- United States

- /

- Healthtech

- /

- NasdaqGM:CCLD

The Market Doesn't Like What It Sees From CareCloud, Inc.'s (NASDAQ:CCLD) Revenues Yet As Shares Tumble 25%

CareCloud, Inc. (NASDAQ:CCLD) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 102%.

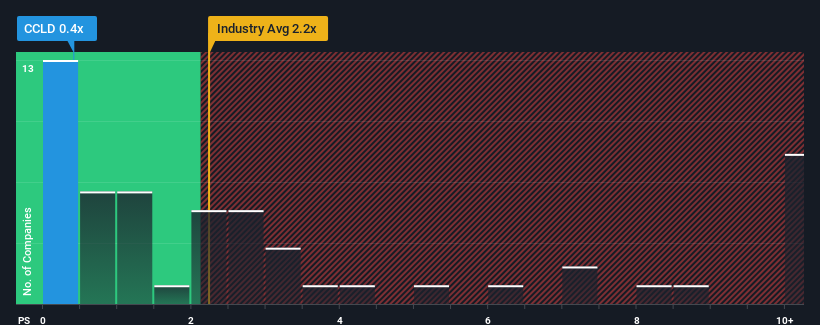

Since its price has dipped substantially, CareCloud may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Healthcare Services industry in the United States have P/S ratios greater than 2.2x and even P/S higher than 7x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for CareCloud

What Does CareCloud's Recent Performance Look Like?

While the industry has experienced revenue growth lately, CareCloud's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CareCloud.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, CareCloud would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 8.4% decrease to the company's top line. As a result, revenue from three years ago have also fallen 17% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 0.2% over the next year. That's shaping up to be materially lower than the 9.1% growth forecast for the broader industry.

In light of this, it's understandable that CareCloud's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does CareCloud's P/S Mean For Investors?

CareCloud's recently weak share price has pulled its P/S back below other Healthcare Services companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that CareCloud maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 4 warning signs we've spotted with CareCloud.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CCLD

CareCloud

A healthcare information technology (IT) company, provides technology-enabled business solutions, Software-as-a-Service offerings, and related business services to healthcare providers and hospitals primarily in the United States.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives