- United States

- /

- Healthcare Services

- /

- NasdaqGS:CLOV

Clover Health (CLOV): Evaluating Valuation After Analyst Upgrade, Options Surge, and Tech Partnership Speculation

Reviewed by Simply Wall St

Clover Health Investments (CLOV) saw its stock surge as investors digested a mix of supportive factors, including a research upgrade, active trading in the options market, and renewed speculation about a technology partnership.

See our latest analysis for Clover Health Investments.

This surge puts Clover Health firmly back in the spotlight, with its 1-day share price return of 19.4% following an analyst upgrade and speculation around future tech partnerships. While the near-term momentum stands out, the 1-year total shareholder return is still slightly negative at -2.6%. The long-term story shows a remarkable 143% three-year total return. Momentum is clearly building, driven by renewed optimism in tech-driven Medicare innovation and an uptick in investor interest.

Curious what else is gaining traction? Now’s the perfect moment to expand your investing search and discover fast growing stocks with high insider ownership

With the recent rally and excitement over potential tech partnerships, the question remains: Is Clover Health's current valuation a bargain, or are investors already factoring in all future growth prospects?

Most Popular Narrative: 19% Overvalued

With a fair value set at $3.20, the consensus narrative points to Clover Health trading well above its estimated worth following the last close at $3.82. This creates high expectations for future earnings and leaves little room for disappointment.

The company's differentiated technology-driven care model, particularly the Clover Assistant platform, positions it to benefit from the healthcare industry's accelerated shift toward technology adoption and data-driven, value-based care. This approach supports lower medical costs and higher medical margins, with positive implications for both revenue growth and net margins.

Want to know what’s fueling such bullish valuations? The narrative hinges on ambitious growth, tech-enabled efficiency, and massive profitability expansion ahead. Think these assumptions are realistic? You might be surprised by the pace of revenue transformation implied. Dive in to see the numbers behind the optimism.

Result: Fair Value of $3.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising medical expenses and ongoing regulatory changes could challenge Clover Health's optimistic growth narrative and put pressure on future profitability and valuation.

Find out about the key risks to this Clover Health Investments narrative.

Another View: The Value in Market Comparisons

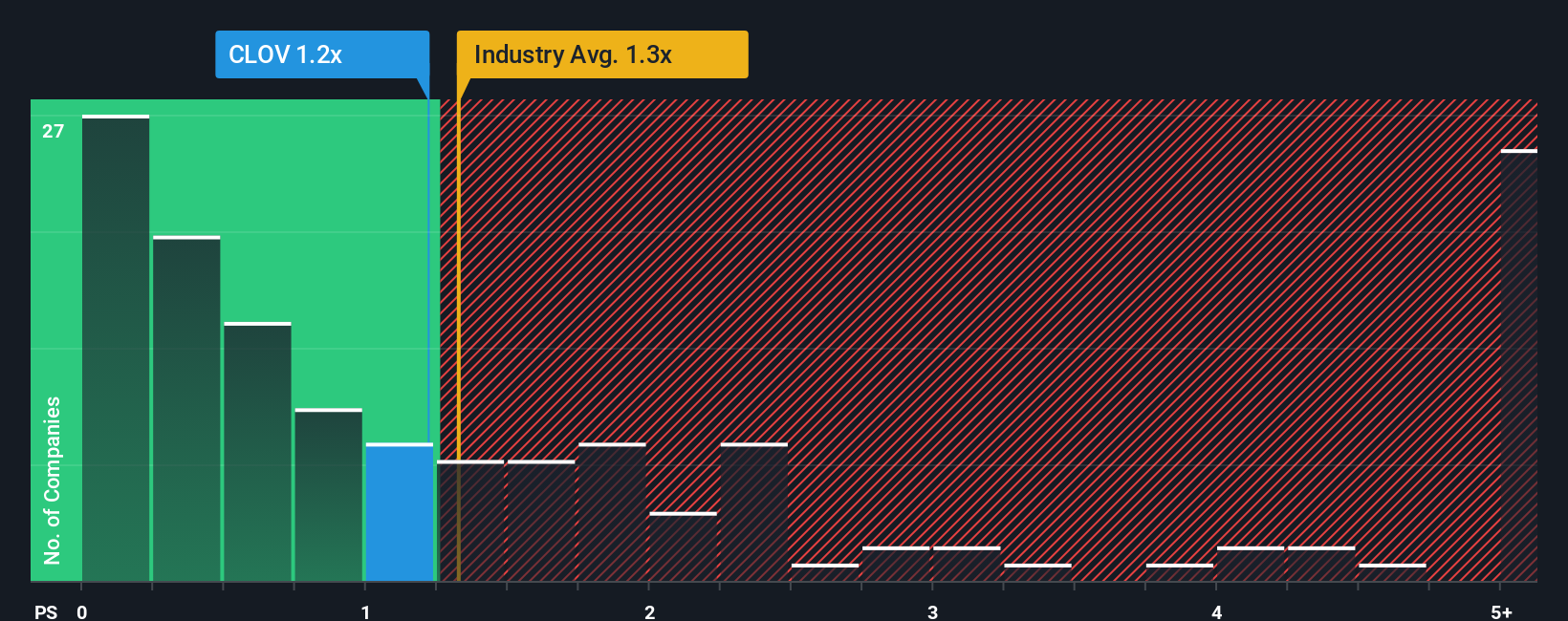

Looking at valuation from a market perspective, Clover Health shares currently trade at a price-to-sales ratio of 1.2x. This is slightly cheaper than both industry peers (2.3x) and the broader US Healthcare sector (1.3x). Interestingly, the company’s ratio even sits just below the estimated fair ratio of 1.3x, hinting at possible value overlooked by the market. If sentiment shifts, this gap could offer upside. But does a low ratio today mean true bargain status, or are risks being correctly priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Clover Health Investments Narrative

If you want to dig deeper, you can review the underlying figures and craft your own perspective in just a few minutes: Do it your way

A great starting point for your Clover Health Investments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't watch from the sidelines while others uncover high-potential opportunities. The Simply Wall Street Screener puts game-changing stocks within your reach, tailored to your style.

- Capture impressive yields by checking out these 17 dividend stocks with yields > 3%, where stable companies are delivering standout income and long-term growth potential.

- Spot tomorrow’s tech leaders as you browse these 27 AI penny stocks, featuring innovative firms making waves in artificial intelligence and automation.

- Boost your investment returns with these 877 undervalued stocks based on cash flows, pinpointing quality businesses trading below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLOV

Clover Health Investments

Provides medicare advantage plans in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives