies' outlook anticipates $4.9 billion in revenue and $786.2 million in earnings by 2028. Achieving this requires 6.4% annual revenue growth and a $378.4 million increase in earnings from the current $407.8 million.

Uncover how Cooper Companies' forecasts yield a $83.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

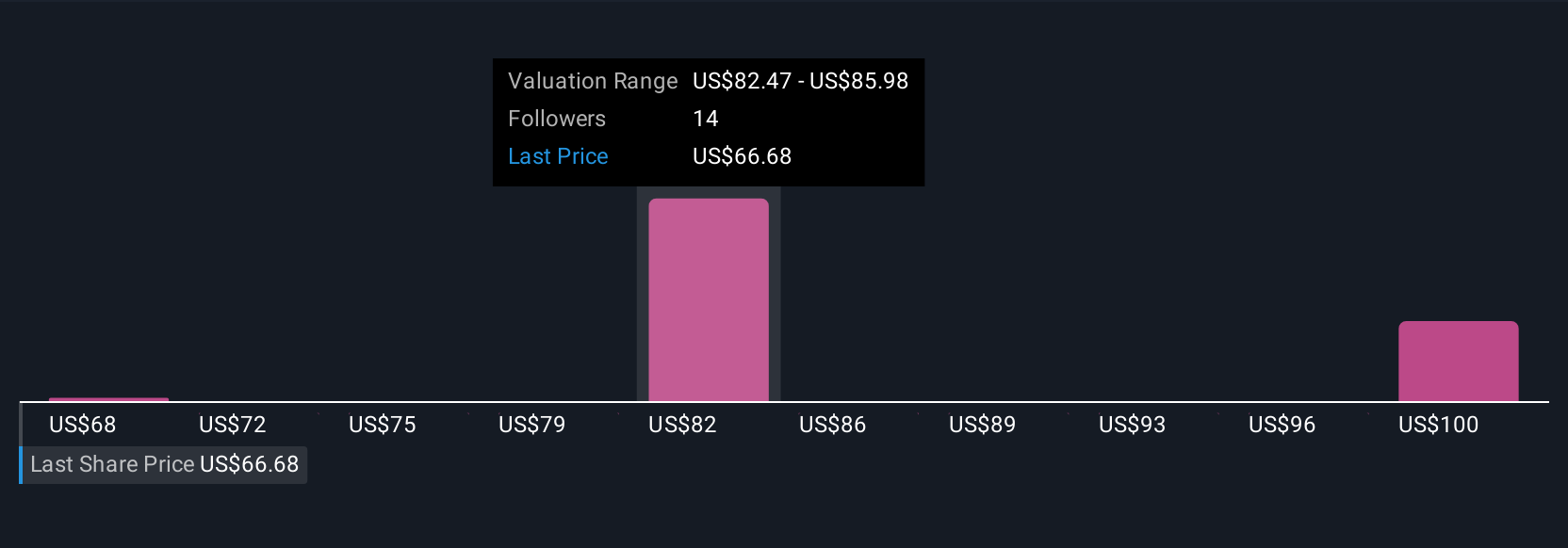

Fair value estimates from the Simply Wall St Community range widely, from US$68.44 to US$99.23, across three individual analyses. Investors have strong differences of opinion, especially at a time when pressure on margins in the Asia Pacific region highlights risks to future revenue performance, be sure to consider multiple viewpoints before acting.

Explore 3 other fair value estimates on Cooper Companies - why the stock might be worth as much as 27% more than the current price!

Build Your Own Cooper Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cooper Companies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cooper Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cooper Companies' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COO

Cooper Companies

Develops, manufactures, and markets contact lens wearers.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026